This article first appeared in The Edge Malaysia Weekly on May 6, 2024 - May 12, 2024

COME May 11, the Employees Provident Fund’s (EPF) flexible account (or Account 3) will go “live”, giving pre-retirement account holders the liberty to withdraw up to 10% of their balances for any purpose — a scenario that will be closely monitored for its potential impact on consumption.

While it is expected to boost consumption, fund managers do not expect a repeat of two years ago when contributors were allowed a special withdrawal of up to RM10,000 owing to the problems wrought by the Covid-19 pandemic.

Fund managers and analysts whom The Edge spoke to are expecting a boost for consumer and retail stocks, although a “less profound impact compared with the RM10,000 withdrawal in 2022”, when consumer companies — and the stock market — enjoyed the highs of revenge spending following the pandemic.

Notably, the economic circumstances were different then as the nation was still dealing with the effects of the rolling lockdowns and border closures. Then, the pent-up appetites of retail investors found their way into the stock market as certain themes such as the play on glove and technology stocks made for an exciting punt even though the special EPF withdrawal was not meant for such use.

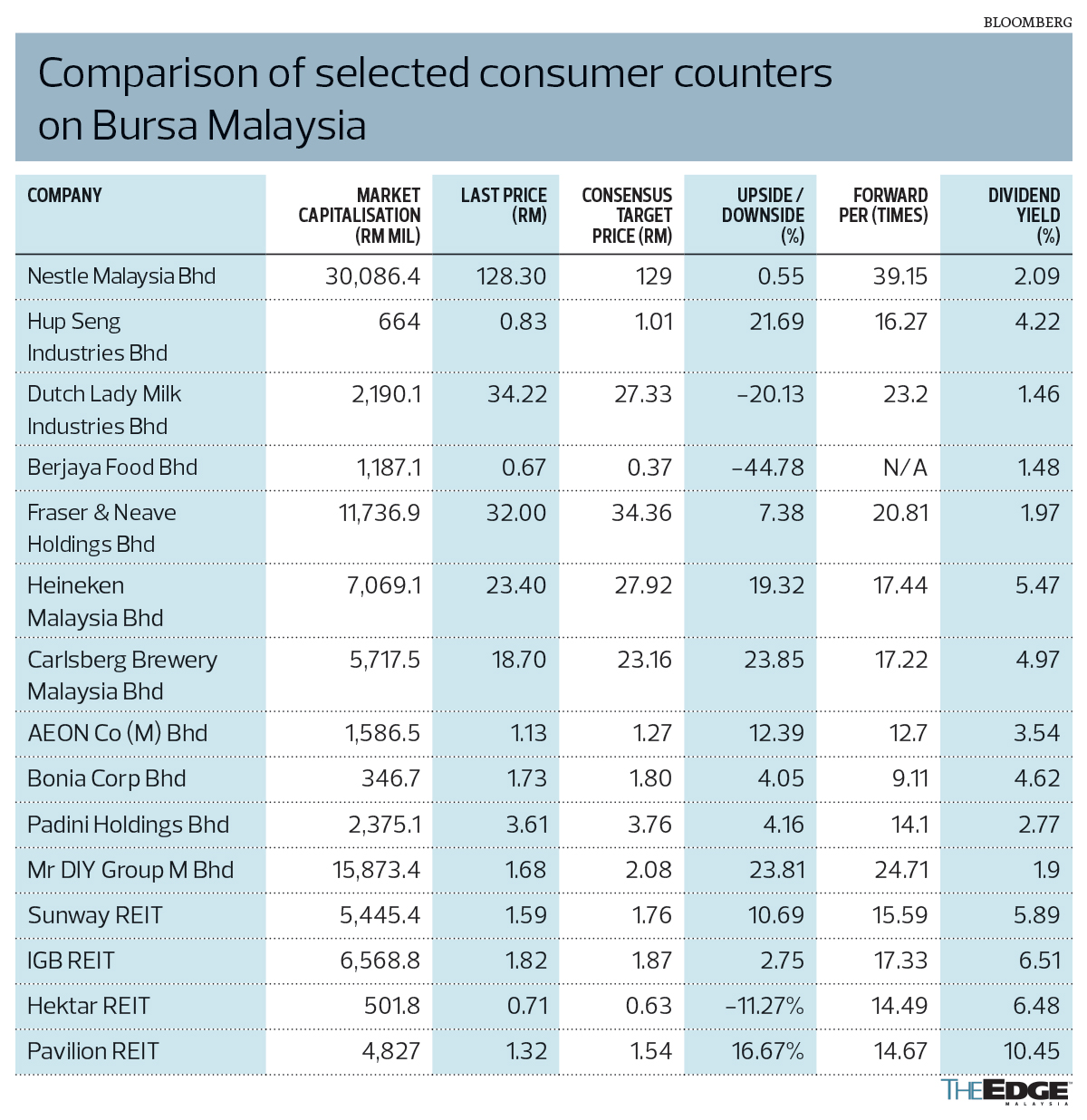

Following EPF’s announcement on March 18, 2022, retail companies such as Aeon Co (M) Bhd enjoyed a share price boost, with the counter rising from RM1.48 to RM1.64 over the following month, while Padini Holdings Bhd and Bonia saw their share price climb 2.7% and 70% respectively over the next two months. Consumer players Fraser & Neave Holdings Bhd, Heineken Malaysia Bhd and Carlsberg Malaysia Bhd rose 10.46%, 3.7% and 5.4% respectively during the period.

Even real estate investment trusts (REITs) with retail malls in their portfolios such as Sunway REIT, IGB REIT, Hektar REIT and Pavilion REIT saw price gains of 14.8%, 20.3%, 30.4% and 16.7% respectively in 2Q2022.

“We should still be positive for consumer and retail this round but perhaps not as much as the last round [EPF withdrawal in 2022]. This is likely to be because those who made previous withdrawals now have less in their accounts,” Rakuten Trade head of equity sales Vincent Lau tells The Edge.

Areca Capital Sdn Bhd CEO Danny Wong concurs, noting that financial advisers do not encourage the withdrawal of savings. Moreover, he observes that EPF members who do withdraw from Account 3 may channel the funds towards the repayment of loans. “Retail lenders may benefit from this,” he adds.

EPF has guided that if every member opts for the one-off transfer from Account 2 to Account 3, the amount will stand at RM57 billion. The provident fund also estimated that RM25 billion of that amount may flow out of Account 3 in the first year, based on patterns from pandemic-related withdrawal schemes, before moderating to RM4 billion to RM5 billion per annum thereafter.

