The dampened market sentiment may linger, underscoring the need for a continued defensive strategy, analysts say. (Photo by Zahid Izzani/The Edge)

This article first appeared in Capital, The Edge Malaysia Weekly on February 10, 2025 - February 16, 2025

THE heavy selloff in equities in recent weeks has pushed the total market capitalisation of Malaysian stocks to below RM2 trillion — a level that has been maintained since May last year.

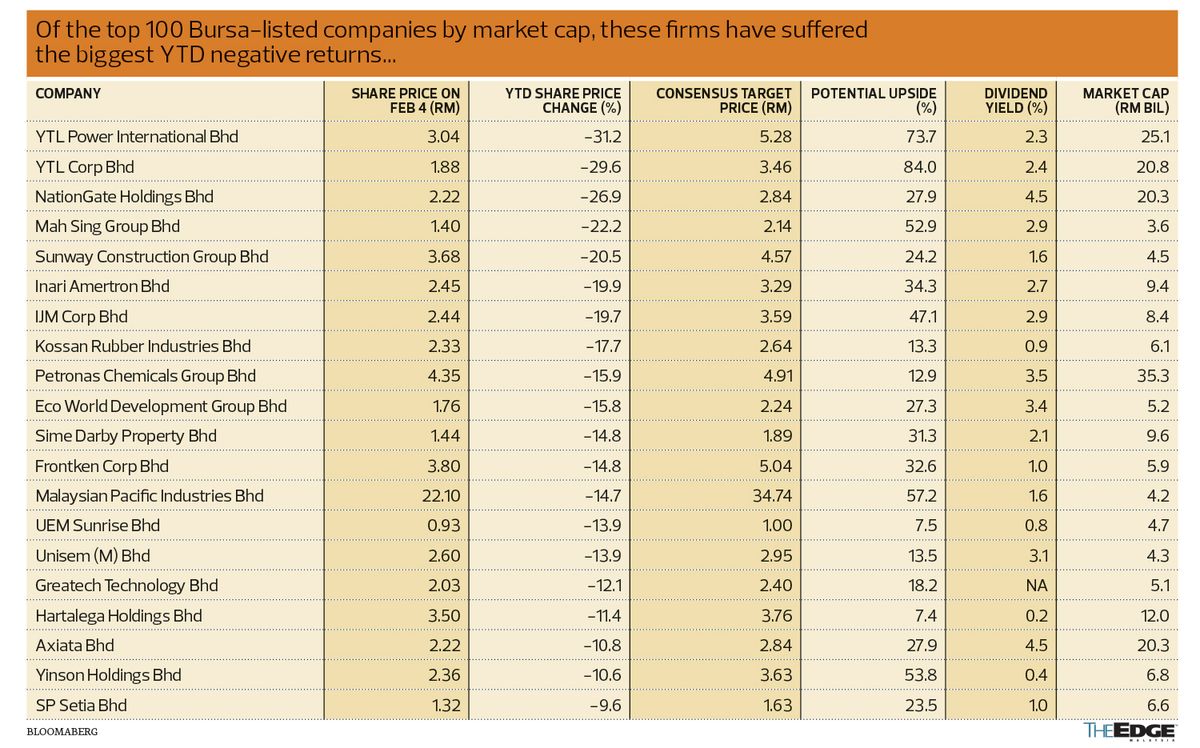

As at Feb 4, the total value stood at RM1.98 trillion, a fall of RM95 billion since the start of the year. A majority of the top 100 stocks by market value have recorded negative returns since the beginning of the year, led by YTL Power International Bhd’s (KL:YTLPOWR) 31.2% or near a third decline, followed by its parent YTL Corp Bhd (KL:YTL) (-29.6%), NationGate Holdings Bhd (KL:NATGATE) (-26.9%), Mah Sing Group Bhd (KL:MAHSING) (-22.2%) and Sunway Construction Group Bhd (KL:SUNCON) (-20.5%).

