(Feb 17): Central banks across Asia are increasingly using derivatives to protect their currencies against a strong US dollar, raising questions over how long they can do so, and whether they are just storing up trouble for the future.

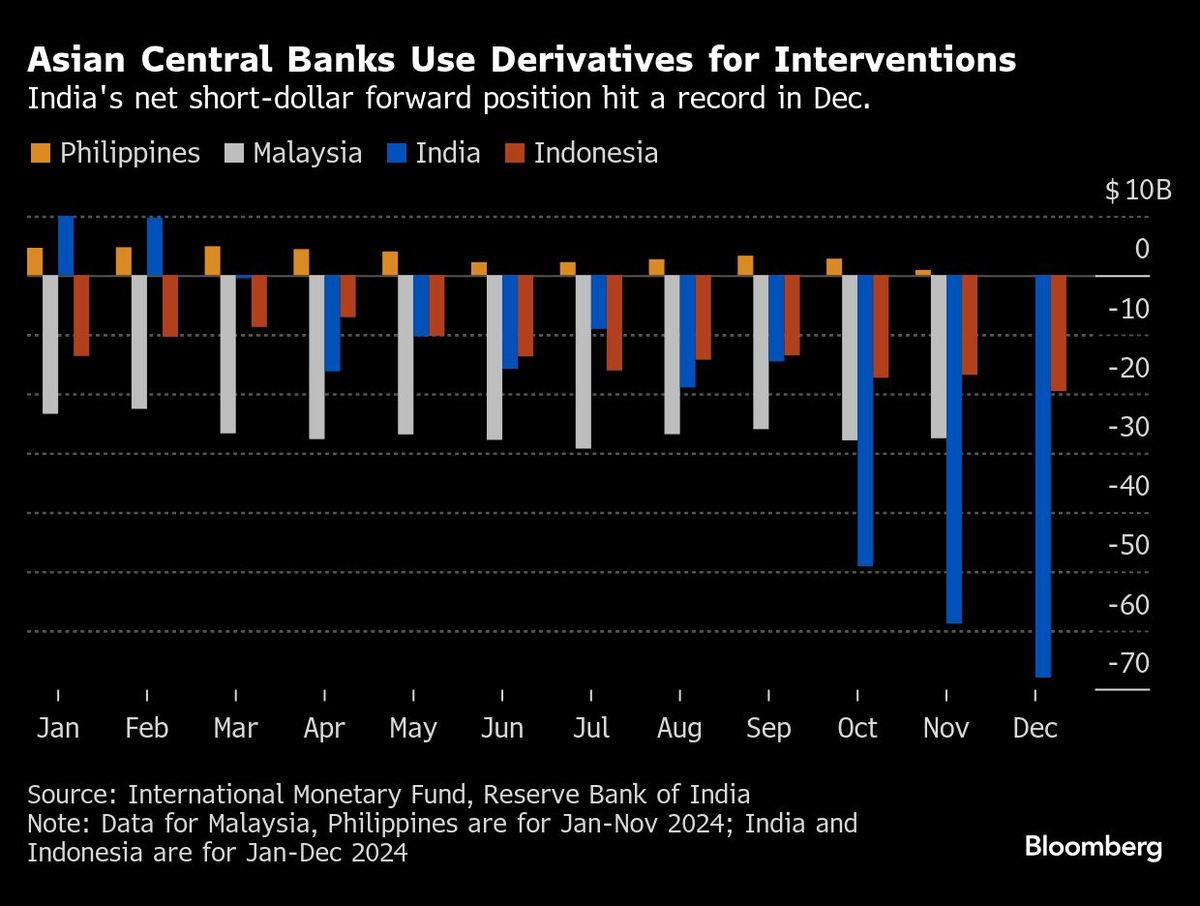

The Reserve Bank of India’s (RBI) net dollar short forward position — the amount of dollars that will be sold at a future date for a pre-set price — hit an all-time high of US$68 billion (RM301.14 billion) in December. Meanwhile, Bank Indonesia’s (BI) net short book reached US$19.6 billion, its highest since at least 2015, the latest official data showed.

The swelling forward books point to a shift in strategy among central banks intervening to defend their currencies. But the use of derivatives in addition to spot trades to push back against the dollar is raising concerns about the risk that selling pressure is being deferred rather than removed.

“It’s basically pushing out currency depreciation to a later date and in the meantime, keeping headline reserves high as a way of displaying confidence,” said Dhiraj Nim, a currency strategist at Australia and New Zealand Banking Group. “I am a bit worried about that scenario.”

BI and the RBI didn’t immediately respond to Bloomberg’s request for comment. Both institutions have previously confirmed use of derivatives.

