_20240805154505_theedgemalaysia.jpg&w=1920&q=75)

(Aug 5): The ringgit jumped the most in nine years on bets foreign capital will flood in amid optimism surrounding Malaysia’s economy.

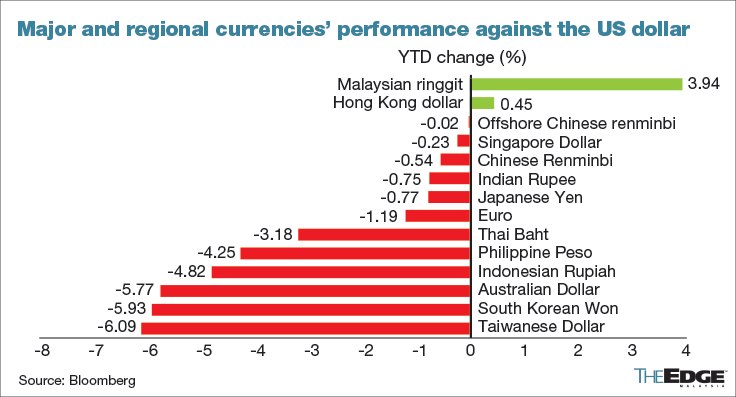

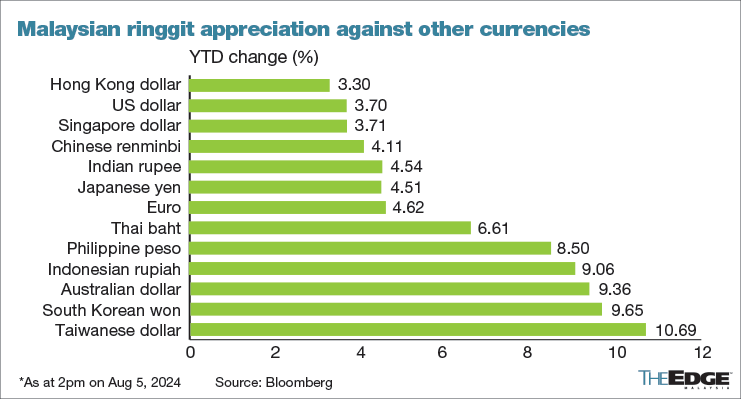

The currency surged as much as 2.3% on Monday, headed for its biggest gain since October 2015. It outperformed its developing peers including the Chinese yuan on a day of significant turmoil across global markets triggered in part by fears of a US recession and an unwind of popular currency trades.

After three years of losses, the ringgit is leading gains in emerging markets this quarter as the government sought to attract more foreign investments and began rolling back subsidies to narrow the budget deficit.

The currency, which analysts say is undervalued, is set to benefit from the prospect of interest rate cuts by the Federal Reserve starting next month. The Malaysian currency stood out against a selloff in global risk assets on Monday amid concerns that the Fed may be behind the curve with policy support for a slowing US economy.

“The ringgit has rallied Monday as it has been under siege,” said Mingze Wu, a currency trader at StoneX Financial in Singapore. “Signs of a pivot from the Federal Reserve has allowed the pressure on the ringgit to be released.”

The Malaysian currency reached 4.3945 per dollar on Monday, its strongest level since April 2023, before paring gains.

Efforts by policymakers to encourage state-linked firms to repatriate and convert overseas income has helped stabilise the ringgit after it fell to a 26-year low in February. Economic fundamentals remained strong as an upturn in the global technology cycle aided a recovery in exports.

“We could indeed be at the start of a long-term unwind of the ringgit’s undervaluation,” Alvin Tan, the Singapore-based head of Asia FX strategy at Royal Bank of Canada, wrote in a note at the end of last week. Strong moves in the currency over the past few days were also due to “large inflows into MYR plus further short-covering in the currency,” he added.

With the dollar entering oversold territory against the Malaysian currency, “we will likely see moderation in the pace of decline,” Tan said.

There are also concerns over the Malaysian government’s pace of structural reforms that would be key to improving the country’s long-term growth potential.

External events especially those related to the US, China and Japan will likely be key drivers going forward, according to Malayan Banking Bhd. Malaysia’s central bank is expected to hold interest rates this year, bucking the trend for policy easing in major economies.

“There is more positive idiosyncratic optimism towards the ringgit,” Maybank analysts including Saktiandi Supaat wrote in a report.

Uploaded by Magessan Varatharaja