This article first appeared in Capital, The Edge Malaysia Weekly on February 17, 2025 - February 23, 2025

BURSA Malaysia’s strong initial public offering (IPO) momentum is attracting interest from companies in Hong Kong and Singapore that are considering listing on the stock exchange.

Hong Kong-based energy services firm Unity Group Holdings International Ltd, which is listed on the Hong Kong Stock Exchange (HKEX), is the first Hong Kong company to pursue a secondary listing on Bursa.

Sources familiar with Unity Group indicate that preparations are underway and an IPO is targeted by year’s end.

According to Dr Terence Wan, managing partner at Beijing Xinghua Caplegend CPA Ltd, Unity Group’s auditor, Hong Kong’s regulations “have not made for a very investor-friendly environment for small and medium enterprises”.

“There is little traction on such counters because many have been largely ignored, as liquidity has been flowing mainly to initial public offerings with big market capitalisations. In addition, the cost of a Hong Kong listing is expensive — about HK$20 million per IPO, with annual maintenance fees of HK$3 million to HK$5 million. A Bursa listing is more affordable by comparison,” Wan tells The Edge.

Unity Group is among several companies considering a Malaysian listing. Two other HKEX-listed companies are expected to begin listing preparations this quarter and submit applications to Bursa by 2026, says Wan. His firm anticipates a Bursa approval process of less than a year for these companies, potentially as short as six months, given their familiarity with listing requirements, as they are already listed on the HKEX.

Foreign companies seeking a secondary listing in Malaysia must already be listed on the main board of the primary stock exchange in their own country, and the stock exchange must be recognised by Bursa.

Unity Group, which provides energy management services such as lighting and cooling systems, operates in China, Malaysia, Indonesia, the United Arab Emirates and South Africa.

Its operations in Malaysia contribute about 50% to the group’s revenue, says a person familiar with the deal. “Foreign companies need a strong presence in Malaysia for a credible Bursa IPO narrative to attract the local market’s interest.”

Singaporean chip-related firms Grand Venture Technology and UMS Holdings Ltd, both of which are listed on the Singapore Exchange, are also eyeing an IPO on Bursa.

Grand Venture Technology aims to boost its liquidity and valuations, and tap into local government projects. UMS Holdings is reportedly targeting a Bursa IPO as early as the first quarter of this year.

IPO advisers say Bursa’s encouraging IPO traction, particularly in the ACE Market post-pandemic, is a key driver for international companies. Wan cites an example of a Hong Kong-based company whose profits increased 12-fold in the first five years of its listing without any corresponding share price increase. “This wasn’t very encouraging to the [promoters],” he says.

Investment bankers tell The Edge that these companies are primarily seeking profiling, not fundraising, through a Malaysian listing.

“Foreign-listed companies have already announced their intention to seek a secondary listing and we hope this will receive support from our regulators. Since last year, Malaysian IPO advisers had been flying into Singapore to look for potential applicants to list on Bursa, where, previously, it was the other way around,” says IPO specialist lawyer, Ong Eu Jin, managing partner of his firm Ong Eu Jin Partnership.

