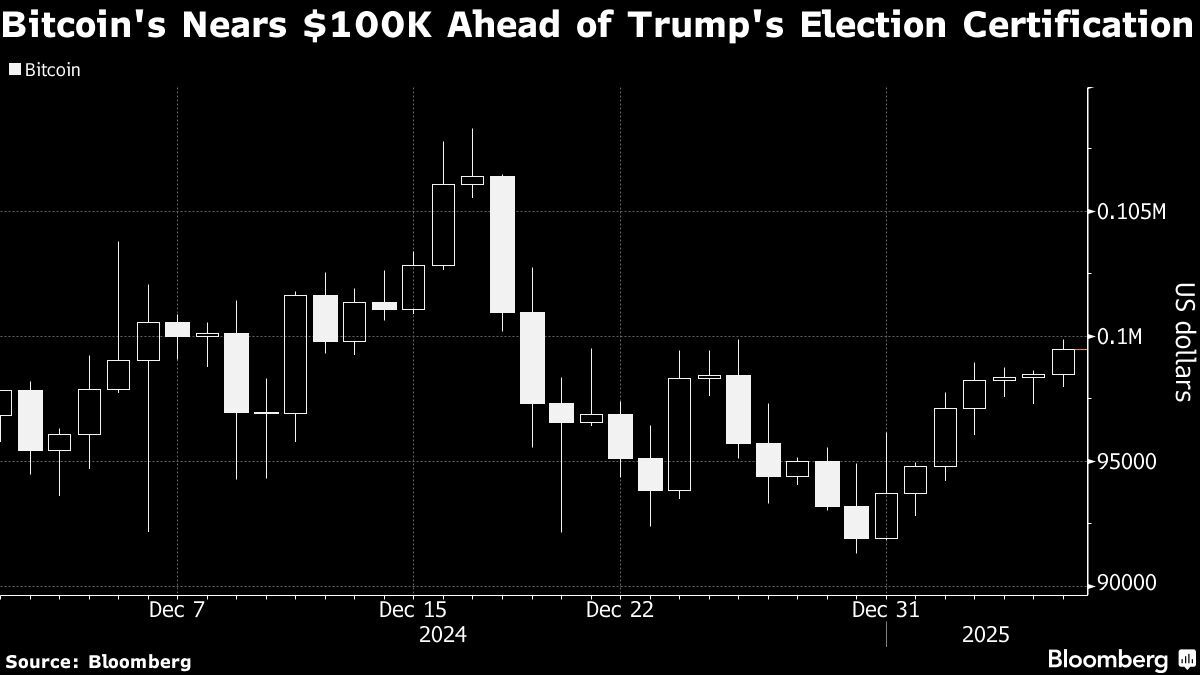

Bitcoin rose as much as 1.41% to US$99,871 on Monday as the largest digital asset regains momentum with Donald Trump’s US Election victory set to be ratified. It was trading at US$99,119 as of 8.57am in London on Monday.

(Jan 6): Bitcoin is nearing the US$100,000 (RM449,813) mark as the largest digital asset regains momentum with Donald Trump’s US Election victory set to be ratified.

The original cryptocurrency rose as much as 1.41% to US$99,871 on Monday. As of Sunday it had posted a weekly gain of 5.66%, its largest since Nov 24, according to data compiled by Bloomberg.

Bitcoin’s record-breaking run in 2024 ran out of steam in late December as investors looked to book profits. Optimism that a pro-crypto White House under Trump will instigate a supportive regime in the US had earlier helped lift the token to an all-time high of US$108,315. Congress will convene to certify Trump’s US election victory on Monday.

“A super cycle of 2025 is anticipated with regulatory reforms by the Trump government,” said Khushboo Khullar, venture partner at Lightning Ventures, which invests in Bitcoin-linked firms.

