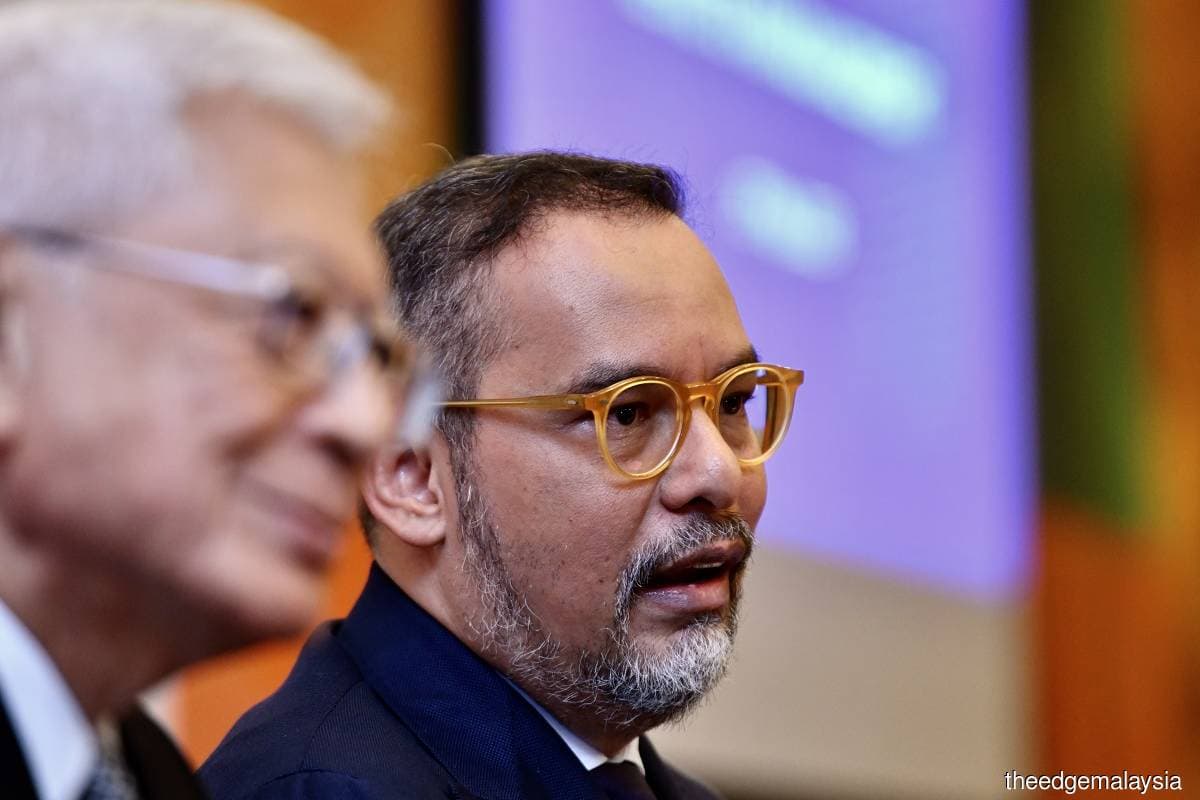

KUALA LUMPUR (May 25): After a dry spell in new direct investments last year, Ekuiti Nasional Bhd (Ekuinas) CEO Syed Yasir Arafat Syed Abd Kadir sees an improvement, although he “won’t be too hopeful” of deal pipelines in 2023.

The private equity firm had looked into over 50 potential opportunities in 2022, but valuations of good quality assets were too high at that point in time, he told a press conference to announce Ekuinas’ 2022 financial results on Thursday (May 25).

This year, Ekuinas is focused on further deploying its RM1.5 billion Direct Tranche IV fund, as well as the RM100 million new fund called Dana Asas which was announced by the government in the revised Budget 2023.

It is also monitoring the exits of the fund under its outsourced fund managers, which have underperformed Ekuinas’ direct investments.

“The challenge for funds like us is to find quality deals in Malaysia. It is a small market; a lot of companies are not regionalists in outlook, and tied down to the local economy,” Syed Yasir Arafat said.

There is also continued competition from global funds, as there is too much dry powder (short-term highly liquid assets) in the market, particularly for deals of US$50 million and above, or US$100 million and above, he said.

Merger and acquisition (M&A) activities in Southeast Asia fell in 2022 to US$533 million, from a record US$1 billion in 2021, according to data from Mergermarket referenced by Ekuinas.

That said, strategic acquirers in Southeast Asia paid median 13.6 times EV/Ebitda valuation and 19.6 times median PER for M&As in 2022, the data showed.

“There’s pressure to deploy capital; people are willing to pay quite a fair bit of premium.

“From our perspective, we try to differentiate from the local angle — knowing the country, knowing the economy, knowing how the market works, and not to have misalignment of culture. I think that’s very important for some of the entrepreneurs,” Syed Yasir Arafat added.

Upside remains for pharmaceuticals, O&G and logistics sectors

On the industry outlook, Syed Yasir Arafat expects sectors such as medical and pharmaceuticals to continue to perform well this year, as well as logistics and oil and gas (O&G). The retail segment, which grew 30% last year, will see softer performance, especially in the food and beverage space.

“The electrical and electronic sector will continue to be attractive for funds like us, because we see that’s an area where Malaysia has a competitive advantage.

“For the energy sector, while we see strong demand, we are concerned about money invested into the sector. I think the challenge for the energy sector is that a lot of funds are not allowed to invest in sectors that are deemed as dirty, for example,” he said.

“But that sector continues to grow, we feel, and returns continue to be interesting. But deploying capital will be challenging, because exit may be challenging for us,” he added.

This year, Ekuinas has begun deploying its RM100 million Dana Asas for Bumiputera companies, with the first investee company being the Kaisar Farmasi pharmaceutical chain owner Eagle Cliffe (M) Sdn Bhd.

Ekuinas, which has received a total RM4 billion capital injection from the government over the course of its 14 years of operation, has directly invested into 24 companies and divested 13 of them to crystallise RM3.8 billion in value. Cash and equivalents stood at RM3.4 billion at end-2022.