The opening hours of the new administration sent a reminder to American business: Don’t bank on what Trump promised — watch what he does.

(Jan 21): President Donald Trump began his second term by taking world financial markets on a daylong rollercoaster ride over his tariff policies, in a sign of turbulence ahead for investors and executives.

After campaigning for months on a plan to impose steep tariffs on goods from China as well as Mexico and Canada, Trump appeared poised early Monday to stay his hand for the time being.

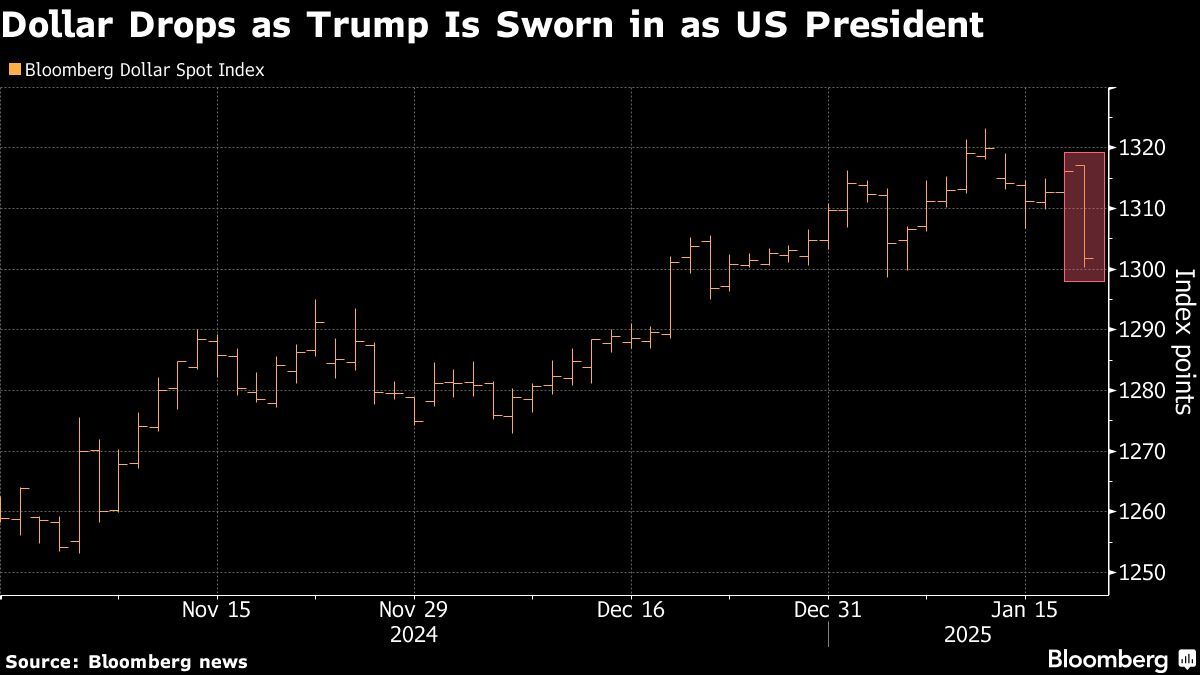

Stock futures rose and the dollar declined on a report that the administration wouldn’t immediately begin putting tariffs in place. Investors had been bracing for an economic show of force from Trump, who had said a few weeks before the election that “tariff” was the most beautiful word in the dictionary.

By day’s end, however, Trump had partially reversed course, saying that he would put 25% tariffs on goods from Mexico and Canada by Feb 1. The news caused the Mexican peso and the Canadian dollar to drop.

Trump, who was sworn in with a coterie of smiling tech billionaires and CEOs at his side, has positioned himself as the most business-friendly of presidents. Executives flocked to visit him at Mar-a-Lago, his private club in Florida, after the election.

If that celebratory-feeling stretch of days marked the Trump honeymoon for business leaders across the US, the hard part starts now.

A fast-paced rollout of policies on Monday offered a preview of how Trump is likely to force companies, corporate leaders and investors to adjust in real time to his shifting priorities. The opening hours of the new administration also sent a reminder to American business: Don’t bank on what Trump promised — watch what he does.

