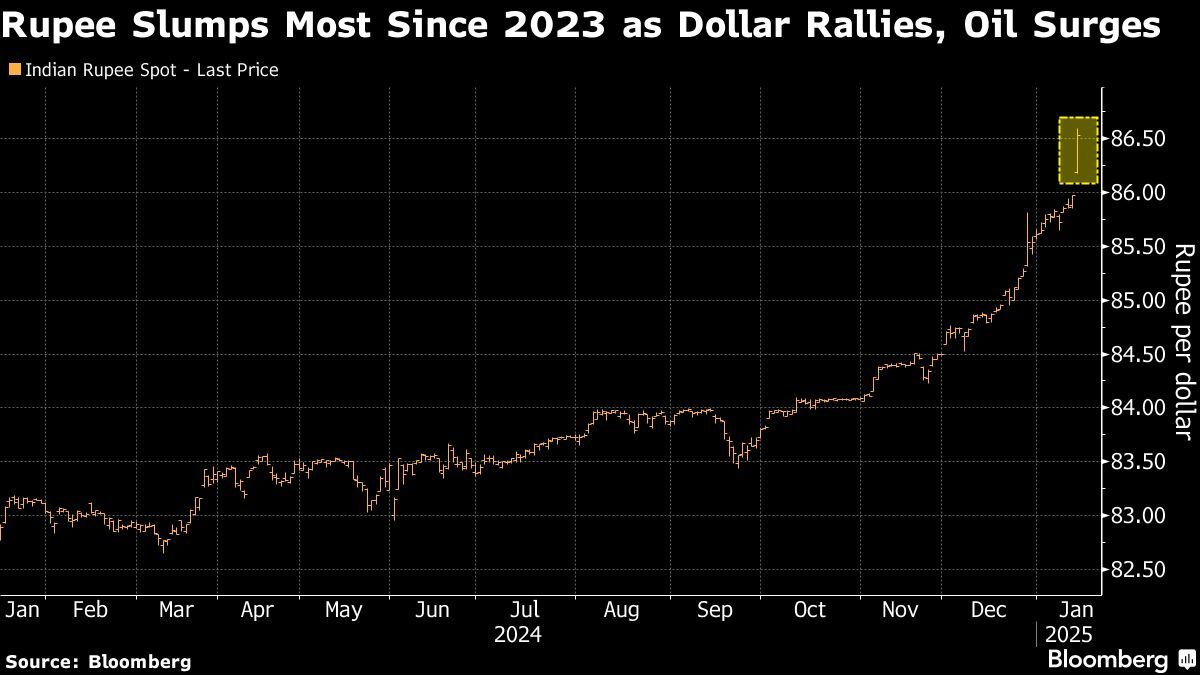

(Jan 13): India’s rupee fell past a key psychological level of 86 per dollar after strong US jobs data damped bets on further Federal Reserve interest-rate cuts and as a surge in oil prices weighed on sentiment for the net oil-importing nation.

The rupee fell as much as 0.7%, the most since early 2023, to a fresh record of 86.5575 on Monday, mirroring the broad declines in almost all Asian currencies against the greenback. Local bonds and stocks also retreated along with most regional peers.

The rupee has plumbed record lows in recent weeks and is expected to extend losses on slowing economic growth and foreign fund outflows. That’s spurred speculation about the Reserve Bank of India loosening its tight grip on the currency, compared to just a few weeks ago when its focus remained on squeezing volatility.

“This reflects a combination of domestic and global pressures,” said Amit Pabari, managing director at advisory firm CR Forex. “The US dollar continues its upward march, driven by the Federal Reserve’s cautious stance and solid economic data. Compounding the rupee’s woes is the sharp rise in crude prices.”

The Indian currency may fall past 90 per dollar this year as the RBI prepares to ditch the currency’s implicit quasi-peg to the dollar, Gavekal Research said last week. Standard Chartered plc recently lowered its rupee forecast to 87.75 to a dollar by end-2025 from 85.50 previously.

Uploaded by Chng Shear Lane