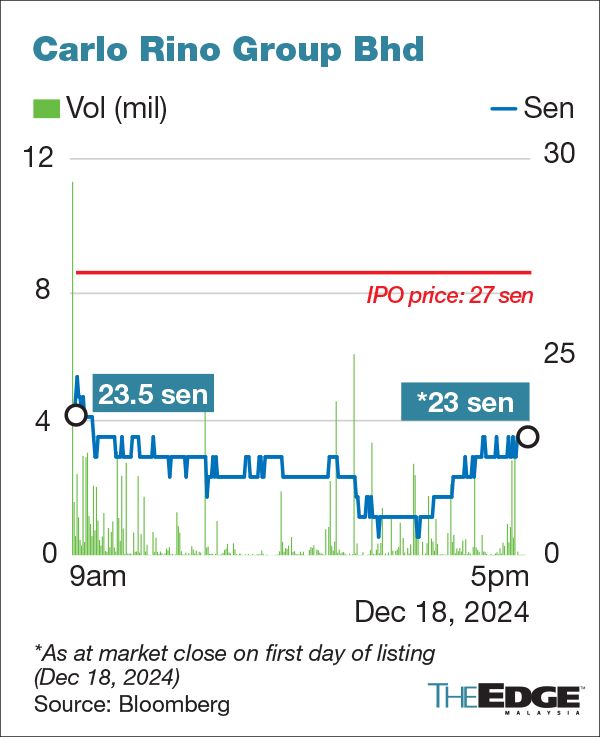

KUALA LUMPUR (Dec 18): Fashion firm Carlo Rino Group Bhd (KL:CARLORINO) ended its maiden listing day on the ACE Market of Bursa Malaysia at 23 sen, down 17.4% from its initial public offering price (IPO) of 27 sen.

The counter opened at 23.5 sen, down 3.5 sen or 13% against its IPO of 27 sen. The 23 sen closing price gives the company a market capitalisation of RM234 million.

The IPO for the transfer of its listing from the LEAP Market offered investors up to a 17.58% stake in the company.

Its IPO involves a public issue that raised RM46.4 million, comprising 48.88 million new shares for the public and 800,000 shares for eligible persons, and the placement of 122.19 million shares to Bumiputera investors.

More than half of the funds raised have been earmarked for working capital, including to stock up inventory and to pay for marketing expenses. About one-third will be set aside for the construction and fitting-out of a new flagship boutique and other facilities.

Carlo Rino mainly designs and sells women’s handbags, footwear, and accessories out of 36 boutiques in shopping malls and five boutiques at premium outlets in Malaysia. The company also consigns its product to 82 departmental store counters and markets its products online.

The IPO price values Carlo Rino close to 14 times its trailing earnings. The company made a net profit of RM19.31 million for the financial year ended June 30, 2024 (FY2024).

Last week, Carlo Rino reported a net profit of RM2.34 million or 0.29 sen per share for its first quarter ended Sept 30, 2024.

“Through this IPO, we aim to accelerate our business expansion, introduce even more vibrancy to our offerings, and invest in upgrading our capabilities to better serve our customers and meet market demands,” said group managing director Datuk Seri Chiang Fong Yee in a statement.

Carlo Rino is controlled by Fong Yee and his father, Chiang Sang Sem, who is the founder of Main Market-listed Bonia Corp Bhd (KL:BONIA).

Post-listing, Fong Yee's shareholding in Carlo Rino will be diluted to 26.3% from 31.91%, while Sang Sem's will be diluted to 42.19% from 51.19%.

TA Securities Holdings Bhd is the principal adviser, sponsor, sole underwriter and placement agent for the IPO.

Read also:

Fashion firm Carlo Rino posts RM2.34m quarterly profit ahead of listing transfer

Carlo Rino’s 48.88 mil IPO shares for public oversubscribed by 18 times

Carlo Rino selling shares at 27 sen apiece for ACE Market listing, IPO may raise RM46.4 mil

TA Securities to underwrite Carlo Rino's listing transfer from LEAP to ACE Market