KUALA LUMPUR (May 25): Ekuiti Nasional Bhd (Ekuinas) portfolio companies recorded a healthy recovery in FY2022 with a 30.2% rise in revenue, from 12.3% last year, and an ebitda (earnings before interest, taxes, depreciation, and amortisation) increase of 31.3%, from 27.2%.

Fund performance of the private equity buyout firm remained positive with Ekuinas Direct (Tranche II) Fund’s gross portfolio return rising further to RM716.6 million, from RM654 million in the previous year.

Gross internal rate of return (IRR) per annum however slipped to 11.9% by 2022, from 12.1% in 2021.

Meanwhile, Tranche III Fund turned around to positive IRR after three years in the red, at RM133.5 million or 3.1% per annum, from a loss of 4.3% or RM125.3 million in 2021.

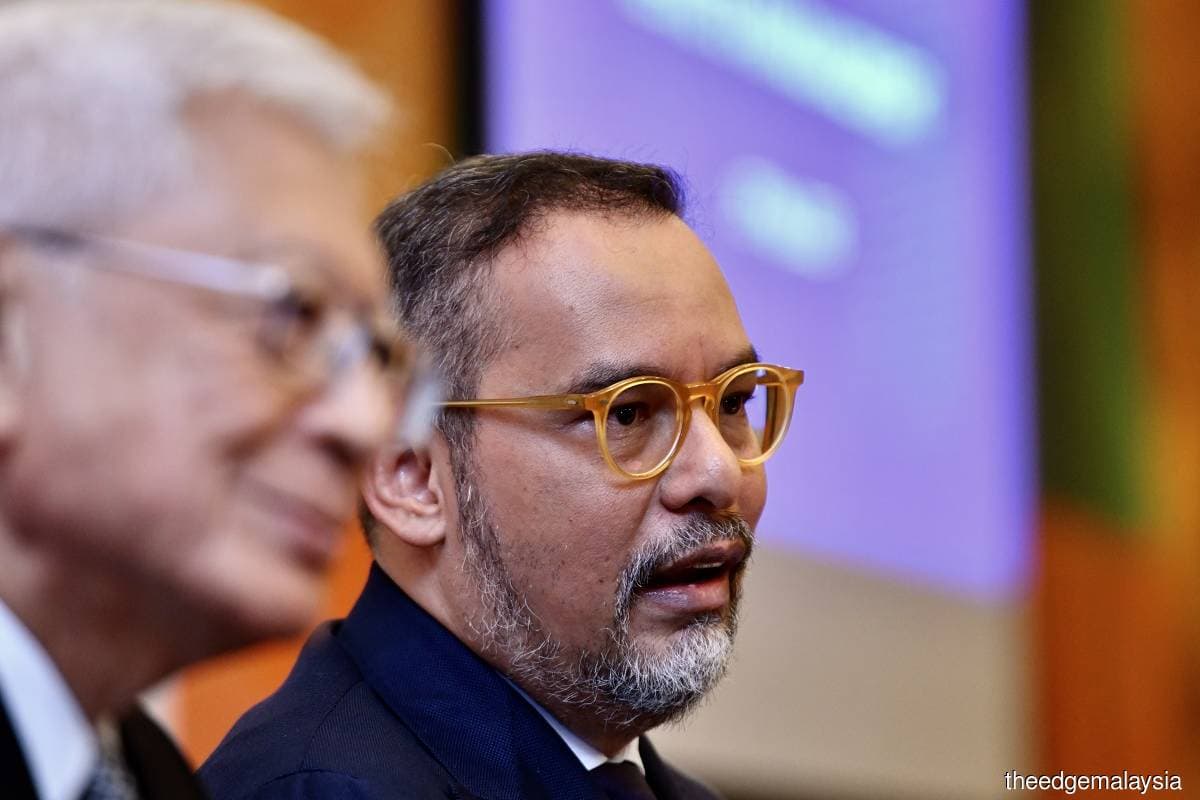

The improved performance for Tranche III was on the back of pent-up demand recovery in the retail space, led by sports retail group Al-Ikhsan Sports, and improvements in the oil and gas (O&G) operating landscape, said Ekuinas chief executive officer Syed Yasir Arafat Syed Abd Kadir.

Tranche III performance also saw higher contribution from Icon Offshore Bhd, which flipped a rig in 2022, which it purchased at the height of the pandemic in 2020, Syed Yasir Arafat said at the press conference after the announcement of Ekuinas 2022 results here.

Ekuinas’ outsourced funds involving four partners did not perform as well, although the Ekuinas Outsourced (Tranche I) Fund IRR improved to 4.1% per annum, from 3.3%.

The Ekuinas Outsourced (Tranche II) Fund returns declined further in 2022, with a negative IRR of 2.7%, from a 0.8% negative IRR last year.

For 2023, Ekuinas will continue to monitor the exits of its portfolio under outsourced fund managers, as it seeks to refocus into direct investments, it said.