This article first appeared in The Edge Malaysia Weekly on January 20, 2025 - January 26, 2025

THERE has been a lot of pushback on the recent proposal to raise the base tariff for electricity in Peninsular Malaysia in the second half of the year, which means higher bills especially for commercial and industrial users.

The hike is to reflect the higher fuel costs and larger investments required to meet the rising demand for electricity, notably from data centres sprouting up across Malaysia, and the intermittency of renewable energy, the supply of which is expected to soar in the country.

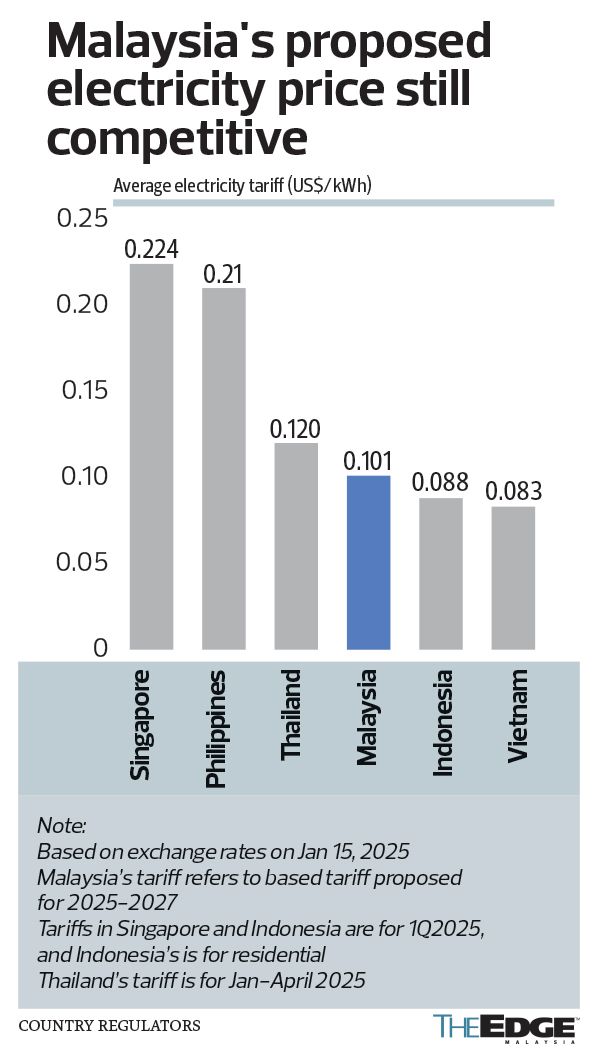

Some quarters point out that Malaysia’s base electricity tariff now exceeds that of Vietnam and Indonesia (see chart), while others view this as part of the country’s journey away from low-cost to higher-value-added manufacturing. Besides that, the government needs to rationalise subsidies due to fiscal constraints.

It is worth noting that charging consumers below costs could have a lasting impact on the Malaysian power sector’s ability to maintain its world-class service reliability. The water sector, which has suffered underinvestment over the years and whose tariffs have been below costs since at least 2010, is an example of this. As much as 35% of treated water in the country is lost through problems like pipe leakages. For some states, non-revenue water is as much as 61%, meaning that more water is wasted than used.

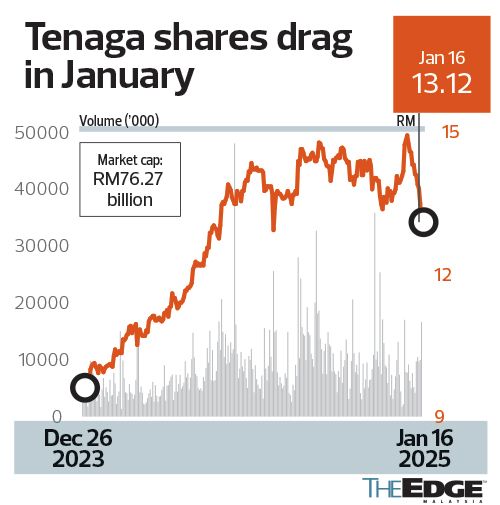

To recap, Tenaga Nasional Bhd (KL:TENAGA), which operates the power grid in Peninsular Malaysia, announced on Dec 26 a proposed adjustment of the base electricity tariff to 45.62 sen/kWh in the fourth regulatory period (RP4, from 2025 to 2027) from 39.95 sen/kWh in RP3 (from 2022 to 2024).

The utility giant pointed to higher fuel costs assumption — coal and gas — as the main reason for the increment. Indeed, the proposed 14.2% rise is not the steepest. In 2009, the base tariff went up 24% to 32.5 sen/kWh from 26.2 sen.

“A major part of the tariff is fuel prices. We know, over the past few years, fuel costs have fluctuated quite drastically … We need to do good forecasting of what the fuel prices are going to be,” said Datuk Nazmi Othman, who was then Tenaga’s chief financial officer, at a media briefing on the proposed RP4 adjustment.