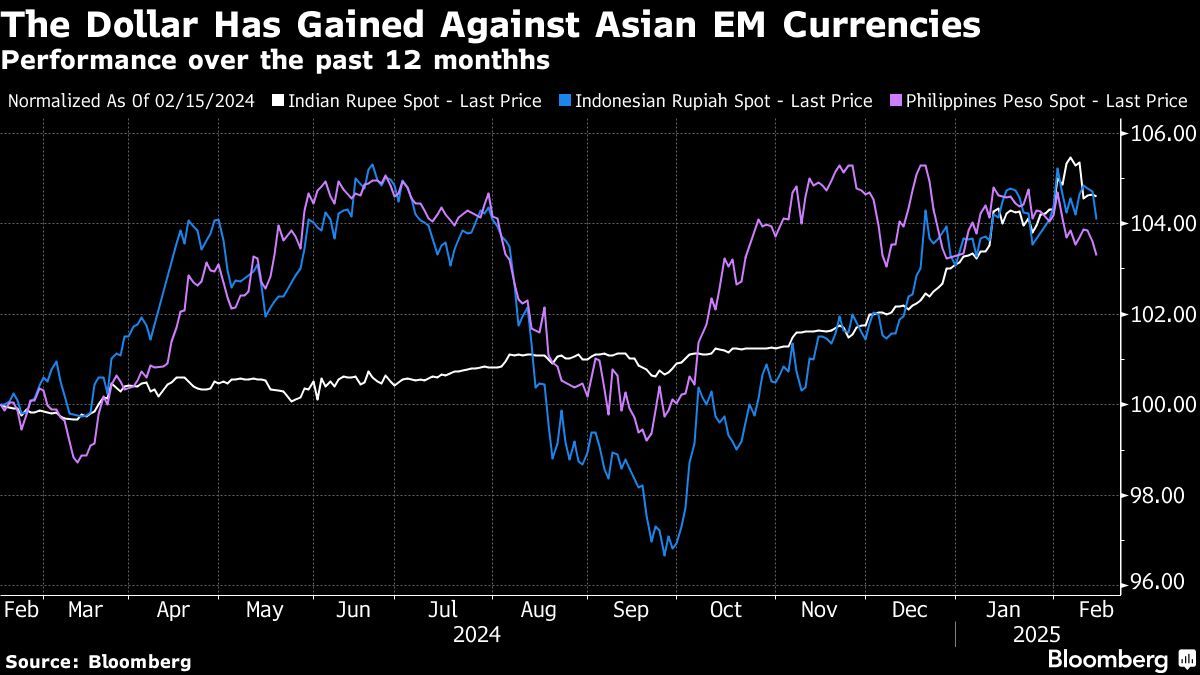

The Indian rupee and the Indonesian rupiah have been two of Asia’s worst performing currencies over the past 12 months, both losing more than 3.5% of their value against the dollar.

Political risk

The election of US President Donald Trump has ramped up pressure on emerging-market central banks. Trump’s threats of tariffs have fuelled waves of currency depreciation against the dollar, while his willingness to label other countries as currency manipulators has raised the political scrutiny of intervention.

“It’s clearly a very sensitive issue, particularly in the environment we are now in, when there’s a lot of scrutiny by the US with regard to fair trade and currency manipulation,” said Claudio Piron, a co-head of currency and rates strategy at Bank of America Corp. “I don’t think there’s a real desire to be in the market excessively intervening.”

In the wake of Trump’s inauguration on Jan 20, a fact sheet circulated detailing his plans, including a call for federal agencies to address currency manipulation by other countries. The designation comes with no immediate penalties, but it can rattle financial markets. Trump labelled China a currency manipulator during his first term, while India has previously been on the US watch list.

Forwards have a number of key advantages for central banks, including potentially lower costs, and the fact that they don’t drain the money supply. But they also allow central banks to mask their interventions. The derivatives don’t eat into official reserves, something that may minimise the risk of attracting Trump’s ire. The strategy also allows central banks to keep traders guessing.

Malaysia has also adopted the strategy of using currency forwards. Its net short forward book was around US$27.5 billion by November, after swelling about US$4 billion last year. The Philippines reduced its net long forward to just US$874 million, International Monetary Fund data showed.

Bank Negara Malaysia (BNM) told Bloomberg on Monday that it uses instruments such as foreign exchange swaps and reverse repos to manage onshore market liquidity. The Philippine central bank did not immediately respond to a request for comment.

On Feb 11, the RBI was suspected of a heavy intervention to push up the rupee. The currency rose nearly 1%, its biggest gain since November 2022, triggering stop-losses among rupee bears. The central bank intervened across spot and forward markets, traders said.

Dollar decline

In theory, a recent decline in the dollar offers central banks a reprieve. Trump has cancelled or delayed tariffs on Canada, Colombia and Mexico, fuelling doubts that he will deliver on his biggest threats. A broad gauge of the dollar has lost roughly 1.7% so far this year.

There are also signs that policymakers are changing tack, with new RBI governor Sanjay Malhotra appearing to adopt a more flexible approach to managing the exchange rate. The RBI has dialled down its bets in the non-deliverable forwards market, according to strategists, and is instead conducting onshore operations in a bid to boost domestic liquidity.

But the advantages of forwards mean the strategy is likely to remain popular among central banks.

“I see very few cons” to using the forward market, said Aaron Hurd, a senior portfolio manager in the currency group at State Street Global Advisors. Central banks need to be careful not build up a forward book that is too large, but right now that isn’t a big worry, he said.

What to watch

- Indonesia and Nigeria will decide on interest rates

- Inflation data is due in South Africa and Malaysia

- Mexico, Colombia and Thailand will release gross domestic product data

Uploaded by Tham Yek Lee

- CK Hutchison will not sign deal to sell strategic Panama ports next week — Reuters

- Powerful quake in Southeast Asia kills several, 81 trapped in Bangkok building rubble

- Genting says Nevada authorities have signed off settlement terms for Las Vegas complaint

- Businessman who assaulted bodyguards for fasting sentenced to six years and 10 months' jail

- Foreign investors shifting to safer Malaysian assets amid market volatility — analyst

- Greenland's new prime minister takes office facing challenge from Trump

- Apple, Meta face modest fines as EU seeks to avoid US spat

- Smoother air travel this Aidilfitri, no complaints over flight tickets — Loke

- Slow traffic flow, vehicle numbers expected to increase on major expressways

- Loke assures thorough probe into Kluang fatal crash