The share prices of those companies, all of which are involved in data centre development, took a beating on news of US chip export curbs, and the surprise emergence of China-owned artificial intelligence (AI) software company DeepSeek and its successful large language model that has rocked global markets.

Faring much better are companies in traditional sectors, including Guan Chong Bhd (KL:GCB) (+8.6%), Alliance Bank Malaysia Bhd (KL:ABMB) (+7.4%), Axis REITS (KL:AXREIT) (+4.6%) and Sunway REIT (KL:SUNREIT) (+4.3%).

But the battered-down stocks still offer an attractive upside potential compared to their consensus target prices, the highest being YTL Corp (84%), YTL Power (73.7%), Malaysian Pacific Industries Bhd (KL:MPI) (57.2%) and Yinson Holdings Bhd (KL:YINSON) (53.8%).

That said, the dampened market sentiment may linger, underscoring the need for a continued defensive strategy, analysts say.

Interestingly, January 2025 was the worst first month of the year for Malaysian stocks in three decades because of the massive foreign selloff.

If it’s any consolation, February has been historically positive, according to CIMB Securities.

The FBM KLCI declined 5% month on month in January — the steepest decline for the month since 1995. Year to date (YTD), the benchmark index is down more than 4%.

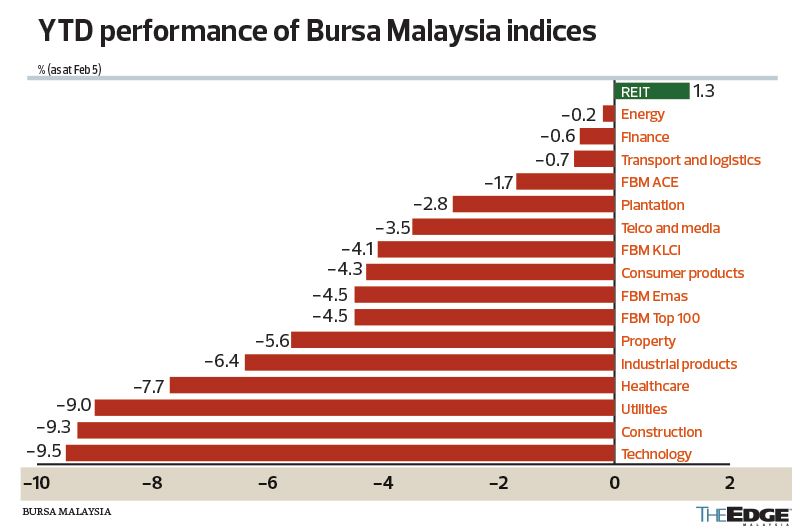

All indices on Bursa Malaysia posted negative YTD returns, except for the real investment trust (REIT) sector, which gained 1.3%. Construction and tech were the worst hit, both charting declines of 9.3% and 9.5% respectively.

Foreign investors dumped RM3.1 billion worth of Malaysian equities, the highest monthly net selling by foreign investors since 2020. Having been net sellers on Bursa Malaysia for 15 weeks in a row, foreign funds sold RM503.3 million worth of local equities for the week ended Jan 31, 2025, resulting in a YTD net outflow of RM3 billion, according to MIDF Research.

Given the current market headwinds, Tradeview Capital CEO Ng Zhu Hann cautions against chasing thematic stocks in the first quarter (1Q).

“Look at stocks with very consistent dividend payout, and don’t chase thematic stocks. If you want to buy thematic stocks on weakness, make sure you can stomach the volatility,” he warns, adding that banking and insurance stocks offer better defensive quality.

“Once the diagnosis-related group (DRG) pricing system issue starts to normalise, I think investors can consider insurance companies such as LPI Capital Bhd (KL:LPI), Syarikat Takaful Malaysia Keluarga Bhd (KL:TAKAFUL) and Hong Leong Financial Group Bhd (KL:HLFG). LPI could benefit from a potential special dividend; Takaful Malaysia is the only shariah-compliant takaful company, while HLFG has an insurance asset in Hong Kong,” he tells The Edge.

