Tee: I hope the investors will look at our counter for the longer term and give us a little bit more time to prove ourselves. (Photo by Shahrill Basri/The Edge)

This article first appeared in The Edge Malaysia Weekly on March 18, 2024 - March 24, 2024

DESPITE reporting record profits, Johor-based electronics manufacturing service (EMS) provider Cape EMS Bhd saw its shares hit an all-time low this month as earnings came in short of market expectations.

Managing director and group CEO Christina Tee Kim Chin acknowledges the need to better manage market expectations but asks that investors consider the company’s longer-term potential.

“Our management team has been working very hard to deliver the results, but our earnings performance has yet to be reflected in our share price. We are still new in the corporate world, but we are learning. We need to manage market expectations better, especially at the corporate level. From day one, we have been telling investors that Cape EMS will be a very different EMS company compared with our peers. I hope the investors will look at our counter for the longer term and give us a little bit more time to prove ourselves,” she tells The Edge in an interview.

Over the past six months, shares in Cape EMS have declined 25% to as low as 87 sen on March 8. It closed at 89.5 sen last Wednesday (March 13), reflecting 18 times historical earnings and a market capitalisation of RM887.8 million. In comparison, Aurelius Technologies Bhd was trading at 28 times earnings and Cnergenz Bhd at 20 times, while VS Industry Bhd and SKP Resources Bhd were trading at lower multiples of 16 times and 14 times respectively.

When Cape EMS’ stock price was falling, stock exchange filings showed that Tee had on Feb 27 and 28 bought two million shares from the open market, raising her direct stake to 38.05%. Her younger sister Ivy Tee Kim Yok is a non-independent executive director and the second-largest shareholder with a 11.04% stake. Institutional investors collectively own 32.71% stake, while retail investors have 18.19%.

Headquartered in Senai, Johor, Cape EMS specialises in EMS, contract electronics manufacturing, box build and full turnkey projects, as well as total supply chain management. The group also has factories in Tebrau and Kempas in Johor, as well as a testing facility in Singapore.

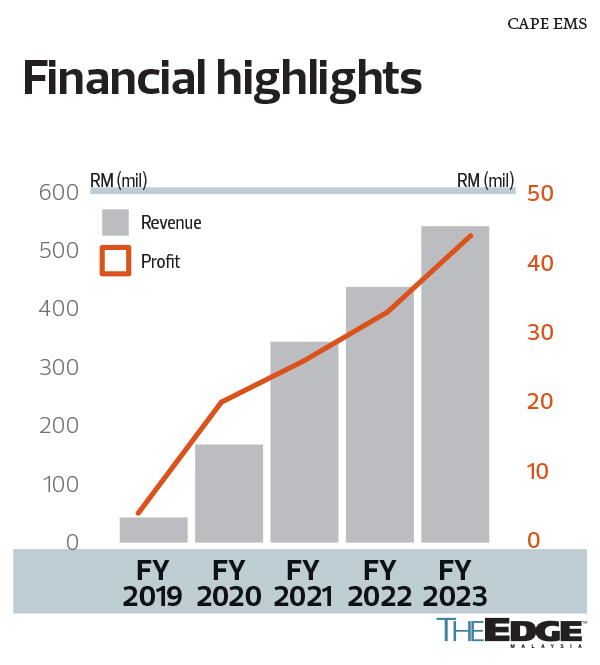

Cape EMS saw its net profit grow 32% to a historical high of RM44.38 million in the financial year ended Dec 31, 2023 (FY2023), up from RM33.54 million the year before. The group’s turnover also increased 24% to RM542.8 million in FY2023, compared with RM437.9 million the year before.

The disappointment came as Cape EMS’ fourth-quarter net profit fell 38% to RM5.5 million from RM8.93 million a year earlier, partly due to finalised tax expenses, as well as higher operational costs.

In a research report on Feb 27, AmInvestment Bank Bhd highlighted that the group’s core net profit of RM47 million in FY2023 was below expectations — 8% below its forecast and 12% below consensus estimate.

Nevertheless, 57-year-old Tee, who founded Cape EMS in 2013, remains optimistic that the company will regain lost ground and recover strongly in the coming two years.

“Ideally, my ultimate target for Cape EMS is to achieve a market capitalisation of RM2 billion within two years. I am very confident about achieving this target. But of course, given that our share price has come down lately, my immediate target is to revisit the RM1.2 billion level first,” she remarks, noting that earnings growth would be driven by three newly secured clients plus three more potential clients in the coming two years.

