This article first appeared in The Edge Malaysia Weekly on December 2, 2024 - December 8, 2024

MUCH has been reported about the Sarawak government’s negotiations via Petroleum Sarawak Bhd (Petros) with Petroliam Nasional Bhd (Petronas) for the Bornean state’s rights to regulate the oil and gas (O&G) developments within its boundaries. Next door, however, information on Sabah’s progress has seemed scant by comparison, given that both states are on a similar quest.

For the most part, people watching the unfolding of events in Sarawak have perceived Sabah to be sitting in the shadows, as if waiting to ride the efforts of its gallant neighbour. Up until about a year ago, SMJ Energy Sdn Bhd (SMJE), which is, if you will, Sabah’s version of Petros, stayed out of the public eye, maintaining a carefully positioned narrative of having transformed into a RM5.1 billion company since its inception in December 2021, after its acquired assets bore fruit last year.

Although both states have separate agreements with Petronas, SMJE (formerly known as SMJ Sdn Bhd) says its method to steer the state’s O&G sector is, at least for now, profoundly different from that of Sarawak.

“We know who we are, where our limitations lie, what our risk appetite is. Rather than trying to be someone we’re not and taking on risks that are beyond our financial means, we work within our capabilities to negotiate O&G assets for [Sabah],” SMJE CEO Dr Dionysia Aloysius Kibat tells The Edge in an exclusive interview in Kuala Lumpur.

As Kota Kinabalu-based Kibat and Datuk Seri Panglima Lim Haw Kuang, the Sabah government’s adviser on SMJE, talk about the company’s stance and objectives, it is with certitude of the state’s weaknesses and strengths and what that means for their bargaining chips in negotiations with Petronas.

Lim says: “Let’s know our limitations. Let us be humble and not try to be overly ambitious. Upstream explorations are expensive and risky, running in the hundreds of millions. We avoid exploration risks by negotiating free carry or back-in rights. We do know how to identify good, producing assets with strong cash flow operated by reputable operators with proven ESG (environmental, social and governance) track records. We know how to restructure, manage and sweat assets.”

Lim, 70, is a veteran in the O&G industry who previously held top leadership positions. He is no stranger to the international oil majors, as he has served as executive chairman of Shell (China) Ltd, head of Royal Dutch Shell Planning and Strategy, Shell Downstream president for Asia and Middle East, Shell Malaysia chairman and a board member of BG Group, Bank Negara Malaysia, Sime Darby Bhd (KL:SIME) and Ranhill Utilities Bhd (KL:RANHILL).

Lim is also executive chairman of Sabah Development Bank (SDB).

In short, SMJE is not trying to become a “mini” Petronas Carigali for now and will leave the exploration work to Petronas. To Sabah, Petronas can continue to play its current role in the state. Only at a later stage when the assets are producing and profitable will SMJE buy a stake.

And this move will hinge on Sabah’s commercial collaboration agreement (CCA) with Petronas in December 2021, signed a year after Sarawak’s own commercial settlement agreement (CSA) with Petronas in December 2020.

SMJE’s seemingly amicable approach is to acquire producing assets in a bid to build up a balanced portfolio of upstream, downstream and liquefied natural gas (LNG) assets with reputable operators.

It is in stark contrast to Sarawak, which has made no secret of its intention to reclaim full command and operatorship of the targeted projects as stipulated in its CSA. Sarawak also wants Petros to be the gas aggregator in the state, where all gas produced by the state has to be sold to the state-owned entity and not Petronas. In addition, Petros has launched its own Bid Round 2024 to award carbon capture sites and onshore O&G exploration sites.

The differences are also described in the two agreements: The CSA stipulates that Petros’ role is to manage onshore oil and gas resources and invest in offshore ventures; whereas Sabah’s state entity (which was later identified as SMJE) will have the opportunity to increase participation and revenue sharing in upstream, midstream and downstream petroleum arrangements in partnership with Petronas.

The CCA stipulates that Sabah has “greater say, greater participation, greater revenue share” in the state’s O&G industry, emphasises Kibat. It also gives Sabah the right to negotiate free carry of exploration expenses from bidders of exploration blocks and/or back-in options from Petronas offshore Sabah. For new exploration blocks, SMJE explains that it may exercise free carry or back-in rights, depending on the circumstances.

