Business activity in the euro area hardly grew again in February with the S&P Global's composite purchasing managers' index holding at 50.2, just above the 50 threshold separating expansion from contraction.

(Feb 21): Business activity in the euro area hardly grew again in February, reinforcing fears that the bloc remains mired in stagnation.

The composite purchasing managers’ index (PMI) by S&P Global held at 50.2, just above the 50 threshold separating expansion from contraction. Analysts had predicted a reading of 50.5.

“The somewhat milder recession in the manufacturing sector is only just being overcompensated for by the barely noticeable growth in the services sector,” Cyrus de la Rubia, an economist at Hamburg Commercial Bank, said on Friday in a statement, adding that the figures don’t point to a recovery.

The euro held an earlier drop, trading about 0.2% lower at US$1.0476, as investors added to bets on European Central Bank (ECB) interest-rate reductions. Money markets are now pricing 78 basis points (bps) of easing this year compared with 74bps on Thursday. Bonds held gains, with the German 10-year yield three basis points lower at 2.5%.

European growth has been hobbled by a manufacturing malaise, political turmoil in its two biggest member-states and heightened uncertainty from the war in Ukraine to persistent threats of US trade tariffs The latest jolt came from President Donald Trump and his administration as they signalled much weaker support for European defence in the future, necessitating much higher military outlays by the continent itself.

“The PMI survey for February suggests the hit to the euro-area economy from the rise in uncertainty created by Trump’s tariff threats has been modest. However, the coast is still far from clear as the details of his proposed measures remain hazy. In any case, putting trade policy aside, the expansion of the economy has been lackluster for some time and it could still benefit from further monetary easing,” says David Powell, senior euro-area economist at Bloomberg Economics.

The euro area’s PMI has been fluctuating around 50 since June, with a series of ECB cuts since last June helping prevent a downturn. Long-awaited rebounds in consumer demand and corporate spending, however, have failed to materialise, even as inflation looks set to return to 2% this year.

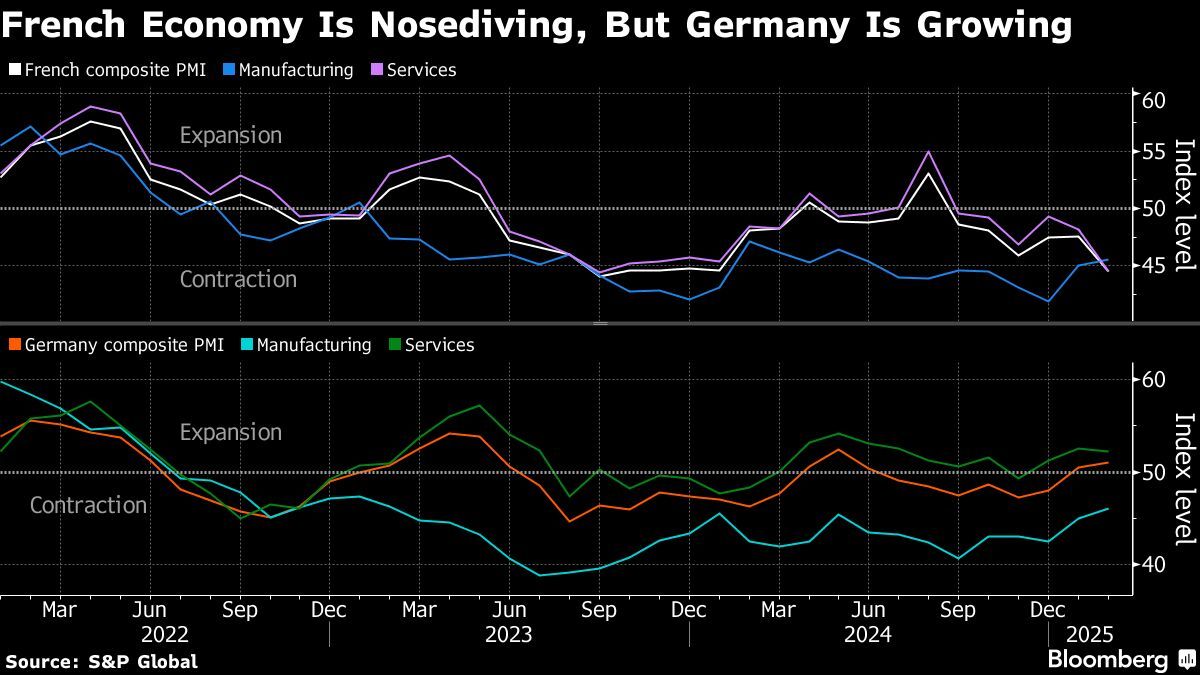

Germany has begun to perform a little better ahead of Sunday’s snap ballot, where it’s hoped that the likely next chancellor, conservative Friedrich Merz, will cut red tape and reinvigorate investment. Its composite PMI beat analyst expectations to reach 51.

De la Rubia was upbeat on the prospect of a new course for the region’s top economy, saying that the next German government may “be able to act after the elections, which should also provide a positive impetus for the eurozone as a whole”.

By contrast, French data wrong-footed economists with a reading of just 44.5 — well below January’s 47.6. That reflected a particularly poor showing in services.

Nonetheless, the data revealed that gauges for services inflation across the region either rose or stayed elevated.

“With just two weeks to go before the ECB meeting, the price front is sending bad news,” said de la Rubia. “This is partly due to the fact that wage settlements continue to be above average.”

The ECB has become increasingly certain that price gains are headed back towards the 2% goal in the coming months, allowing them to continue lowering borrowing costs. Executive Board member Isabel Schnabel, however, has warned that after five moves since last June, the central bank is nearing the point where it might pause or halt rate cuts.

PMIs are closely watched by markets as they arrive early in the month and are good at revealing trends and turning points in an economy. A measure of breadth of changes in output rather than depth, business surveys can sometimes be difficult to map directly to quarterly GDP.

Separate data showed continued private-sector growth in the UK, though the composite PMI reading was less than expected. The US index is seen advancing to 53.2 when numbers are released later on Friday.

Uploaded by Felyx Teoh

- Gas pipeline blaze: Petronas Gas, Gas Malaysia’s shares open marginally lower after trading halt

- Gas pipeline blaze: MIDF flags potential RM18m impact to Petronas Gas

- Police to look into allegations that digging caused gas pipeline fire

- Digital banks in Malaysia urged to re-examine strategies to better serve B40 segment

- T7 Global plunges to two-year low as executive deputy chairman departs

- Al-Aqar REIT faces earnings risks with lease renewal of key properties, acquisition — analysts

- Putra Heights blaze: Housing Ministry studying best way to help displaced victims

- Walmart keeps price pressure on suppliers after Beijing pushback — Bloomberg

- Alibaba prepares for flagship AI model release as soon as April, Bloomberg News reports

- US dollar outlook more subdued, but tariffs souring sentiment