KUALA LUMPUR (Jan 22): Bank Negara Malaysia (BNM) on Wednesday kept the benchmark interest rate unchanged as widely expected, comfortable with its outlook for sustained economic growth and manageable inflation.

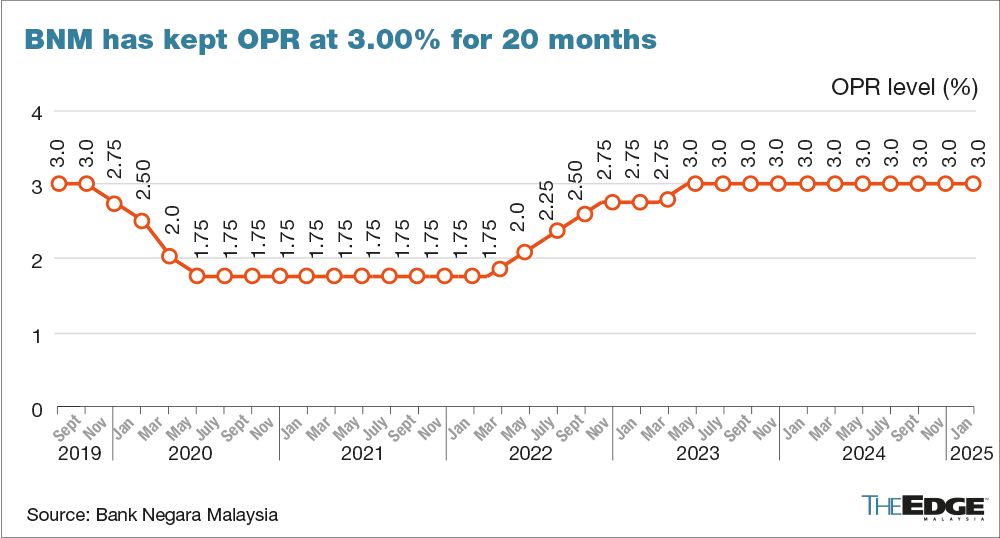

The overnight policy rate (OPR) was maintained at 3.00%, following the Monetary Policy Committee’s two-day meeting, the central bank said in a statement. A survey of 24 economists by Bloomberg unanimously called for BNM to stand pat at the first of six reviews scheduled for this year.

“At the current OPR level, the monetary policy stance remains supportive of the economy, and is consistent with the current assessment of inflation and growth prospects,” BNM said.

The benchmark interest rate has been kept at this level since May 2023, when BNM increased the OPR by 25 basis points from 2.75%.

The committee “remains vigilant to ongoing developments” for assessment on the domestic inflation and growth outlook, and will “ensure that the monetary policy stance remains conducive to sustainable economic growth, amid price stability," the central bank said.

Growth upside seen

BNM forecasted that economic growth could “potentially be higher from greater spillover from the tech upcycle, more robust tourism activity, and faster implementation of investment projects”.

Domestic economic activity is expected to remain strong in 2025, driven by resilient domestic expenditure, supported by employment growth, wage increases, and policy measures like higher minimum wages and civil-servant salaries.

Investment activity will be bolstered by progress in multi-year projects, high realisation of approved investments, and the ongoing implementation of catalytic initiatives under national master plans, the central bank said.

“These investments, supported by higher capital imports, will raise exports and expand the productive capacity of the economy,” BNM said.

However, the outlook is subject to downside risks from an economic slowdown in major trading partners, amid heightened risk of trade and investment restrictions, and lower-than-expected commodity production, it said.

Uncertainties surrounding trade restrictions and elevated policy risks could increase volatility in financial markets, BNM cautioned.

The central bank expects headline and core inflation, which averaged 1.8% in 2024, to remain manageable going into 2025, amid easing global cost conditions and the absence of excessive domestic demand pressures.

The overall impact of the recently announced domestic policy reforms on inflation is expected to be contained, while upside risks would depend on the extent of spillover of domestic policy measures, as well as global commodity prices and financial market developments, it said.

The ringgit’s performance, meanwhile, continues to be primarily driven by external factors, BNM said, contending that the narrowing interest rate differentials between Malaysia and advanced economies support the ringgit’s strength.

“While financial markets could experience bouts of volatility due to global policy uncertainties, Malaysia’s favourable economic prospects and domestic structural reforms, complemented by ongoing initiatives to encourage flows, will continue to provide enduring support to the ringgit,” it added.