In a nutshell, free carry means SMJE, on behalf of the Sabah government, may opt to participate in a new production sharing contract (PSC) with pre-agreed-upon negotiated equity interest after exploration success without paying for the exploration cost.

Under back-in, SMJE may choose to participate in a new PSC with a pre-agreed-upon negotiated equity interest after exploration success but will reimburse its share of the exploration cost retrospectively.

Either option eliminates exploration risks for SMJE in the event of failure. Currently, SMJE has back-in rights of 20% in Blocks SB403 and SB409 respectively, in the PSC.

SMJE is chaired by Sabah Minister of Finance Datuk Seri Panglima Masidi Manjun; other prominent names on the board of directors include Ministry of Finance permanent secretary Datuk Mohd Sofian Alfian Nair and Pelaburan Hartanah Bhd group CEO Mohamad Damshal Awang Damit. Interestingly, the list also includes former Petros CEO Datuk Sauu Kakok.

Bigger say, bigger share, less risk

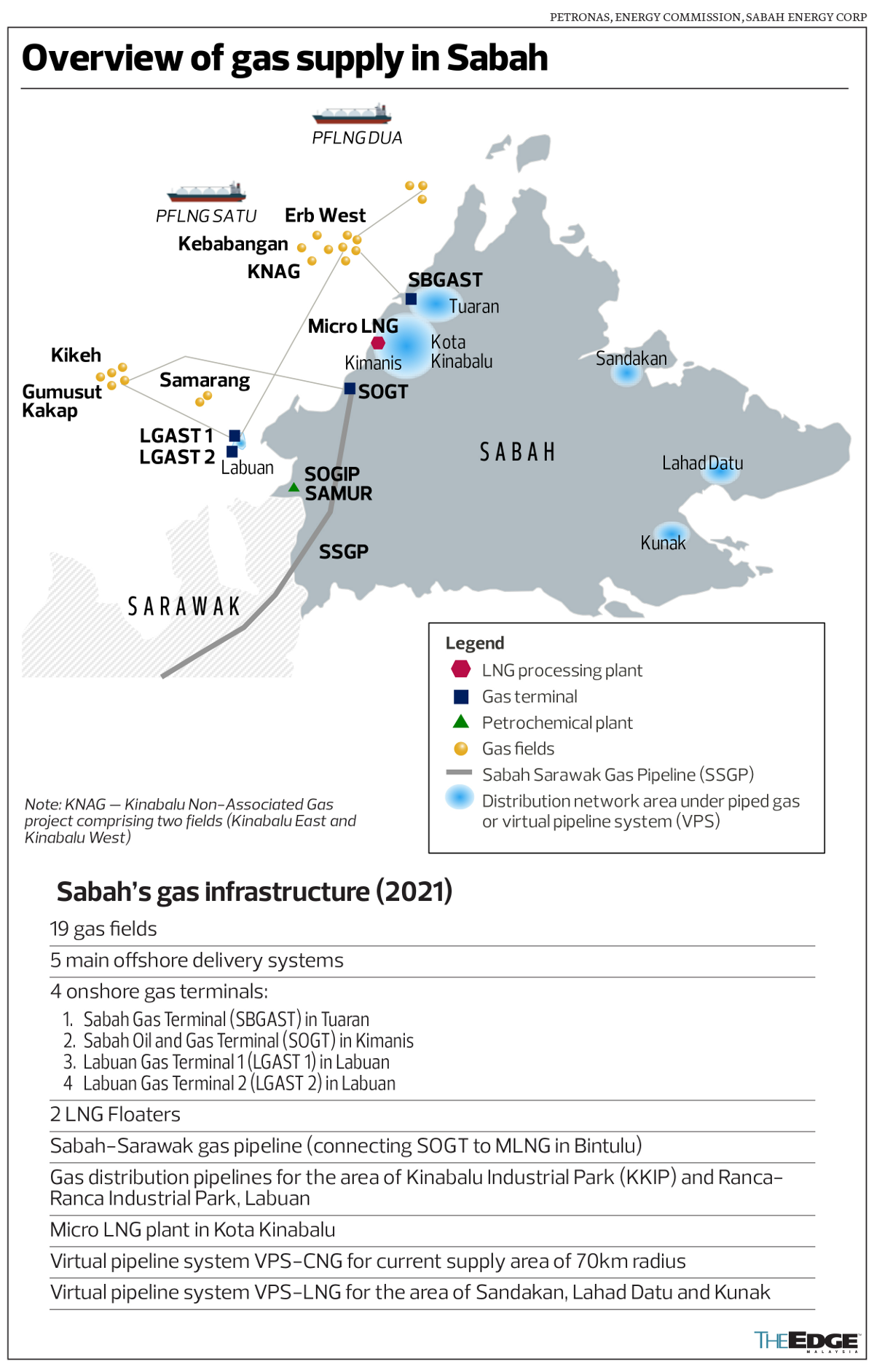

Official data shows that Sabah produces around 41% of Malaysia’s oil and condensate, versus Sarawak’s 30%. The northern Borneo state also produces up to 18% of natural gas in the country, much lower than Sarawak’s 60%.

So far, SMJE’s successful acquisitions from Petronas have included 50% interest in the Samarang PSC offshore Sabah, an upstream asset producing about 36,000 barrels of oil and gas equivalent a day for customers in Kota Kinabalu and Labuan; and a 25% interest in the 1.2 million metric tonnes per annum (mmtpa) Petronas Chemicals Fertiliser Sabah Samur petrochemical plant, a downstream project operating an integrated ammonia and urea production complex in Sipitang, Sabah. The acquisitions were concluded in May and April 2023 respectively.

Separately, SMJE also completed the acquisition of Sabah International Petroleum Sdn Bhd (SIP), which gives it 10% equity in its crown jewel, the 3.6mmtpa Petronas LNG Train 9 liquefaction plant in Bintulu, Sarawak (LNG9).

According to SMJE, these assets are projected to continue to deliver steady cash flow for the next 12 to 13 years, with potential extensions subject to gas availability.

