(Jan 25): A group of banks led by Morgan Stanley is preparing to sell as much as US$3 billion (RM13.18 billion) of senior debt tied to Elon Musk’s buyout of X, the social media platform formerly known as Twitter, according to people with knowledge of the matter.

Bankers have contacted a small group of investors to assess their interest in buying chunks of at least US$250 million at a discounted price in the range of 90 to 95 cents on the dollar, said the people, who asked not to be identified discussing private information. A sale may kick off as soon as next week, they said.

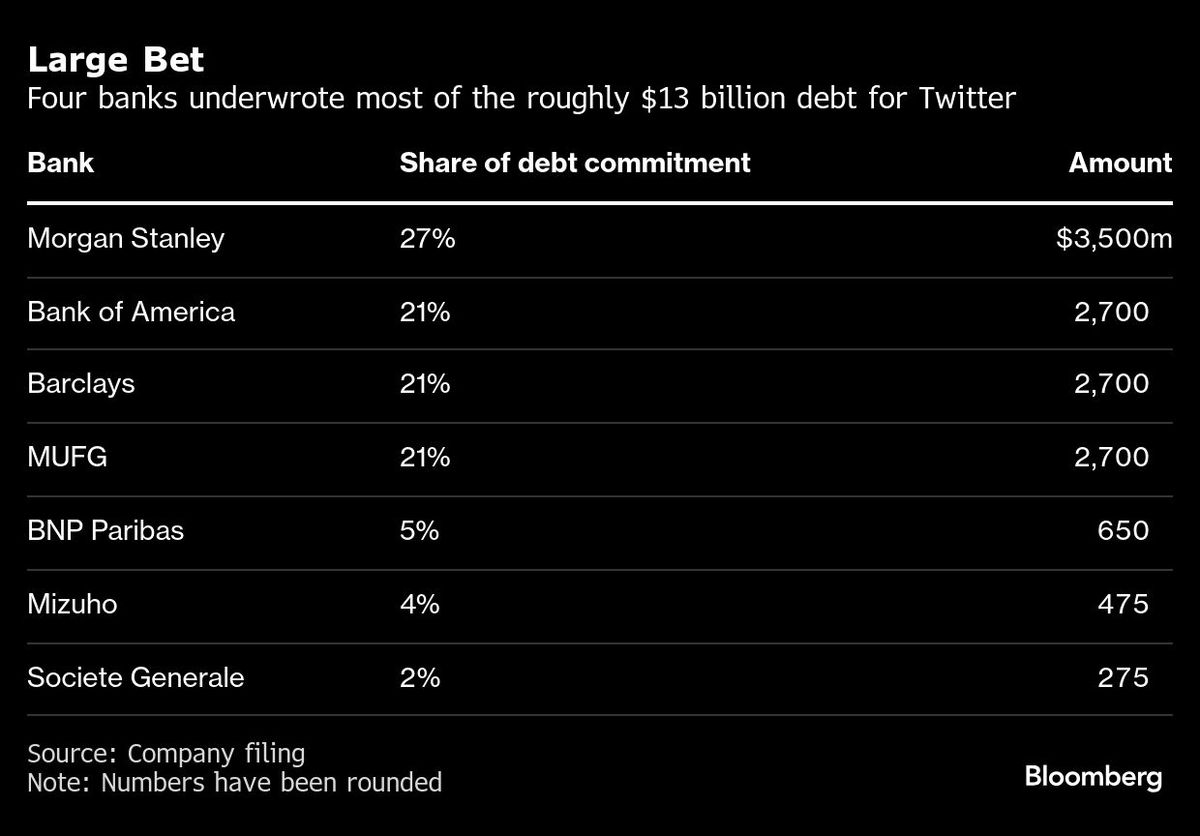

The approach marks the banks’ most significant effort so far to rid themselves of US$13 billion of debt tied to Musk’s purchase of Twitter Inc that got stuck on their books in 2022 after the billionaire launched a surprise bid to take the company private. Seven banks including Bank of America Corp, Barclays plc, and Mitsubishi UFJ Financial Group Inc agreed to finance that deal.

The banks, which recently offloaded about US$1 billion to multiple investors in a private transaction, plan to hold on to Twitter’s more junior debt for the time being, one of the people said.

The Wall Street Journal first reported about the plans on Friday.

In 2022, Wall Street banks became stuck with about US$40 billion of debt for acquisitions that they had underwritten in the easy-money era, as the Federal Reserve began aggressively hiking interest rates. They have since managed to offload the majority of those deals.

The social media giant’s transaction proved especially thorny after Musk spent months trying to back out of the Twitter purchase before being forced by a judge to close the deal. Through his ownership, Musk renamed the company to X, slashed costs and headcount, and positioned the platform as a bastion of free speech. Some of his early moves angered advertisers, threatening a much-needed source of revenue.

The acquisition saddled Twitter with an unprecedented amount of debt, bringing its annual interest expense from around US$50 million to well over US$1 billion. Since then, the banks have been waiting for an opportune moment to show investors that Musk’s ambitions for the company can justify that cost.

More recently, Musk’s prominent role in President Donald Trump’s inner circle — including his spot at the top of the newly minted Department of Government Efficiency — has ignited a new wave of optimism around his businesses. The tone in debt markets has also improved markedly, as investors clamour for new transactions after a drought in mergers and acquisitions.

When the acquisition closed, banks got stuck with three tranches of debt: US$6.5 billion meant to be sold to investors as senior secured leveraged loans, along with two US$3 billion tranches to be replaced by secured and unsecured junk bonds. To take the company private, Musk and co-investors put up US$33.5 billion of equity.

Uploaded by Chng Shear Lane

- Embattled billionaire Ong Beng Seng’s firm to be run by veteran executives

- Jentayu signs 40-year power purchase agreement for RM2.8b 162MW Sabah hydropower project

- Majujaya files petition to wind up Bina Puri for failure to pay RM30m awarded by court

- Trump warns tariffs coming for electronics after reprieve

- Zarul Ahmad now says his firm received distinct advantage from Guan Eng in bid for Penang undersea tunnel project

- UK confident of keeping British Steel going after taking control

- CATL reports 33% jump in 1Q net income despite falling battery prices

- China, Vietnam sign deals as Xi visits Hanoi amid US tariff tensions

- EC issues 116 postal voting papers for Ayer Kuning by-election

- Ayer Kuning: Amanah lodges police report on PN state by-election candidate's religious credentials