“When fuel prices fluctuate above the base tariff assumption, Tenaga ‘has to fund first’ for six months before it is compensated by the additional tariff surcharges in the following six months under the ICPT (imbalance cost pass-through),” he explained just a few days before his retirement this year.

Should fuel costs fall — for example, a big drop in coal prices to below the forecast level — end-users would be given a rebate, which will bring down the tariff.

The moving parts

However, fuel costs are not the only component in electricity tariffs, which include charges for power plants to have sufficient capacity on-call.

Fuel and generation costs make up about 70% of the base tariff, while the remaining 30% largely comprises costs to operate, maintain and upgrade the national grid (also called the regulated asset base or RAB).

In its announcement, Tenaga disclosed that it would raise its grid and distribution network capital expenditure (capex) to RM26.5 billion in RP4 (2025-2027) up from RM20.55 billion in RP3 (2022-2024). The utility giant will bump up operating expenditure (opex) to RM20.782 billion from RM17.96 billion in RP3.

The higher expenditures are mainly due to the electrification trend as there is an increasing number of daily items powered by electricity, including electric vehicles, smartwatches, cashless payment devices and data centres, which require electricity 24/7.

Furthermore, the grid infrastructure needs to be improved to withstand an increasingly volatile electricity flow amid the influx of solar panel installations on the rooftop of households and commercial premises such as shopping malls. And now that third-party grid access has been allowed, the use of solar energy, the supply of which is intermittent depending on weather conditions, is expected to rise substantially.

Considering the intermittency of solar power, the country needs to plant up more capacity to ensure sufficient supply is available to fill the gap. It is estimated that there will be an increase in electricity demand of 7.7gw from data centres alone by 2030, representing 38.37% of the peak demand of 20.07gw in July 2024.

Tenaga reportedly projected an electricity demand growth of 5.8% to 6.3% in 2024 alone. Besides, the annual electricity consumption per capita may soon exceed 5,000kWh for the first time, even as electronic devices become increasingly energy-efficient.

Energy costs are rising globally. Few may argue about the need to raise electricity tariffs. However, the debate is on whether the quantum of the hike is justified. The lack of details on the RP4 determination does not help, according to manufacturers and players in the power industry contacted by The Edge.

Apart from the capex, opex and cost of capital allocation for Tenaga’s grid and distribution network (unchanged at 7.3%), RP reviews in the past disclosed other components that determined Tenaga’s returns from its transmission, distribution and retail businesses.

There was an item-by-item breakdown of the base tariff components, how big the grid assets can be and how much revenue it can collect from those assets. The transparency will help the industry and the public to understand that while the base tariff is higher, Tenaga’s profitability from grid management is also regulated.

It is understood that the government is reviewing the tariff structure to better reflect the costs amid an increasingly diverse group of consumers, such as those with solar panels or battery storage.

The tariff structure indicates that Tenaga also needs to consider charging for connecting energy transition projects, to ensure the capex incurred does not spill over into the tariffs for households that do not use the infrastructure. This would be crucial for the utility giant to cover its expenses should it be required to roll out its contingent capex, which could be up to RM16.267 billion, to support the energy transition journey.

Long overdue

As for the subsidy rationalisation, few may disagree that the current government has made a good effort by adjusting the ICPT surcharge closer to the actual market price of fuel. Additionally, it has removed the blanket rebates for high-consumption households to pave the way for a fairer tariff structure.

However, much still needs to be done. For example, the lowest tier of household tariffs for monthly consumption below 200kWh (or monthly bill of RM43.60) has been maintained at 21.8 sen/kWh since 1997, or for 27 years. The second tier (201-300kWh or monthly electricity bill of RM77 and under) has been maintained at 33.4 sen/kWh since 2009, or for 15 years.

Prime Minister Datuk Seri Anwar Ibrahim has said the tariff adjustment is not expected to affect 85% of households, which reportedly consume 20% of the electricity supply. Recall that at this point, only the top 1% of households with monthly bills of more than RM708 have a surcharge while most households enjoy a rebate.