The returns from the assets contributed to SMJE’s net profit of RM259 million in the financial year ended Dec 31, 2023 (FY2023), making up for a string of net losses in preceding years that led to a net loss of RM7.1 million in FY2022.

SMJE says its investments in the LNG9 Project and the SAMUR complex have generated a combined RM1 billion in revenue so far from midstream and downstream operations.

Referring to its performance in FY2023, SMJE says it remitted a dividend sum of RM50 million — the same amount injected by the state at its inception — as well as a sales and service tax (SST) of RM36 million to the state. Last Tuesday, SMJE declared dividends of RM50 million to the state again for FY2024.

“As an upstream player, we pay SST to the state. Our other role is to make a socioeconomic impact in Sabah, increasing the number of local contract awards as well as heightening the quality of O&G services,” Kibat says, pointing to the involvement of Sabahan contractors in less than 200 O&G work categories out of more than 1,000 at present.

“The CCA stipulates that [Sabah] has a greater say, greater participation, greater revenue share — thus, the state set up [SMJE] with its own independent board and independent management, making independent investment decisions. We don’t rely on the state government to finance us. Instead, we raise financing from the market,” says Kibat.

On this matter, SMJE works with the state government and Petronas to intervene and prioritise involvement of Sabahan contractors and the local workforce in more work categories through tendering conditions and joint ventures.

“Matters of cost, safety, quality and schedule in the O&G business must never be compromised,” Lim states.

In May, Sabah established its own Local Content Council, where the state and Petronas have jointly agreed to a target to award 30% of all oil and gas services and equipment spending within Sabah to qualified Sabahan companies. In the process, the number of active Sabahan companies has risen to 113 this year, from 79 in 2022.

Not all has been rosy, though. A matter of contention was SMJE’s acquisition of previously debt-ridden SIP from Sabah Development Bhd for RM1.2 billion in October 2023.