Other policy pledges with the potential to bring significant changes for major US industries were acted on right away. Trump wasted no time in issuing a series of executive orders on immigration that could have a big impact on labour markets. And administration officials outlined steps to boost oil production above its already historic heights.

Promises made

As Trump makes good on other campaign vows, businesses’ responses will show the extent — and the limits — of his influence.

Corporate America, for its part, stayed silent on the impact of any new policies. While executives have spent weeks cosying up to Trump, few commented publicly on Monday.

That silence is unlikely to last. Major companies like American Airlines Group Inc and General Electric Co report earnings this week and are likely to be asked about the policies by analysts looking for clarity on what’s to come.

In some cases, like when it comes to electric vehicles, market forces also will exert a powerful pull. The Trump administration intends to scrap existing mandates intended to press the auto industry more quickly toward electrification but major automakers have shown few signs they will reverse course on the EV investments they have already made.

Monday brought other reminders that the president can stray from the script at times. After a strident but controlled inaugural address, Trump pivoted to give a second set of remarks where he repeated his false claim that the 2020 election was stolen from him, mocked his political opponents and hinted at pardoning the participants in the Jan 6, 2021, assault on the Capitol, who he referred to as “hostages”.

Corporate leaders, including those who share Trump’s views on regulation and taxes, have been preparing to respond to potential policy changes.

A corporate consultant who works with large public companies said this week that one client, a major transportation-related firm, had convened an internal team of executives to map out strategies for different tariff plans that could be coming.

Others have been planning to deemphasise or eliminate programs aimed at improving or bolstering employee diversity, in anticipation of a federal crackdown on so-called DEI policies, the consultant said.

Market volatility

After dropping 1.1% on Monday, the dollar bounced back Tuesday, paring that move, as markets reacted to Trump’s decision to press on with levies on Canada and Mexico, sending both currencies tumbling more than 1%. A Bloomberg gauge of the greenback rose as much as 0.7%, with all Group-of-10 peers down on the day.

Treasuries rose in the meantime as bond investors focused on the fact Trump refrained from imposing China-specific tariffs for now. That eased fears that his policies will fuel inflation and encouraged traders to add to bets on Federal Reserve interest-rate cuts this year.

“Clearly, we are going to eventually have something — but it’s not going to happen on day one,” said Brad Bechtel, head of FX at Jefferies.

In the options market, some leveraged funds were forced to go back to bullish dollar trades they had exited the previous day. Speculative traders had recently boosted their wagers on a stronger greenback to the highest level since 2019, according to Commodity Futures Trading Commission data — underscoring the potential for the consensus to be confounded by an unpredictable president.

Wall Street is facing a difficult task in squaring uncertainty about Trump’s policies with lingering anxiety over inflation and the Fed’s next moves. The potential scope of protectionist trade measures and the timeline for their implementation remain open questions. The White House said on its website Monday that Trump will introduce an America First trade policy.

In the meantime, investors are keeping tabs on corporate earnings and looking for signs that companies can keep up the momentum that drove stocks to multiple records last year. European automakers slid on Tuesday as Trump’s threat of Mexico tariffs added to the group’s woes, while Spanish banks with Mexican operations lagged. Meanwhile, Chinese stocks listed in the US rose.

“The reality is, everyone is a little overwhelmed and no one on Wall Street has a clear plan as to what exactly they’re going to do,” said Michael Purves, chief executive officer at Tallbacken Capital Advisors.

Uploaded by Arion Yeow

- Authorities urge vigilance, calm after 5.4 magnitude quake hits Indonesia’s Banda Aceh

- Insolvency DG warns of rising trend in self-declared bankruptcy

- 5.1-magnitude aftershock hits north of Mandalay amid series of quakes — USGS

- Young man rescued from Cambodia job scam repatriated to Malaysia

- Myanmar quake death toll hits 1,700 as aid scramble intensifies

- Unity must be preserved with utmost care, says King, Queen in Aidilfitri message

- Myanmar quake death toll hits 1,700 as aid scramble intensifies

- Muslims in Malaysia celebrate Aidilfitri tomorrow

- Foreign minister to undertake humanitarian mission to Myanmar, express Malaysia’s solidarity

- Balloon seller scuffle: Police open three investigation papers