(Photo by 123RF)

This article first appeared in Capital, The Edge Malaysia Weekly on January 20, 2025 - January 26, 2025

MOVING into 2025, the broad macro backdrop for global equities looks positive given the improving economic conditions, growing corporate earnings, solid balance sheets and favourable credit conditions, say experts at Principal Asset Management.

That said, liquidity, which was the linchpin for the global stock market last year, continues to play a critical factor. Global liquidity will remain in good shape unless there are geopolitical or inflation issues, says Christopher Leow, CEO and chief investment officer of Principal Asset Management Singapore.

“Last year was an example where liquidity was a key driver of how assets performed. For 2025, the US, the European Union and China — which account for almost 60% of global GDP — are signalling stimulative policy actions. We also expect China to up its fiscal spending, and its fiscal deficit is expected to be 4% in 2025 versus 3% in 2024,” he tells The Edge in an interview.

Nonetheless, Leow warns of rising volatility after the strong equity performance in 2024.

“We expect bouts of volatility to happen. And of course, the sensitivity of the market is something that was quite clear last August when there was a sharp global sell-off sparked by a very modest policy shift by the Bank of Japan (BoJ). Even though it was not a huge policy shift, the impact on the market was very large,” he explains.

The BoJ’s decision to tighten its monetary policy last August came under fire, as the unwinding of the Japanese yen carry trade caused a global equity bloodbath. The local stock market was not spared from the “Black Monday” crash either, with the benchmark FBM KLCI plunging 4.6% for its worst day since March 2020.

Adding to the market uncertainty is outgoing US President Joe Biden’s plans to introduce new export restrictions on artificial intelligence (AI) chips under a three-tiered system by country.

“We don’t have a lot of additional insights beyond that and this is coming from an administration that is about to exit. [US president-elect] Donald Trump may have a different view, or he may continue whatever that has been announced,” says Leow.

Meanwhile, Trump, during the presidential campaign, vowed to impose 60% tariffs on US imports of Chinese goods, as well as minimum tariffs of 10% to 20% on all other imported goods.

Leow expects global economic growth for 2025 to be reasonably healthy, driven mainly by the US, which continues to be on a fiscal expansion.

“I think the fiscal stimulus in the US will not be pulled back meaningfully in 2025 and other indicators in the US suggest that large drivers such as consumption, investment, employment and housing are healthy. Inflation is sticky, but it’s not going out of control. And hence, I think, broadly speaking, the US, which is a very significant driver of the global economy, will see 2%-plus GDP growth in 2025.”

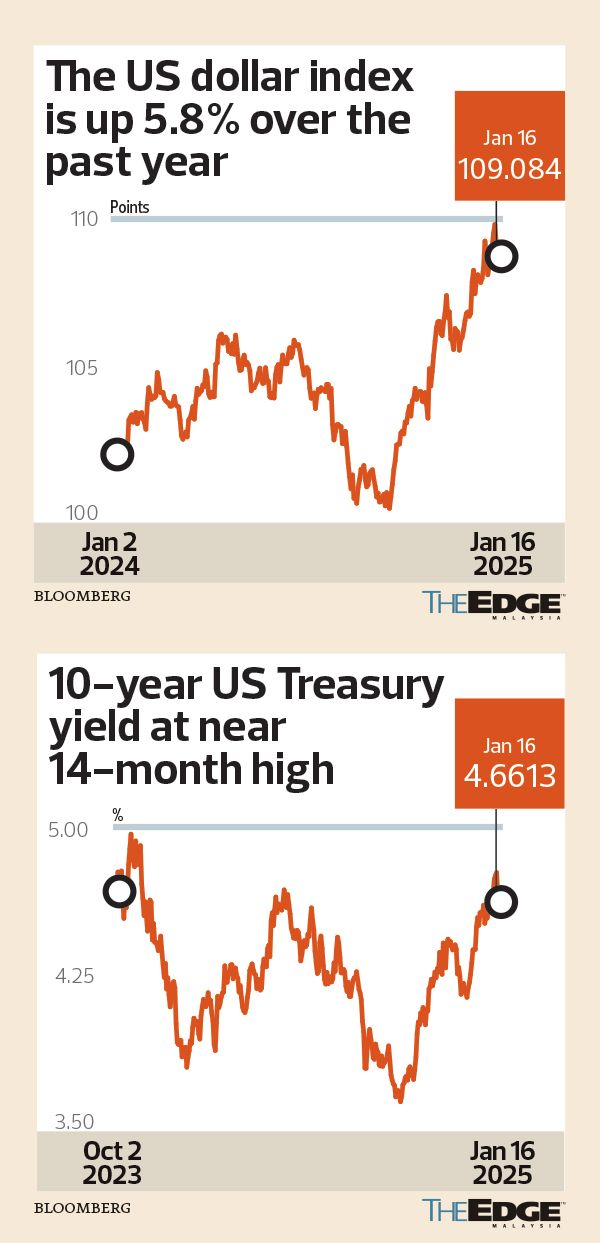

US core inflation — which excludes food and energy costs — eased for the first time in six months in December 2024, increasing 0.2% after rising 0.3% for four straight months.

Asked whether the US rally will continue, Leow says it will depend on the ability of US companies to meet earnings forecasts. If they miss earnings forecasts, it could result in volatility.