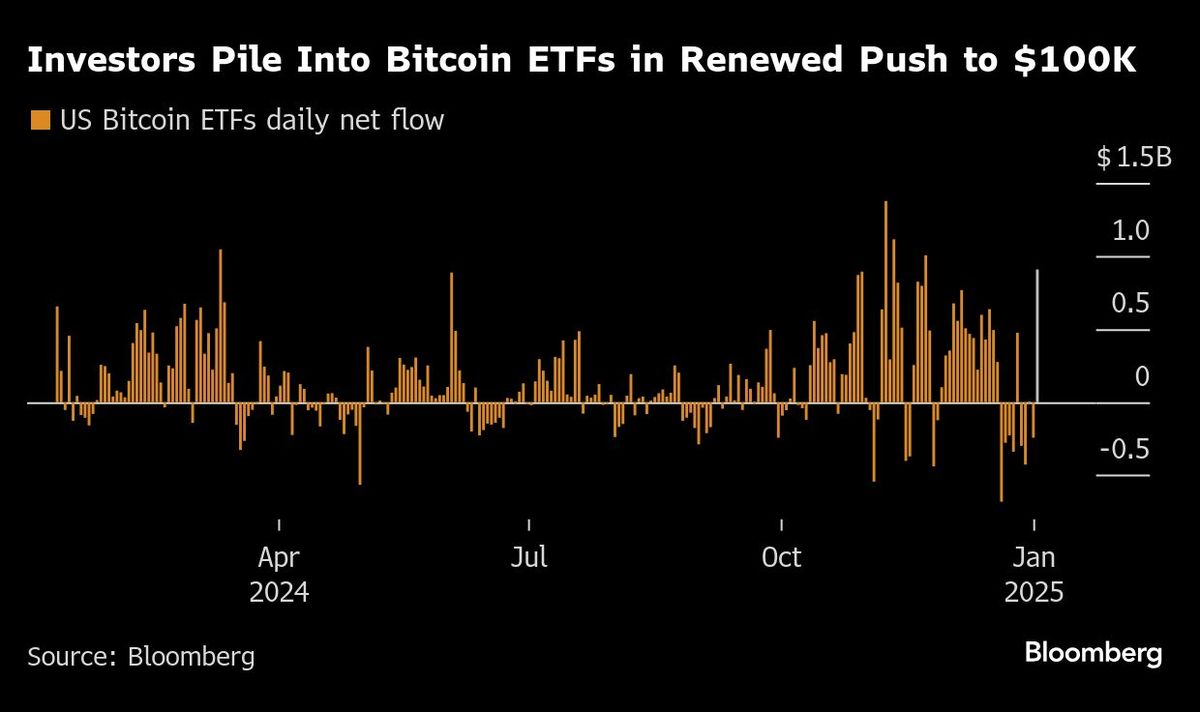

The momentum shift comes after investors poured a net US$908 million into a crop of US Bitcoin exchange-traded funds (ETFs) on Friday, the fifth biggest inflow for the group since their launch in January 2024, according to data compiled by Bloomberg. Those funds posted a record net outflow of US$680 million on Dec 19.

