Bank Negara Malaysia is the only Southeast Asian central bank that hasn’t pivoted to policy easing so far. However, Malaysian swaps are fully pricing in a 25-basis point rate reduction over the next 12 months, from about a 66% chance of a quarter-point cut as of end-February.

(March 20): Swap markets in Asia are indicating a slight increase in bets on interest-rate cuts in the region as the dollar slumps.

Indian, Malaysian and Thai swaps are signalling more policy easing as the dollar’s weakness bolsters regional currencies, allowing central banks to focus on reviving growth instead of actively supporting their exchange rates.

The urgency for rate cuts is rising amid growing signs of disinflation. February headline inflation in Indonesia, the Philippines, South Korea, Thailand, Taiwan, China and India all came in weaker than expected. Easing policy could help counter any economic impact of possible tariff announcements from US President Donald Trump in April.

“Recent baht strength could give more scope for Bank of Thailand easing, which will support Thai bonds,” said Wee Khoon Chong, a strategist at BNY in Hong Kong. “India’s bonds will similarly be supported by the anticipated easing ahead, although index inclusion flows will also influence its trajectory.”

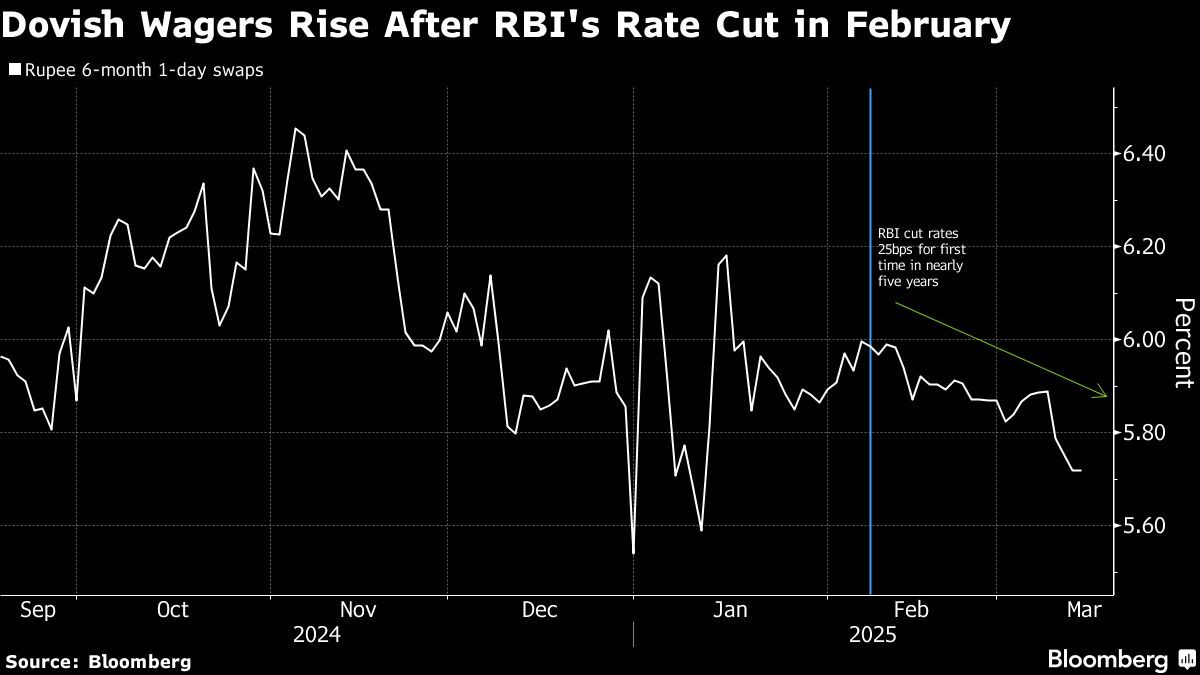

Here are three charts that show how traders have recently turned more dovish.

India

Indian swaps have priced in an additional 37 basis points (bps) of rate cuts over the next six months. The rupee has backed off more than 1.5% from a record low touched after the Reserve Bank of India’s (RBI) rate cut on Feb 7. There are headwinds to growth as President Trump said India won’t be able to avoid being hit by reciprocal tariffs from the US in April.

The country’s inflation rose 3.6% in February, below the RBI’s midpoint target of 4%. That “should allow the central bank to cut rates more aggressively to support growth,” according to a Bloomberg Economics a note last week. Brent oil prices, which have fallen over 10% from year-to-date high in January, will also help keep a lid on inflation.

Malaysia

Bank Negara Malaysia is the only southeast Asian central bank that hasn’t pivoted to policy easing so far. However, Malaysian swaps are fully pricing in a 25-basis point rate reduction over the next 12 months, from about a 66% chance of a quarter-point cut as of end-February.

Malaysia’s economy may face headwinds from global trade tensions. That’s because the US is Malaysia’s third-largest market for semiconductor exports, making the Asian nation susceptible to Trump’s tariffs on the chip sector.

Thailand

Baht swaps are pricing in a total of 48bps of rate cuts over the next one year. That’s 10bps more than what was priced prior to the Bank of Thailand’s surprise policy easing last month.

And while the BOT said it’s keeping a high bar for the next cut, traders have priced in more dovish views amid the government’s preference for looser monetary policy and expectations that the Thailand’s export-oriented economy would be vulnerable to US tariffs.

While a weakening dollar could see more policy easing in emerging Asia, it will not be a shift to a strong dovish forward guidance to “avoid causing additional volatility in the local market,” said Jeffrey Zhang, a strategist at Credit Agricole in Hong Kong.

Uploaded by Felyx Teoh

- Alliance Bank, Crest Builder, Capital A, AirAsia X, Nestlé, DRB-Hicom, VS Industry, Genting, Salcon, Erdasan, CelcomDigi

- Wall Street falls on tariff woes; FedEx slides after bleak forecast

- Jentayu Sustainables incurs RM6.35m cost from aborted hydro asset acquisitions

- UAE to pledge US$1.4 tril in US investment after Trump meeting

- Trump’s ‘big one’ on tariffs has emerging market on edge

- Who paid the highest dividends in FY2024?

- Former Sabah minister Peter Anthony seeks to review Court of Appeal's decision

- Terengganu was allocated RM1.84 bil for development this year — PM

- Nga tells the people to reject divisive voices that threaten multiracial unity

- China backs Malaysia’s Asean leadership, prioritises ACFTA 3.0