Tee acknowledges that Cape EMS is not as big as the likes of VS Industry and SKP Resources, which she describes as “volume game players”.

“We are more into the niche market. In the industrial products segment, you need to develop a lot of manufacturing intellectual property (IP) to increase customer stickiness and also protect your customer’s IP,” she explains.

Absolutely Stocks data shows that Cape EMS’s rolling 12-month net margin was 8%, slightly lower than Cnergenz’s 9% and Aurelius’ 10%, but higher than VS Industry’s 4% and SKP’s 5%.

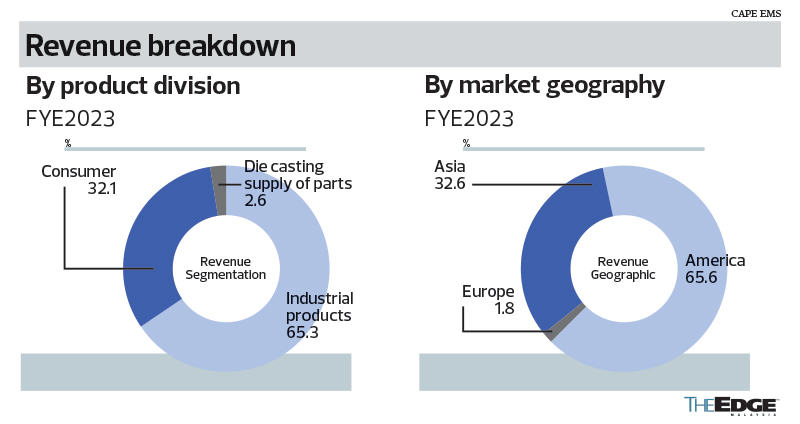

“Industrial products generally give us better profit margin than consumer products. It’s always about 8% to 10%. But for consumers, it’s basically about 5% to 8%. Hopefully, our mix will be more into the industrial products,” Tee says.

Generally, EMS companies with a consumer-centric focus may face increased vulnerability amid a potential global economic downturn due to diminished consumer sentiment. But those with an industrial-centric approach are better positioned, benefiting from structural growth trends like 5G, electric vehicles, artificial intelligence and data centres.

“We have higher exposure towards the industrial sector, whose demand is relatively [more] stable than the consumer sector. Industrial demand always remains strong but normally is high-mix, low/medium volume. But even if you look at Cape EMS’ consumer products such as e-cigarette with FDA (Food and Drug Administration) approval, there are no signs of slowing down,” Tee elaborates.

Diversified customer base

Cape EMS currently has four active customers, namely Mimosa Network Inc, NextCentury Submetering Systems, K&Q and Customer A. The group has three newly secured clients in the queue, and it expects another three new customers in the next two years.

“With such a pipeline, we expect financial contributions from the new clients to start kicking in by the second half of this year or next year. When I look at these three new clients plus the three potential customers, I think their orders could be as big as the current orders from our existing four major customers. In short, we are going to have 10 active customers in the future, and we don’t want any of them to contribute more than 10% in our profile. If everything goes according to plan, I think our RM2 billion targeted market cap is achievable,” Tee reiterates.

Cape EMS was listed in March 2023 following an initial public offering at 90 sen apiece, which raised RM155.7 million. As at Dec 31 last year, the company’s cash and cash equivalents amounted to RM170.2 million, while its gearing ratio stood at 0.4 times.

In mid-December 2023, Cape EMS raised RM73.83 million by placing out 69 million shares at RM1.07 each to help fund its US$16.5 million acquisition of US-based electronic manufacturing services company iConn Inc.

Tee points out that since Cape EMS went public a year ago, she has set a target for the company to have at least five customers from different segments, so that it can be an EMS company with a diversified clientele base.

“If you look at some of our EMS peers, especially those from Johor, most of them are consumer products-oriented whereas our strength is more towards industrial products,” she explains.

For consumer products, Cape EMS only makes electronic cigarettes and vacuum cleaners. As for industrial products, it makes wireless connectivity transmission products, smart utility data collection equipment and packaging tracking devices.

As at Jan 31 this year, Cape EMS’s order book stood at RM217.9 million, of which 85% was from the industrial products segment, and the remaining 15% from the consumer products segment.