SIP was known as M3nergy Bhd, and Trenergy (M) Bhd before that, in which Melewar Industrial Group Bhd (KL:MELEWAR) held a substantial stake. The loss-making SIP was delisted in 2010 through a management buyout before Sabah Development Bank took over the company to recover its loan liabilities.

Naysayers have pointed out that SIP was saddled with a RM1.6 billion debt from failed investments in the past, and Lim’s role in the takeover deal raised concerns about a conflict of interest. After all, he is SDB’s executive chairman and plays the role of adviser to SMJE.

Kibat and Lim maintain, however, that SMJE’s acquisition of SIP has been value-accretive, as the loan refinancing has resulted in RM60 million in interest savings in 2023 alone.

“When we took over [SIP], we restructured SIP’s debts, changed its management and got rid of loss-making businesses. People were doubtful initially, saying we were getting a sick baby. But we knew how to restructure it. It had the jewel in the crown — Petronas LNG9, which is producing so much money today and generates stable cash flow to SME Energy,” contextualises Lim.

“We’re now sweating the assets and maximising shareholder value and, most importantly, SIP is no longer a sick baby. It is debt free and produces stable cash flow now,” adds Lim, emphasising that SMJE, a wholly-owned government-linked company under the Chief Minister Inc, operates independently under a professional board with strong corporate governance.

A matter of playing it right

Lim says the Sabah government has no immediate plans to go into upstream exploration and development for now, but SMJE “has to evolve” as conditions change.

“Importantly, SMJE is aligned with the state in terms of the overall priority and strategic direction. But we are still a commercial organisation. We are not the state,” he says.

Asked whether SMJE is given preferred pricing or priority of assets, Lim says they are “all subject to commercial negotiations”, where both the Sabah government and Petronas aim to walk away satisfied.

“Because this [materialised from] the CCA, the state government also provides the support … We are nobody without the CCA, and that is a relationship between the state and Petronas,” he adds.

Asked what happens if Petronas does not want to part with certain assets in the state after the first oil, Lim says “then we’ll talk”, pointing to the acquisition of Samarang, which also produces gas. He describes it as the outcome of a “successful” negotiation. “Both sides will just need to talk it out. The CCA does say it is necessary.”

The state’s negotiations with Petronas appear, however, to be taking longer than expected. In October last year, SMJE had told The Edge that it expected to conclude the talks to acquire stakes in six Petronas producing assets between end-2023 and the first half of 2024. Two of the assets are in the upstream business, two in downstream and two in liquefied natural gas. The last deal was SMJ Energy’s second back-in option to acquire a stake of up to 20% in Block SB403 signed in January this year.

When queried about it, Kibat says SMJE is still in discussions with Petronas on various opportunities, and that it was ironing out the “nitty-gritty of the various assets”. The relationship with Petronas is good, she adds.

Among ongoing projects spearheaded by Petronas in Sabah are the construction of its third floating LNG asset (FLNG3) in Sipitang, alongside Sabah’s largest near-shore LNG facility, which is capable of producing 2mmtpa at the Sipitang Oil and Gas Industrial Park.

Meanwhile, Sarawak’s gas aggregator negotiations with Petronas have already missed the supposed October deadline unilaterally announced by Sarawak Premier Tan Sri Abang Johari Tun Openg.

Note that Sabah has its own Gas Supply Enactment 2023 as well, which some may compare with Sarawak’s Distribution of Gas Ordinance 2016. Both versions spell out the activities in the gas value chain, from gas imports to retail, requiring licensing from the respective states.

Discussions are heating up on the legal and financial implications surrounding the gas aggregator deadlock in Sarawak, which some may speculate to be somewhat overshadowed by politics — Gabungan Parti Sarawak’s 23 members of parliament, together with Sabah’s 18, are part of the 112 MPs supporting the federal government to secure the two-thirds majority in the Dewan Rakyat.

Sabah is due for state election next year and will have to hold the poll before end-2025. How hard the state government bargains with the federal government at the negotiating table is likely to be a factor in garnering votes. Holding sizeable stakes in producing assets is akin to having more than one cash cow, which helps boost the state’s coffers.

For now, all eyes are on which state will play its cards right by Petronas and the federal government.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.