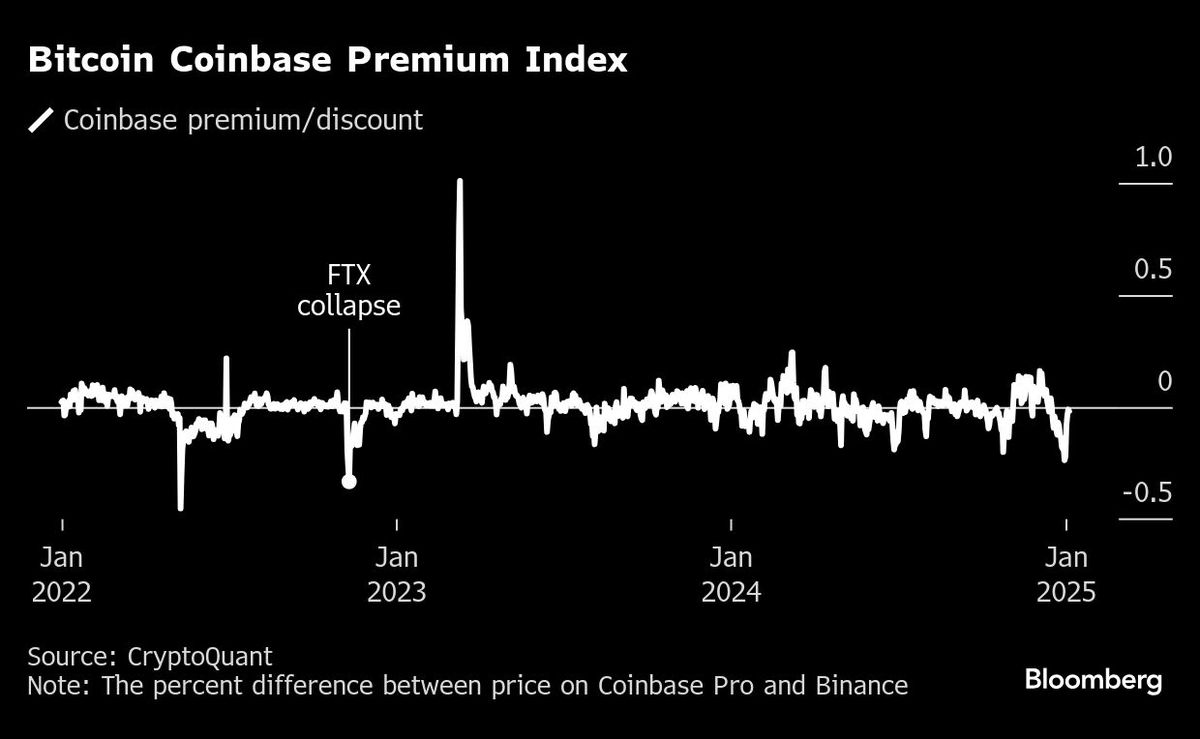

Similarly bullish for Bitcoin traders is the recovery of the Bitcoin Coinbase Premium, a metric that tracks the difference between the price of the token on Coinbase Global Inc, a leading US digital-assets exchange, and global crypto bourse Binance Holdings Ltd.

At the start of the new year the premium had crashed to its lowest point since the collapse of Sam Bankman-Fried’s FTX in 2022, but it has since rebounded, indicating stronger investor demand in the US.

“The ETF issuers almost all trade and custody with Coinbase so they tend to push the premium or discount based on demand for the ETF,” said Joe McCann, founder and chief executive officer of Miami-based crypto hedge fund Asymmetric.

Bitcoin’s prospects in 2025 will hinge partly on to what extent Trump follows through on his crypto pledges, which include establishing a national stockpile of Bitcoin. Some are doubtful that the rally can be sustained. In a Jan 6 MLIV Pulse survey that asked which winning investments of 2024 are most likely to turn into losers in 2025, 39% of respondents chose Bitcoin, giving it the largest share of the vote.

Bitcoin was trading at US$99,119 as of 8.57am in London on Monday.

Uploaded by Felyx Teoh

- Berkshire dismisses 'false' reports on Buffett comments after Trump shares video

- Trump’s TikTok plan upended by Chinese objections over tariffs — Bloomberg

- LTAT moving forward despite challenges

- US starts collecting Trump's new 10% tariff, smashing global trade norms

- China’s rare earths curbs put multiple US industries at risk

- Melaka to host Visit Malaysia 2026 launching ceremony, says Anwar

- From Ray-Bans to wigs, US buyers may see unexpected price hikes

- Second batch of Putra Heights fire victims get temporary vehicles

- My Say: Taking inspiration from bacterium: the devolution of power

- China says 'market has spoken' after US tariffs spark selloff