Since the company’s listing, Tee has also implemented a “no boss policy”: nobody in Cape EMS is allowed to call her boss. “When you work here, everybody is the owner and everyone is the boss. This is our company culture. You don’t need to please your boss in your appraisal, because your colleagues will be appraising you too. To me, profit is important, but the people and the planet are even more important. We have to grow sustainably and we will take good care of our employees,” she stresses.

A&W roots

Tee began her career in A&W (M) Sdn Bhd, joining its first outlet in Batu Road (now known as Jalan Tuanku Abdul Rahman) in Kuala Lumpur in 1985 after completing her Form 6. Starting as a management trainee, she was promoted to marketing assistant, personal assistant, general manager, and finally assistant manager at the Ipoh outlet. In 1992, Tee left A&W and joined Jangta Electronics (M) Sdn Bhd as a storekeeper before rising up the ranks to be the general manager in 1999. Three years later, Tee became general manager at Crestar Printer (M) Sdn Bhd. She later held positions at PT Ultrakindo Crestec Indonesia and Toyoplas Holdings Pte Ltd, where she oversaw factory management and operations.

In 2013, Tee acquired equity interest in Toyoplas EMS Manufacturing (M) Sdn Bhd, which was later renamed Cape EMS Manufacturing (M) Sdn Bhd, and assumed the role of CEO.

“It has always been my dream to run an EMS company. When I started Cape EMS in 2013, it was actually a management buyout from my former employer Toyoplas. In 2010, I had set up an EMS division for Toyoplas before I left the company in 2012,” she recounts. About six months later, Tee’s ex-boss offered her a buyout deal.

“We acquired Toyoplas’s EMS business for RM20 million in 2013 before we sold it to one of the top tech firms from Shenzhen in 2017. So, we actually divested the old EMS business unit and we started all over again with some restructuring works in the second half of 2019. In a way, you could say that Cape EMS is a different, newly set-up company,” she explains.

Mimosa Network was its first customer. “They had given us the letter of award as they were moving out from China by the end of 2019. Since then, Cape EMS has been on a steady growth path by seizing opportunities from the US-China trade war, and we were able to list the company in a short time,” says Tee.

Throughout her career, says Tee, she has always been a “sales girl” and a “factory girl”. She also acknowledges that her seven-year work experience in A&W has shaped her strong character today.

“During my time at A&W, they gave me very good management training; they taught me how to read the financials, and I had also learnt about managing a store. I still remember the first thing that my manager trained me to do — how to welcome customers. Every morning, my job was to greet the passengers who came down from the bus [in Batu Road] and ask them to come to A&W, making sure that they didn’t walk into KFC [next door]. That’s how I was trained to become thick-skinned,” she says, relating how she was initially upset by the work arrangement but later overcame shyness and learnt the value of good customer service.

“Even if they don’t come in for breakfast, they might come in to buy a cup of coffee. My manager once told me that some customers came to our store just because they liked my smile. Slowly, my smile became more shining and natural as I felt more confident. That’s why when I joined the manufacturing industry and started doing sales, I was always very thick-skinned and never ashamed to ask for business. Like my late father always said, when you have no GPS and no map, the map is your mouth. That’s how we were trained from young,” she says.

Tee says she never hesitates to ask for help and believes solutions will be closer than one thinks with the right support. “People will not laugh at you if you ask for help, but you will be in trouble if you don’t. Even if that person can’t provide you help, he or she may call another person to help you. You will never know that your help is probably just six, seven people away. If they don’t give you, you have got nothing to lose. But if they give you, then you win the game.”

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

- China amplifies rebuke of Li Ka-shing’s Panama Port deal with BlackRock

- Batik Air throws support behind Subang Airport's expansion, urges faster slot allocation following AirAsia’s departure

- Malaysian stocks turn positive as investors across Asia cheer potential bipartisan deal to avert US govt shutdown

- Gold counters on Bursa Malaysia surge as safe haven demand rises amid concerns over US economy

- Donald Trump makes Chinese stocks great again

- Khazanah said to be in talks to buy INCJ stake in tower firm Edotco — Bloomberg

- Tesla warns it, other major American exporters could face retaliatory tariffs as a result of Trump's trade policies

- China tells lenders to boost financial support for consumption

- Singapore's DBS raises US$2b through US dollar bonds, term sheet shows

- Navigating complexity: The significance of systems thinking in future studies