“If you go back two years ago, the same arguments were made for the US — valuations were expensive relative to history. But what has happened since then is that the companies underlying the index have performed in terms of earnings growth and beat expectations.

“Broadly speaking, the EPS (earnings per share) growth was the main driver. That will be another benchmark as to whether this market [rally] will continue. And that’s where one source of volatility could come from if corporations miss earnings expectations,” he adds.

The US S&P 500 index, which hit a record high of 6,099.97 points a month ago, has chalked up a return of 25% over the past year.

Impact of China’s slowdown

Developments in emerging markets will be influenced by the economic growth in China, says Leow. However, he is not overly concerned about the impact of the slowdown in the world’s second-largest economy.

“The slowdown in the Chinese economy has already been playing out for the last couple of years. There are two sides to the point here. While China is a very significant trading partner for Asia, the fact remains that with the realignment of supply chains, Chinese companies in China have been reinvesting in Asia to improve the connectivity with the rest of the world, via the China+1 strategy.

“We cannot view this in a linear fashion, whereby Asia will definitely be [in a bad position] when China’s economy slows down. It is a little bit more complex than that. There are other things happening in the background whereby investments are coming into Asia,” says Leow.

For example, India is a hot spot for centres of excellence. It is attracting large companies to set up research and development centres in order to take advantage of skilled labour there, he continues.

Leow points out that there has been a perception gap in Asia, stemming from investor views on China. This gap could narrow if China’s economy stabilises on the back of a combination of proactive fiscal policies and some stabilisation in the property market.

“In Asia, perhaps we will have earnings growth of 8%-10% in 2025. Its valuations are undemanding at 13 times price-earnings ratio, with a dividend yield of 2.5%. So, all these are very supportive. It is just that there are a lot of concerns, and US tariffs are one of them. Of course, policy response from China has been a little bit on the muted side thus far,” he adds.

For 2025, Leow is positive on domestic-related consumer and banking stocks in Asia. “Certainly, there are many parts of Asia where there are still opportunities to grow for financial banking services.”

Malaysia a brighter spot

Within Southeast Asia, Leow sees Malaysia being a relatively brighter spot on the back of investment flows into the country. “Malaysia seems to be a little bit unique because it is not only attracting investments from China, but also from large multinational companies, especially technology companies like Google.

“I think there has been a push from the government to not only have investments in data centres per se, but also to require these companies to set up operations, so that they can train people and upskill the labour force in Malaysia within the technology sector. And this is really important because you don’t want a case where you just attract people who set up data centres with racks — which actually don’t need many people to manage them — and take advantage of cheap power and water and then go away.

“You want investments to come in and to not only stay, but also to help develop the country. I think Malaysia is doing something right,” says Leow.

Google has committed to investing US$2 billion (RM9.4 billion) to house its first Google data centre and Google Cloud region in Malaysia. Other big names such as Microsoft Corp and Oracle have also disclosed huge investments in the country.

On the oil outlook, Leow says a lot of market supply will be determined by the US, given that the incoming Treasury secretary Scott Bessent has said that the plan is to increase oil production in the US by three million barrels per day (bpd) by 2028.

“For context, the US currently produces close to 13 million bpd, so it’s a very large number. The main reason why there’s such a laser focus on oil production in the US is plain to see — because it is quite a significant input to inflation. Now, the debate is, how are you going to get this three million bpd? Will it be oil or oil equivalent, which is gas in liquids?”

Last Tuesday, the US Energy Information Administration raised its estimate for US oil production slightly this year to 13.55 million bpd, from 13.52 million bpd.

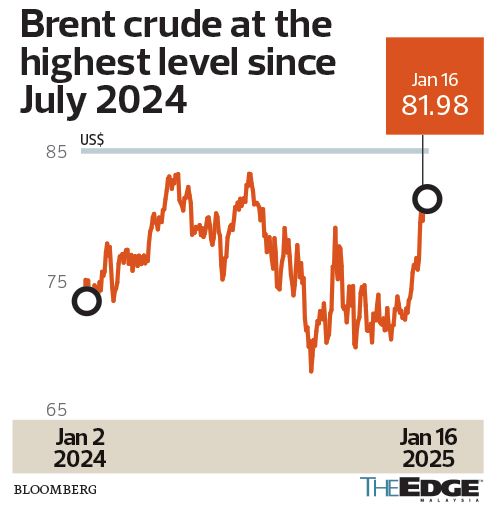

Brent oil price recently climbed back to the US$80 level following fresh sanctions by the Biden administration against Russian oil producers, tankers, intermediaries, traders and ports. At 5pm last Thursday, Brent was trading at US$81.98 a barrel.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

- Intel CEO invested in hundreds of Chinese companies, some with military ties

- YNH Property's independent review reveals interconnected directors, shareholders in RM1.1b JV deals

- Perak eyes RM72b investments for Lumut Maritime Industrial City

- MSM sued by Ranhill over termination of effluent treatment plant project in Johor

- Chin Hin, HeiTech Padu, MyEG, MSM, Ranhill, Toyo Ventures, YNH Property

- LVMH finds making Louis Vuitton bags messy in Texas

- Trump’s manufacturing dreams clash with business owners’ reality

- Trump nods at ‘transition problems’ as White House clarifies China tariffs at 145%

- Sell-off accelerates on Wall Street, traders weigh risks as tariffs on China increased to 145%

- Anwar receives courtesy visit from tech giant Oracle, discusses AI and digital innovation