Momentum to accelerate

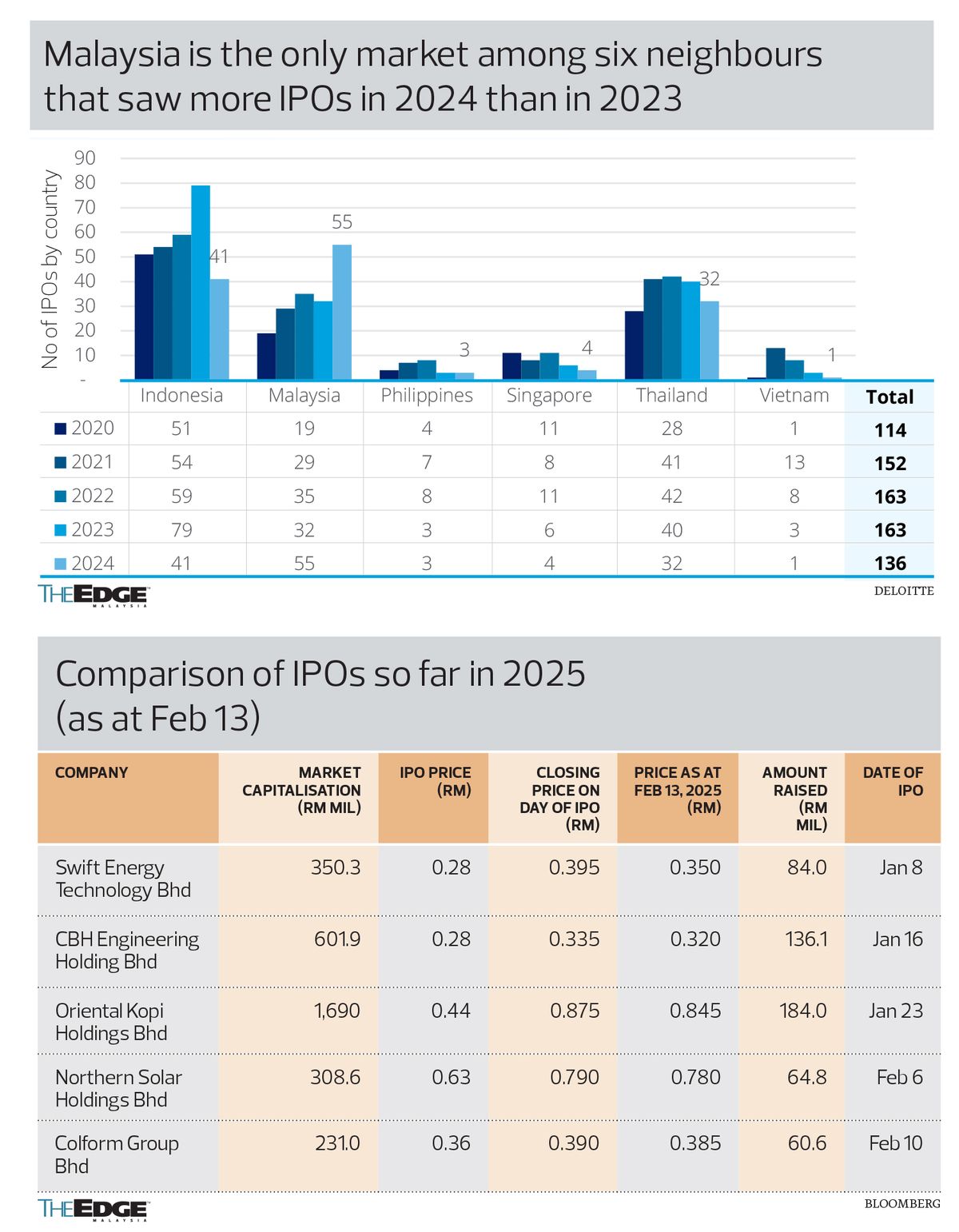

The growing interest in Bursa IPOs comes as Malaysia, with 55 IPOs in 2024 versus 32 in 2023, topped five neighbours — Singapore, Indonesia, Vietnam, the Philippines and Thailand — as the only country that saw an increase in IPOs in 2024 from 2023. A total of RM7.42 billion was raised by the 55 Bursa IPOs in 2024, compared with RM3.58 billion by the 32 IPOs in 2023.

Five IPOs have already taken place so far this year, including that of Colform Group Bhd (KL:COLFORM) last Monday. Four more IPOs are expected by March 3, according to Bursa’s website. Three will take place this week: Richtech Digital Bhd on Monday; Techstore Bhd on Tuesday; and ES Sunlogy Bhd on Thursday (see “RichTech Digital, TechStore and ES Sunlogy to list on ACE Market this week” on facing page). So far, all are ACE Market listees.

According to M&A Equity Holdings Bhd MD Datuk Bill Tan, many companies submitting IPO applications have good profit track records. “The vibrancy seen on the bourse as well as the speed of the authorities pertaining to the approval process have been encouraging more flotation exercises,” he says.

Sources predict that, barring unforeseen events, the number of IPOs in 2026 could exceed Bursa’s target of 60 listings for this year. Bursa anticipates the new listings for this year are estimated to contribute RM40.2 billion, compared to the RM31.37 billion in 2024.

Bursa Malaysia chairman Tan Sri Abdul Wahid Omar reportedly said the target for 2025 was based on a strong pipeline of submissions. He confirmed two Main Market listings approved for March and 15 approved for the ACE Market, with more in the pipeline.

The Securities Commission Malaysia and Bursa had, in February last year, pledged to an expedited three-month approval period for Main Market and ACE Market IPOs for new applications received from March 1, 2024.

“As long as all the required documents and information disclosed are in order, the approval process can be within three months compared to four to five months previously. With the regulators and political leadership encouraging more listings, the working people are also working tirelessly to shorten the approval process,” says Ong.

Blockbuster IPOs, more Sabahan listings

Talk of big IPOs has been circulating, including that of KK Supermart & Superstore Sdn Bhd, following 99 Speed Mart’s listing. The latter debuted on the Main Market on Sept 9, 2024, as the country’s largest IPO in seven years, raising RM2.36 billion, including RM1.7 billion from the offer for sale of 1.028 billion shares by founder and CEO Lee Thiam Wah and his wife, Ng Lee Tieng.

Other potential Main Market IPOs this year include that of MMC Corp Bhd’s port business, MMC Port Holdings Sdn Bhd, which could raise RM7 billion. If that happens, it will be the biggest flotation exercise in more than a decade — beating the RM1.5 billion raised by Mr DIY in October 2020, another recent high-profile IPO.

According to a source, Sabahan companies — including a property developer — are also reportedly considering listings, encouraged by recent successful IPOs of local counterparts such as KTI Landmark Bhd (KL:KTI) in June, beverage manufacturer Life Water Bhd (KL:LWSABAHA) in November and Colform last week. Life Water is listed on the Main Market; KTI and Colform are listed on the ACE Market.

“Prior to KTI Landmark’s IPO, it had been a long stretch since the last IPO by a Sabahan company. The listing is consistent with Putrajaya’s policy to encourage more East Malaysian companies to [step forward] to spur economic growth in the state. Listing helps,” says M&A’s Tan.

“As the price-earnings ratio of property developers is rather low, the motivation for property developers to seek a listing may also be for prestige when dealing with bankers, contractors and buyers of their properties,” says Ong.

Sources based in Kota Kinabalu say local companies eyeing a flotation exercise on the Main Market in the three- to five-year horizon include a consumer group that has more than 50 outlets across the state, and an aesthetics company.

“Both are still in the early stages but, internally, preparations have begun,” says another source.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

- Fire incident in Putra Heights not related to Gas Malaysia facilities, company says

- Massive gas pipeline fire in Puchong — Fire Dept

- Petronas confirms fire incident at Petronas Gas main pipeline near Puchong

- Gas pipeline blaze: 25 receiving initial medical treatment as of 10.35am

- Gas pipeline blaze victims recount earthquake-like tremors

- Directors cannot be automatically retired without an AGM, Court of Appeal rules

- LSH unit assumes management of KL Tower for 20 years until end-March 2045

- SpaceX eyes Starlink hub with multiple ground stations in Vietnam — Reuters

- Teleport to raise a maximum of US$100 mil for capacity expansion

- Gas pipeline blaze: 82, including 12 injured rescued — Selangor MB