“If history repeats itself, a portion of that RM57 billion might even find its way to the stock market,” Lau remarks.

“This time, yes, Account 3 will boost domestic consumption and that will help to offset some of the challenges currently faced by retail and consumer companies,” TA Investment Management Bhd chief investment officer Choo Swee Kee opines. But he is neutral on retail and consumer stocks because of the negative impact from inflation and rising material costs, which offset the positive boost in demand.

Kenanga Research pointed out in an April 26 research note that in hindsight, the EPF withdrawal scheme in April 2022 saw a spike in retail counters that tapered off fairly quickly, while monthly auto sales were muted.

“We believe the boost to sales of retailers will be more subdued this time around compared to what we saw in April 2022. This is because even if we assume full participation in Akaun Fleksibel, the total withdrawals during the first year are estimated at only RM25 billion compared with RM44.6 billion previously,” said the research house, which made no changes to its earnings forecasts and stock ratings.

Its top picks are F&N and Mr DIY Group (M) Bhd, which have been ascribed “outperform” calls and target prices of RM33.80 and RM1.95 respectively.

Bearing in mind that the consumer-led boycott of certain brands in Malaysia which intensified towards the end of 2023 is still ongoing, it is unclear how Berjaya Food Bhd, which owns Starbucks Malaysia, will fare with the EPF withdrawals in the bag.

“Looking at the long-term implications, we are not positive on this trend as people are using retirement money to fund current consumption. With a smaller balance in their EPF accounts, people will soon find it more difficult to buy homes in the future,” says Choo.

Economists have also called out the government on the latest EPF proposal, saying it was a “mistake” that would have an adverse effect on the 5.2 million contributors in the M40 and B40 income groups and that these communities risk having insufficient savings upon reaching the retirement age.

Fund managers believe that Prime Minister Datuk Seri Anwar Ibrahim’s announcement on May 1 that civil servants would receive a salary increase of at least 13% starting December 2024 would have a greater impact than withdrawals from EPF’s Account 3. The salary hike will amount to an estimated RM10 billion.

While the fund managers are ambivalent about the Account 3 withdrawals, they cannot deny the impact of the recent announcement. “Historically, when civil servants were accorded salary raises, we tended to see an uptick in the sales of automobiles, travel tickets and accommodation, gadgets and more,” says a fund manager who wished to remain anonymous.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.