This article first appeared in The Edge Malaysia Weekly on January 13, 2025 - January 19, 2025

THE days of “super big profits” once enjoyed by Sime Darby Bhd (KL:SIME) in China’s car market are over, but the automotive and industrial equipment trading company remains confident in its long-term prospects.

Executive director and group CEO Datuk Jeffri Salim Davidson still believes in the long-term outlook for the Chinese passenger car market despite the current headwinds, but he concedes to sleepless nights over the supply glut.

Foreign carmakers, which have dominated China’s car market for decades, are facing problems on multiple fronts, including the rapid rise of China’s home-grown electric vehicle (EV) makers, such as BYD Auto Industry Co Ltd and XPeng Motors.

Sime has not been spared. It is the principal car dealer for automotive brands such as Rolls-Royce, BMW and MINI cars in China. In the July to September 2024 quarter, German luxury carmaker BMW reported an 84% drop in net profit to €476 million as sales in China slumped by a third.

“What happened was we didn’t foresee China becoming an automotive juggernaut. The pace of development by Chinese carmakers was unprecedented,” Jeffri tells The Edge in a wide-ranging interview.

For the first 11 months of 2024, China accounted for a staggering 34.1% of global car sales that reached 82.01 million units, according to the China Passenger Car Association. The US came in second with a market share of 18.2%.

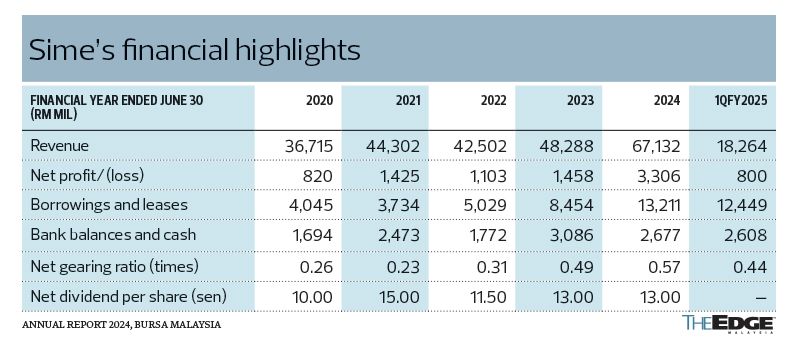

During the pandemic financial year ended June 30, 2021 (FY2021), Sime posted a net profit of RM1.4 billion, up 74% from the previous financial year as Chinese consumers splurged on luxury cars to make up for the months of lockdown and inability to travel overseas.

In FY2022, Sime’s China motor division’s profit was hurt by supply chain disruptions and numerous pandemic-related lockdowns. The group saw net profit fall 23% year on year (y-o-y) to RM1.1 billion.

The situation has become increasingly difficult since then. A debilitating price war in China’s automotive industry, coupled with weak consumer demand, has severely hurt the mainland’s car players. In addition, the country’s EV industry is producing more cars than it can sell domestically.

According to news reports, there are now more than 200 EV manufacturers in China, the world’s largest automotive market. EVs make up more than half of new car sales in the market, propelled by government incentives and fast-expanding charging infrastructure.

This worries Jeffri, 60, whose concerns about the oversupply in China’s car market keep him awake at night.