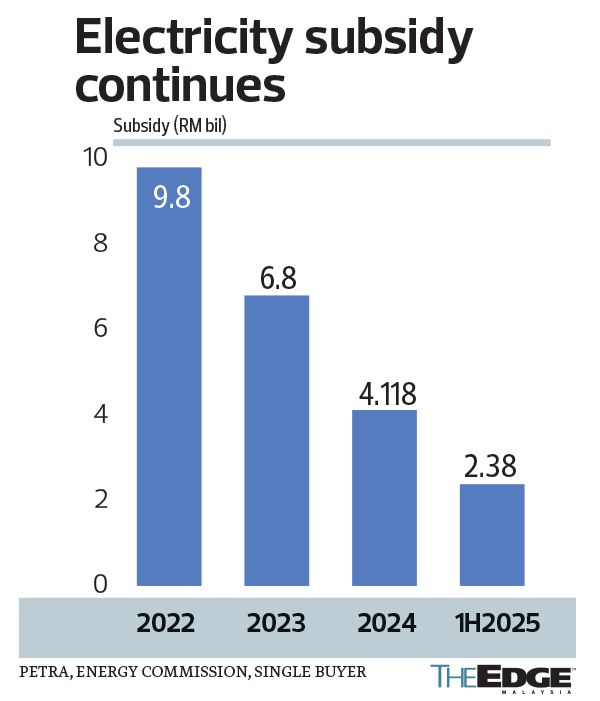

Even with the current ICPT surcharge, there still leaves RM2.4 billion that the government needs to subsidise in 1H2025, according to an FAQ on ICPT posted by the Single Buyer, an entity authorised pursuant to the Electricity Supply Act (ESA) 1990 to conduct electricity planning and manage electricity procurement services for Peninsular Malaysia.

In RP3 (2022-2024), the electricity subsidy totalled RM20.7 billion, or about 2% of federal government revenue (see chart).

The Malaysian public is currently using electricity at below costs, which are covered by the government’s coffers as well as some contributions from the power plant operators to the Electricity Industry Fund, or KWIE.

Subsidised power partly produced by cheap gas

Deputy Prime Minister and Minister of Energy Transition and Water Transformation Datuk Seri Fadillah Yusof said on Dec 27 that RP4 coal prices are projected at US$97 per tonne, up 22.78% from US$79 per tonne in RP3.

For natural gas, the price floor and ceiling is RM24 and RM35 per mmbtu in RP4, compared with RM24 and RM30 per mmbtu in RP3 — a 16.7% increase in the price ceiling for usage below 800 mmscfd. Any gas volume consumed above that (Tier 2 gas price) is projected at RM46 per mmbtu in RP4, up from RM35 per mmbtu in RP3.

Coal and natural gas are the two key fuels for power generation in Malaysia, making up more than 79% of the fuel mix.

Actually, electricity users are currently paying a surcharge to compensate for fuel costs that are higher than the projections for RP4. For example, a 16 sen/kWh surcharge was imposed on medium to high voltage commercial and industrial users in 2H2024 to reflect the fuel costs for the previous six months.

High-consumption households are paying a 10 sen/kWh surcharge. The rate has been maintained in 1H2025.

The charges are based on the average coal price of US$112.9 per tonne in 1H2024. This is still 16.4% higher than the RP4 benchmark of US$97 per tonne. Similarly, the Tier 2 gas price average was RM47.4 per mmbtu, which is 3% higher than the RP4 benchmark.

Should fuel costs drop further, consumers could potentially pay lower than current payments despite the upward revisions in the RP4 benchmarks. Coal and natural gas prices already trended slightly lower in 2H2024, according to data from the Energy Commission’s website.

As for natural gas, the Tier 1 gas price of RM24 to RM35 per mmbtu for the first 800 mmscfd represents the bulk of gas supply to the power sector. Between 2022 and 2024, Malaysia’s reference price for LNG ranged from RM33.97 to RM58 per mmbtu, with an average of about RM43, compared with the highest forecast of RM35 for the period.

Natural gas is a finite resource, so Peninsular Malaysia is bringing in more gas from places like Australia. The fuel is imported at market prices but charged with the tariff on a blanket basis at a discount.

In line with the government’s policy to do away with a blanket subsidy, a discounted fuel cost is an issue that has to be addressed so the gains can be channelled to the public in a targeted manner.

The government has given itself more than six months to finalise the new tariff structure, and the public deserves to know the details of the RP4 determination. Although RP3 was implemented without the details being published at the outset — unlike during RP2 (2018-2020) — that does not mean this is acceptable, especially when the government wants to rationalise the electricity subsidy further. In a nutshell, this is a reallocation of taxpayers’ money from subsidising electricity to other purposes.

To quote an Energy Commission electricity pricing unit department head in a 2017 interview, the tariff adjustment should ensure consumers know they are paying the cost of electricity tariffs based on “actual costs formulated transparently and systematically”.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

- Yellen says sell-off in Treasuries shows US confidence loss, not dysfunction

- China suppliers mock tariffs with Nike, Lululemon deals on TikTok

- Reach Energy faces trading suspension, possible delisting, as regularisation plan deadline extension rejected

- Reach Energy, Cahaya Mata, Able Global, Pestec, Bina Puri, Jentayu Sustainables

- Malaysia declares state funeral for Tun Abdullah Ahmad Badawi

- Asian stocks set for cautious day as US trade probes sow more anxiety

- South Korea unveils US$23 billion support package for chips amid US tariff uncertainty

- US stocks, bonds climb after week of upheaval

- Tariff-fueled market rout cost Chicago’s pensions $1 billion

- Norinchukin dodges Trump’s market chaos after selling Treasuries