(Feb 12): US companies are putting up one of their best earnings seasons in three years on the back of robust economic growth. It’s just not enough to offset worries about tariffs and high interest rates.

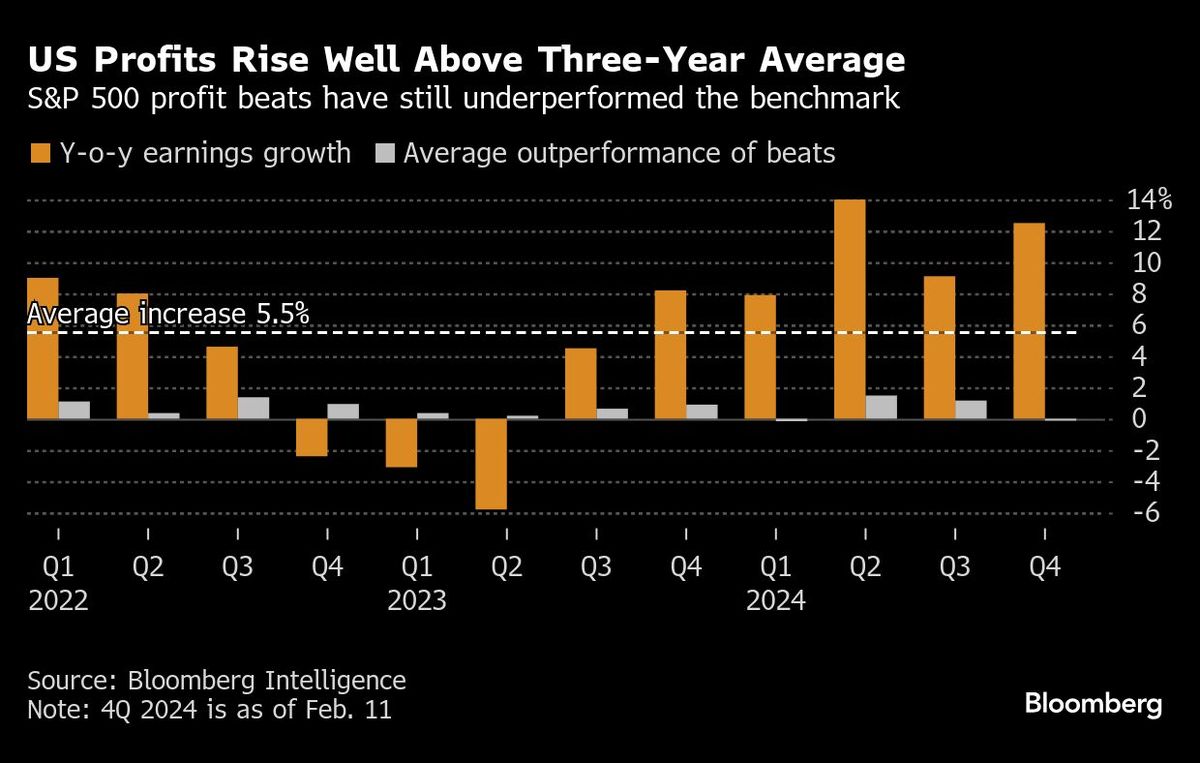

With firms making up three-quarters of the S&P 500 Index’s market capitalisation having reported results, earnings-per-share are on track to jump 12.5% compared with an anticipated 7.3% before the season kicked off, according to data compiled by Bloomberg Intelligence. That’s well above an average 5.5% increase posted since the first quarter of 2022.

But that doesn’t mean investors are rewarding the performance. Stocks beating estimates have still underperformed the S&P 500 by an average of 0.1% on the day of reporting results — one of the worst reactions in four years, BI figures show. And companies falling short of expectations are being punished, with their shares trailing the benchmark by an average 3.2%

The rally in US stocks was already wobbling before the earnings season began on concerns about President Donald Trump’s tariffs, higher-for-longer interest rates and lofty big tech valuations amid heavy spending on artificial intelligence.

“The S&P 500 is easily on track to double its earnings hurdles, but a lower beat rate and sky-high investor expectations for the dominant Magnificent Seven has tripped up stocks as they hesitate around all-time highs,” said Gina Martin Adams, chief equity strategist at BI.

Not so magnificent

Indeed, some of the so-called Magnificent Seven group of tech firms, including Alphabet Inc, Microsoft Corp and Amazon.com Inc, have underwhelmed with their results. Shares of chip-designer Arm Holdings Plc and industrial firm Honeywell International Inc. also dropped as a tepid outlook overshadowed stronger-than-expected earnings.

Analysts cut their estimates ahead of the season, which is partly why the beat rate looks so “healthy,” according to Sophie Huynh, a senior cross asset strategist at BNP Paribas Asset Management.

“We have seen defensive sectors beating sales estimates more than cyclical sectors, with the price reaction to earnings-per-share misses being quite sharp,” she said. “On top of it, guidance is coming in a bit weak.”

Solid reports from retail-oriented firms such as KFC-owner Yum! Brands Inc and apparel maker Ralph Lauren Corp assuaged worries about consumer spending. Walt Disney Co’s earnings topped estimates, and unexpected demand for Pfizer Inc’s Covid vaccine helped the company beat quarterly expectations.

Focus is now shifting to the rest of 2025 and the ability of firms to protect profit margins as concerns rise of an inflation spike later this year. About 44% of S&P 500 firms have beaten operating margin estimates this season, the smallest share since late 2022, BI figures show.

“While this earnings season is going well, it now relies heavily on margin defense by large corporations,” said Florian Ielpo, head of macro research at Lombard Odier Investment Managers. “This approach poses a risk for future seasons.”

Uploaded by Magessan Varatharaja

- Volkswagen's Audi to cut 7,500 jobs in administration, development by 2029

- Vietnam developer proposes 15-year rescue for bank at heart of giant fraud, documents show

- Creative Technology cuts workforce, adding to global wave of tech layoffs — report

- Gobind takes helm of DAP, carrying forward father’s legacy

- Indonesian stock plunge triggers trading halt on economic woes

- Israel strikes in Gaza kill at least 200, Palestinian health authorities say

- My Say: Affordable food: When markets and money decide what we eat

- Indonesian stock plunge triggers trading halt on economic woes

- Americans see growing risk they’ll get turned down for loans

- S&P cuts Vista-backed Solera’s credit rating further into junk