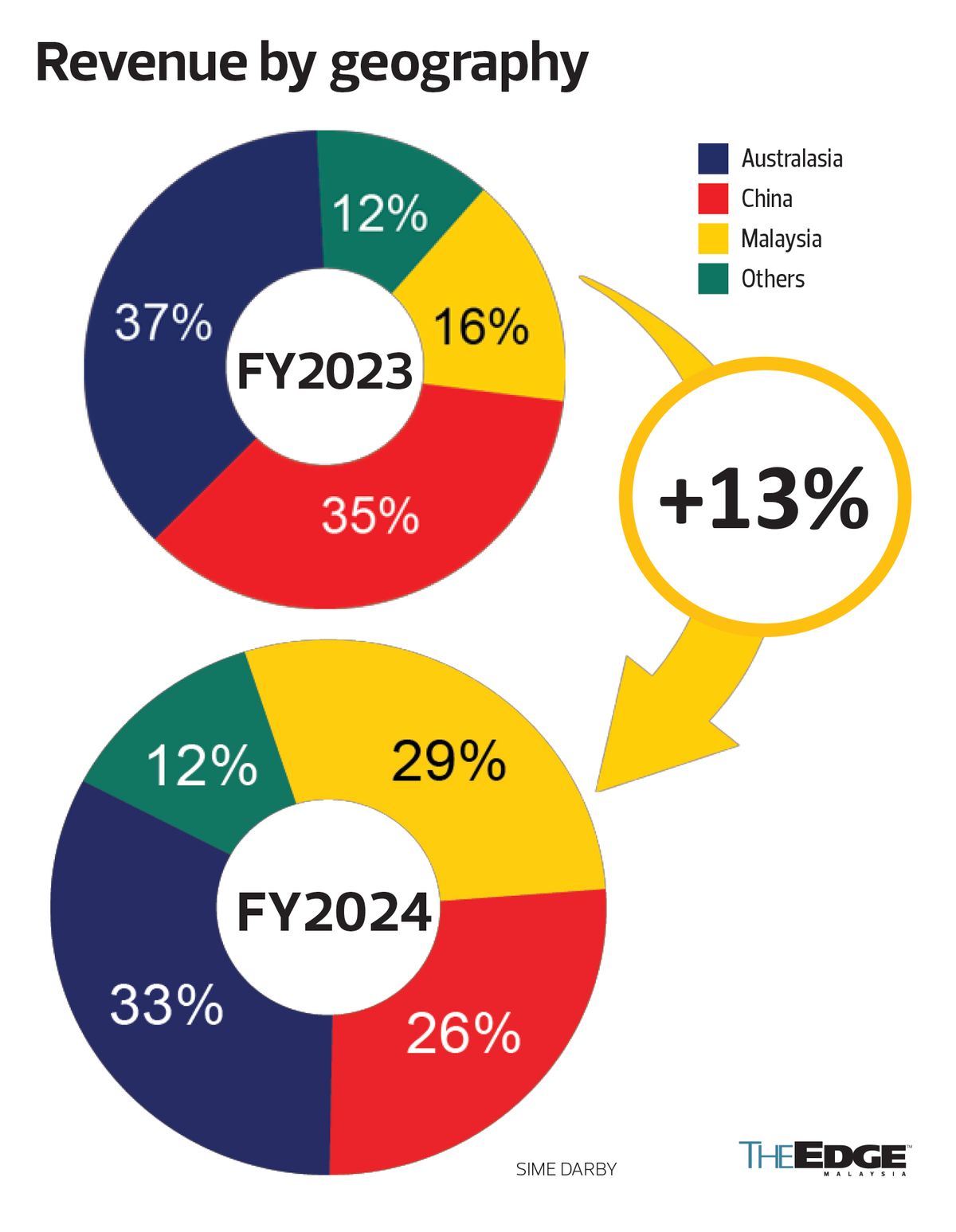

Sime’s motor business in China has been severely affected by the intense competition in the country, which accounts for one-third of the group’s revenue. It contributed 26% of the group’s revenue in FY2024, down from 35% in the previous financial year.

Notably, the motor business in China recorded a loss of RM123 million in FY2024, dragging the group’s motor division profit before interest and tax (PBIT) down by 44% to RM584 million in FY2024, from RM1.05 billion in FY2023.

In announcing its 1QFY2025 financial results last November, Sime said its China motor operations had improved. However, Sime’s motor division PBIT continued to slide in 1QFY2025, falling 6.4% to RM190 million on lower profits from Australasia.

Jeffri points out that while China’s economic growth has weakened, it is still growing at a clip of 5%. “The bigger problem we have in China is the supply-demand imbalance. Demand is holding up and we have been achieving our sales volume targets [set by our franchisors], but Chinese automakers are building too many cars,” he says, noting that the overcapacity has led to industry-wide aggressive discounting, affecting the group’s margins.

Foreign and Chinese carmakers are now grappling with huge oversupply, and experts predict many smaller companies will not survive the fiercely competitive environment. To combat these issues, Chinese carmakers are exporting their vehicles to overseas markets. Because Europe and the US are limiting sales of China-made EVs with tariffs, Chinese carmakers are focusing on Asia-Pacific, South America and Africa.

“The problem is the [profit] margins are gone because of the oversupply and there is a price war/discounting going on [in China]. You get into a situation where you are almost selling the car for nothing. The question is when will the industry recalibrate? We don’t know,” says Jeffri.