Given its attractive risk-reward profile, Hong Leong Investment Bank (HLIB) Research recently upgraded the banking sector to “overweight” after a recent pullback. The sector is trading below its pre-pandemic, five-year average price-to-book ratio at one standard deviation below the historical mean.

Among key positive factors for the sector are a potential emerging market rotational play, driven by the unwinding of long-term inflation expectations in the US, a stronger greenback and elevated US Treasury yields.

“Also, domestic liquidity from GLICs (government-linked investment companies) could help to drive and support the performance of index-heavy weighted sectors in the short term,” the research house said in a Feb 3 note.

For Ng, the January selloff in the local market was indeed a surprise, even though 1Q has always been a defensive month.

“Our funds also adopted the same defensive strategy. But the January selloff was very fierce, and we didn’t expect this kind of magnitude, which was the worst month since 1995.”

Following concerns over AI valuations as well as the emergence of DeepSeek, Ng expects a slight improvement in market sentiment for the remainder of 1Q.

On the brighter side, he sees DeepSeek’s emergence accelerating the adoption of AI, which points to the likelihood that AI infrastructure will still be in need. “We think that the awarded contracts will still go on. The AI and data centre infrastructure will go on.”

However, he highlights that there will be some level of caution arising from the AI adoption, as countries like South Korea, Ireland and France have expressed concern over DeepSeek’s data practices, while Australia has even banned DeepSeek from all government devices and systems.

“There will be a territorial kind of issue surrounding AI. Whether Malaysia can continue to get FDIs [foreign direct investments] depends on whether it can continue to maintain its new stance of managing both superpowers [US and China],” he says.

Trident Analytics Sdn Bhd founder and chief research officer Peter Lim Tze Cheng advises investors to stick to companies with good prospects as he believes that local technology players will see orders coming back this year.

“Inventory has been depleted, and therefore orders have to come in for tech players.”

He favours outsourced semiconductor assembly and test (OSAT) players like MPI and Unisem (M) Bhd (KL:UNISEM); automated test equipment (ATE) manufacturer Greatech Technology Bhd (KL:GREATEC); as well as SAM Engineering & Equipment (M) Bhd (KL:SAM).

Rakuten Trade head of research Kenny Yee views blue-chip stocks as being a safer bet for the time being.

“At the moment, if you go for blue-chip stocks, you won’t go wrong. I think this is a good time to accumulate the big-cap counters.”

However, he is more concerned about small-cap stocks due to the lack of market liquidity.

“At the same time, there are too many IPOs [initial public offerings], so retail investors might just go for new listings. That’s why there is less liquidity in the retail segment. So, for small-cap stocks, I think we need to wait for a while first before seeing an improvement in daily volume traded,” he advises.

Despite the persistent foreign outflow, he believes that foreign funds will return to the Asian markets, including Malaysia, because of the volatility in the US market and the current trade wars.

“Asia is definitely under-invested by foreign funds, and it is the safest investment destination,” he says.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

- Gamuda says to sign several 'imminent' large contracts, as 2Q profit grows 4.8%

- UOB Kay Hian appoints Anne Leh as new CEO

- KLIA Master Plan under review, brick-and-mortar expansion on hold — MAHB

- Gas Malaysia declares final dividend of 10.28 sen per share

- Special Report: Penny stock fever rose as billions poured into market

- Cops probing video, organisation suspected of promoting communist ideology

- Atlantic releases full Signal text chain on Houthi attacks

- Used cooking oil now main commodity in production of sustainable aviation fuel

- 14,000 pigs culled so far in Selangor to curb ASF outbreak, says Veterinary Services Dept

- Bursa Malaysia, subsidiaries to close for Hari Raya Aidilfitri