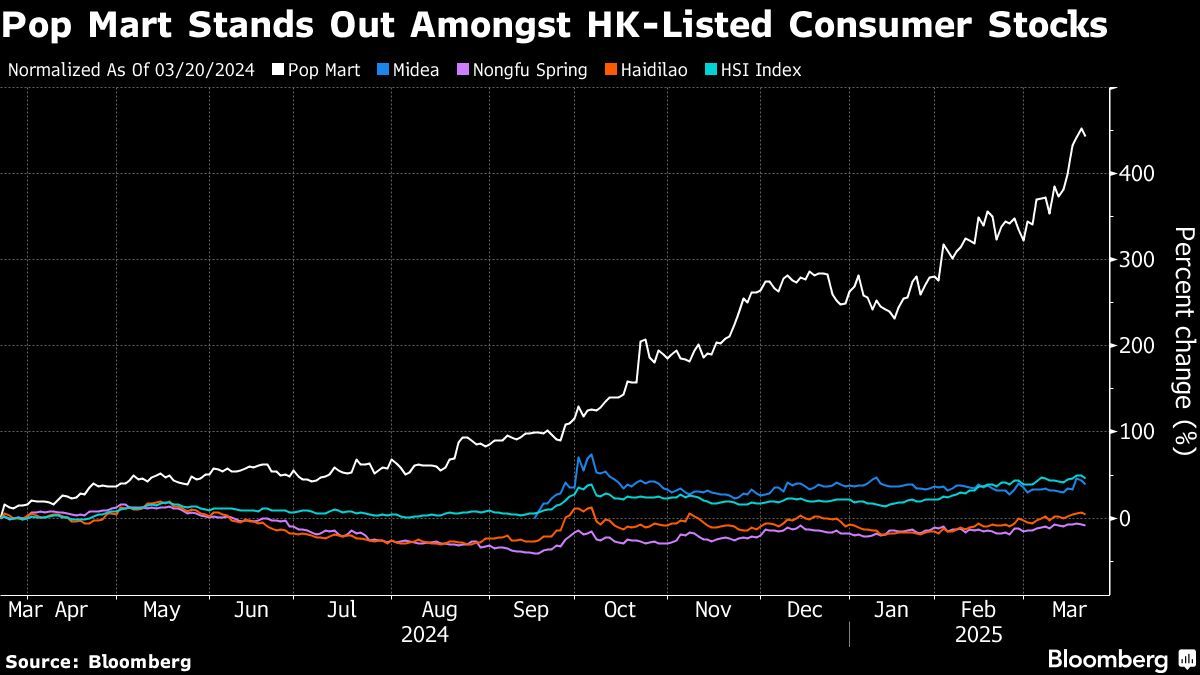

Expectations are particularly high for Pop Mart International Group Ltd, whose blind box toys have become a global phenomenon, amid celebrity fanfare and strong overseas sales.

(March 21): Chinese consumer giants dominate next week’s earnings after a survey showed consumers are feeling increasingly optimistic and Beijing outlined plans to revive consumption by boosting incomes.

Earnings reports are seen as potential catalysts after details from a closely watched consumption-focused press conference earlier underwhelmed investors.

Expectations are particularly high for Pop Mart International Group Ltd, whose blind box toys have become a global phenomenon, amid celebrity fanfare and strong overseas sales. Midea Group Co stands to benefit from China’s consumer trade-in measures. Haidilao International Holding Ltd and Nongfu Spring Co are also due.

Meanwhile, efforts to to support an economic recovery by issuing 500 billion yuan (US$69.1 billion or RM305.0 billion) in special sovereign bonds to boost capital at its biggest banks puts the outlook of Industrial & Commercial Bank of China Ltd (ICBC), China Construction Bank Corp (CCB), Agricultural Bank of China Ltd (AgBank) and Bank of China Ltd in focus. Chinese banks held their benchmark lending rates for a fifth straight month in the absence of more monetary easing.

Highlights to look out for:

Monday: BYD’s full-year revenue likely surged 27%, consensus showed. The carmaker’s recently revealed line-ups of electric vehicles which can charge nearly as fast as the time it takes to refuel a regular car is a “game changer”, Bloomberg Intelligence (BI) said. More affordable models could emerge soon in a boost for sales.

Tuesday: Haidilao International’s second-half revenue will likely be weighed down by lower contributions from its restaurant operations, consensus showed. The company’s table turnover rate is expected to be under pressure in the second half, due to a high base a year earlier and a sluggish catering market, CGS International said. Overall, its full-year revenue growth likely slowed to about 8%.

- Nongfu Spring is likely to post the slowest annual profit growth since its listing amid the price war in China’s bottled water market. Still, BI expects earnings should be steady in the medium term, as Chinese consumer preferences shift towards health-conscious options. Analysts at Citi also expect it to benefit from the country’s pro-consumption measures.

- Kuaishou Technology’s fourth-quarter revenue likely rose 9.7%, supported by growth at its online marketing services unit. Its online digital advertising business will likely face pressure from its rivals including Douyin and Xiaohongshu, BI said.

Wednesday: Pop Mart’s full-year earnings are expected to more than double on higher revenue contributions from its retail stores and online channels. Citi reckons that the company’s growing global footprint and recognition of its diverse character figurines should continue to underpin its solid growth momentum.

- Bank of China may face net interest margin challenges amid lower rates in both domestic and overseas markets, said BI.

Thursday: No major earnings of note.

Friday: Midea should report 11% second-half profit growth as it continued to benefit from China’s home appliance trade-in programme. Analysts also cheered better-than-expected retail sales growth for the first two months of the year, seen as positive for companies like Midea in 2025.

- Country Garden continued to see sales slump amid its restructuring efforts. The developer is seeking to postpone payments for two domestic bonds that were due in March, according to local media outlet The Paper.

- ICBC, CCB and AgBank could see earnings miss consensus, amid a bigger-than-expected margin squeeze, BI said, noting a mandatory 50-basis-point cut in rates on outstanding mortgages and lower reinvestment bond yields. CCB and AgBank are seen worst off.

Uploaded by Tham Yek Lee

- US seeks to control Ukraine investment, squeezing out Europe

- US beef sales to China skid after Beijing lets export registrations lapse

- HI Mobility debuts on Main Market with slight premium

- Iran oil-filled tankers build up off Malaysia as US sanctions mount

- Cars under US$30,000 risk becoming a casualty of Trump’s tariffs

- Genting says Nevada authorities have signed off settlement terms for Las Vegas complaint

- Why does Trump want the US to control Greenland?

- Kumpulan Perangsang Selangor proposes change of auditor

- Stocks with momentum on March 28, 2025: GDEX, Pecca Group

- Selangor fibreglass plastic maker WF Holding breaks below IPO price on Nasdaq listing day