Still, car dealers such as Sime are eligible for a rebate on the purchase price conditional on their achieving the sales targets set by the franchisor. This has helped put the group back in the black, says Jeffri. “However, we may never see the big margins like those [enjoyed] three to five years ago again. FY2021 was the best year [for Sime Darby’s motor business in China].”

So, does Sime expect a drop in its China business in FY2025? “Absolutely,” he affirms.

Nevertheless, the group expects its industrial business in Australasia, Malaysia and Singapore and the full-year contribution from its newly acquired UMW division, driven by its mass-market brands Toyota and Perodua, to cushion the weakness in its China operation.

Jeffri is positive on the mining industry in Australia in FY2025, pointing out that minerals will always be needed. “You need metallurgical coal in the production of steel, and copper is a critical mineral for energy transition. Australian minerals are some of the best quality and the cheapest in terms of extraction cost per tonne. We are in a good space.”

The group acquired Cavpower Group, a Caterpillar dealership based in South Australia, in 2023 and stands to gain from the acquisition, as the Australian state has almost 70% of the world’s copper resources.

“We have had a good run over the last few years. Our results are still pretty strong despite the fact that [our motor operations in] China are struggling. Wouldn’t it be nice if China was still firing, together with Australia and UMW?” he remarks.

In 1QFY2025, Sime posted a 36% y-o-y rise in net profit to RM800 million, helped by a one-off gain from the disposal of its Malaysia Vision Valley land in Negeri Sembilan and profit contribution from the UMW division. Revenue for 1QFY2025 amounted to RM18.26 billion, up 31% y-o-y.

Expands brands to include Chinese automakers

As the China oversupply cloud looms over Jeffri, it is now clear to him that his concerns about the emergence of the agency direct sales model were unwarranted. This shift was one of three issues that used to keep him up at night.

“I am very clear now that this was a false worry. The agency model has been tried and tested and the reality of it is that more and more automotive original equipment manufacturers (OEMs) are realising that the traditional dealership model, where they work with a local partner that is close to customers and understands the market, is fundamental. We had a couple of cases in which the carmakers employed the agency model in certain markets, but it didn’t work. So, they shifted back to us. It doesn’t mean that the agency model approach to the sale of new cars won’t come back later, but I am less worried about it,” he says.

Another thing that Jeffri used to fret over was the industry’s gradual transition from internal combustion engine (ICE) vehicles to EVs and how that would affect the group’s after-sales profits.

“I am less concerned about that also. In fact, with hybrids, we have two types of power trains to repair — electricity and gas. In addition, there are still many petrol and diesel cars in the market,” he says.

Sime is not resting on its laurels and has pivoted to securing distribution rights with other automotive OEMS such as BYD in Malaysia and Singapore, and XPeng Motors in Hong Kong. It has also expanded its assembly business in Malaysia through the assembly of Chery vehicles and wheel and door modules for Porsche.

“When BYD came to Malaysia, its first ‘port of call’ was Sime Darby. Why? We have a strong [automotive retailer] reputation, a long history with all our partners and are able to deliver. We have been a Caterpillar dealer for 95 years and in a partnership with BMW for 56 years. We play the long game.

“We also have a professional management team, our governance is strong and our team is international — comprising Australians, Indonesians and Malaysians — simply because our business is spread so far and wide.”

In regards to the rise of used car e-commerce platforms such as Carsome and myTukar (Carro), which are backed by significant capital and have shifted the used car market online, Jeffri observes that Sime has similarly fortified its own used car business.

“That is doing quite well, as we are focused on profit whereas these e-commerce platforms are focused on revenue and market share. Still, we are keeping an eye on them because we are fighting in the same marketplace.”

Sime has positioned itself to participate in the new mobility ecosystem by investing US$3 million (RM13.4 million) in Socar Mobility Malaysia — a joint venture between South Korea’s SK Inc and car-sharing company Socar Inc — and US$5 million in Singapore-based Carro.

No major acquisitions for now

The group, which unveiled a refreshed “Sime” brand last November to reflect its renewed focus on the automotive and industrial equipment sectors, is taking a break from making large-scale acquisitions over the next year or two, after its RM5.8 billion acquisition of 100% equity interest in UMW Holdings Bhd last March.

The takeover resulted in the absorption of UMW’s 51% stake in UMW Toyota Motor Sdn Bhd and 38% share in Perusahaan Otomobil Kedua Sdn Bhd (Perodua).

Jeffri says the group will focus on integrating its newly acquired businesses. “It will now be a ‘digestion period’ for us, making sure all the synergies are extracted and our businesses are running properly.”

He adds that Sime has no plans to increase its shareholding in Perodua for now. Daihatsu Motor Co owns a 25% stake in Perodua; MBM Resources Bhd (KL:MBMR) holds 20%; state-owned investment fund Permodalan Nasional Bhd, 10%; and Japan’s Mitsui & Co, 7%.

“Even if I wanted to buy another 10% from somebody, you need to get everyone else to agree. It [also] needs the Ministry of Investment, Trade and Industry’s (Miti) approval.”

While Jeffri indicates that the group has no plans to undertake another major acquisition like those of Onsite Rental Group, Cavpower Group and UMW in the near future, it would “never say never” to the possibility of yet another such expansion.

“We are always seeking new opportunities. Some will come true, some will not come true,” he says, commenting on a recent report by The Edge that Sime was in talks to acquire an 80% stake in the retail and after-sales businesses of Ingress Corp Bhd — a Malaysian company controlled by privately held Ramdawi Sdn Bhd (88.98%), Datuk Rameli Musa (10.19%) and Ab Wahab Ismail (0.83%).

While Sime’s gearing ratio has increased to 0.57 times as at June 30, 2024, from 0.49 times a year ago, it remains comfortably within the group’s gearing limit of 0.6 times. “It is a conservative limit; so, we still have room to grow. Our cash flow [from operating activities of RM1.23 billion for the three months ended Sept 30, 2024] remains quite strong,” says Jeffri.

The acquisition of UMW solidifies Sime Darby’s leading position in the Malaysian automotive market, while reducing its reliance on the Chinese market — a recurring point of contention among its board members in the past.

Today, revenue by geography is closely balanced between Australasia, China and Malaysia, following the UMW acquisition.

Perodua sold a record 358,102 vehicles in 2024, capturing a 44% share of the country’s total industry volume (TIV) of 814,000 units estimated for the year. Meanwhile, UMW Toyota Motor sold more than 102,300 units last year, accounting for around 13% of expected new-car sales in Malaysia.

“Along with the market share held by the other brands such as Hyundai and BMW of another 4% to 5%, we hold about 60% of Malaysia’s TIV,” observes Jeffri.

In a Dec 26, 2024, report, RHB Research says it is anticipating a softer TIV of 730,000 units in 2025 as the high-base effect kicks in. It sees no compelling factors for 2025 automotive sales to be maintained at the current elevated levels.

Jeffri concurs, predicting that TIV will ease to a more normalised level of between 730,000 and 750,000 units this year, following a faster-than-expected demand recovery after the pandemic disruption.

While the influx of Chinese OEMs and competitive pricing may heighten market competition in Malaysia, he does not foresee the situation escalating to the levels seen in China. “This is where government policies are important. They cannot allow Chinese OEMs to just import thousands of cars and fight here. I think Miti understands that.”

Will EVs continue to grow here? “That is a good debate. If you see the China story, EVs constitute about 50% of the market. But what we are beginning to see is that hybrid cars have been ‘eating’ into the battery-only EV market share in the last few months. What it means is that Chinese consumers are beginning to buy hybrids. If you look at BMW, they have EVs, hybrids and ICE cars. Toyota is betting on hybrids [over EVs].”

Jeffri says that regardless of how EVs, hybrids or ICE cars perform in sales, Sime is well positioned in all three segments.

“The market will decide whether it wants EVs or hybrids, and the manufacturers will decide what cars they want to build based on what they think the market wants. We therefore believe that, while there may be ups and downs in some years, the long-term outlook for our automotive business in Asia-Pacific is positive.

“Asia is seeing a huge, fast-growing middle class. Asia-Pacific’s share of global GDP is expected to be more than 50% in 2050. This is where the growth is. The Chinese in China, in particular, are getting richer and want to buy aspirational products like BMWs. So, I think we are in the right place.

“China remains the world’s largest consumer market. We remain long-term bullish on its growth prospects, though we expect conditions to remain difficult in the next year. There will be blips along the way but, in the long run, it will be quite strong.”

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.