This article first appeared in The Edge Malaysia Weekly on March 25, 2024 - March 31, 2024

UNLIKE most of its Malaysian peers, dairy manufacturer and tin can maker Able Global Bhd has minimal brand visibility locally, as about 80% of its dairy products are exported. In fact, its foreign sales will continue to grow as its dairy plant in Mexico ramps up productivity from 25% currently, with its products earmarked for the US, the Caribbean islands and Latin America.

Able Global CEO Edward Goh Swee Wang says the strategic shift is anticipated to optimise factory output, with full capacity utilisation achieved by 2027, if all goes well.

“As a group, we have constantly pushed through progressive improvement over the last two years. On the Mexican operations front, the filled milk dairy category successfully completed its maiden shipment to the US in July 2023,” he tells The Edge in an interview.

“Since then, we have experienced recurring orders for this category. We expect demand to grow progressively, with the supportive distribution channel through Walmart Mexico, local chains and our joint-venture (JV) partner Calkins, Burke & Zannie de México (CBZ de México).”

Goh, 61, who has more than three decades’ experience in the metal can and dairy industries, says the company is sanguine about the performance of its food and beverage (F&B) segment, which will be supported by the strong demand from major supermarket chains in Mexico.

“At the current utilisation rate, I think 25% is sufficient to serve the Mexican market. If there is any rising demand, we just need to increase our utilisation rate by 3% to 4%. Our target for the remaining 75% capacity in Mexico is the export business,” he says.

Able Global’s products — condensed milk and evaporated milk — are targeted at the Latin American and Asian population in the US, who traditionally consume such products. “The Caucasians and Afro-Americans don’t consume these products. They prefer fresh milk or creamer for their coffee and tea,” he says.

Goh says Able Global will participate in trade shows in the US — for instance, the Private Label Trade Show in Chicago held each November, which is attended by all the major American supermarket chain operators — to get new customers for its original equipment manufacturer (OEM) segment.

“Ideally, the US market should absorb 40% of our total capacity there, Mexico will continue to take up about 25% and the balance will go to South America, the Caribbean islands and even certain parts of Central America,” he adds, explaining the breakdown of its Mexican plant’s capacity utilisation.

The venture will be instrumental in making the company a global exporting player.

“Prior to the establishment of this Mexico venture, we were already exporting our dairy products to the Americas. However, given the logistical considerations, it was not very cost effective on our part,” says Goh.

A major advantage of its Mexican operations are the free trade agreements (FTAs) enforced between Mexico, South America, North America and the Caribbean, which allow the group to export its products more cost efficiently.

“This has enabled us to have a direct foothold in the US and capture growth opportunities in North America and South America, supported by lower freight costs and shorter delivery time frame from our Mexico plant,” he says.

Able Global — originally incorporated as Johore Tin Bhd in 2000 and listed on Bursa Malaysia in 2003 — is based in Skudai, Johor. The group has three main business operations: F&B; speciality metal packaging; and property development.

While it started as a tin can manufacturer, Able Global ventured into the dairy business in 2011 when it acquired Able Dairies Sdn Bhd, a sweetened condensed milk and evaporated milk company formed in 2007.

Having identified dairy as its path for future growth, the group aggressively diversified in the F&B segment and established Able Food Sdn Bhd in 2013 as a one-stop solution centre for the packing of dry milk powder, infant formula and dairy ingredients.

Notably, Able Dairies de Mexico SAPI de CV was established in 2018 as the group’s first overseas venture catering for the North America, Latin America and Caribbean markets.

Able Global and its customer turned partner CBZ de México own a 43% stake each in the Mexican JV. The remaining interest is held by two other Mexican partners.

“CBZ de México is one of the largest distribution companies in Mexico, which has been importing our dairy products from Malaysia. We worked together for seven to eight years before deciding to enter this JV in Mexico,” says Goh.

“It has an extensive distribution network, from Walmart to all the local hypermarkets. That’s why we were able to penetrate the Mexican market immediately.” He adds that, given the huge population, it is vital to have good retail partners to gain market share.

Cheapest dairy stock on Bursa?

Able Global makes liquid milk (condensed milk, evaporated milk, UHT and flavoured milk), dried milk (instant milk powder, infant formula, growing-up formula, maternal and lactating formula), non-dairy creamer and whitener, as well as coconut milk and other plant-derived drinks.

Goh, his father, Goh Mia Kwong, (executive director) and his sister Lisa Goh Li Ling (operations manager) are major shareholders of Able Global, with a total equity interest of 19.28%. Chairman and executive director Ng Keng Hoe (Huang Qinghe), a 50-year-old Singaporean, is the second-largest shareholder with a 12.45% stake.

Interestingly, former Nanyang Siang Pau business editor and widely followed investor Fong SiLing — who goes by his pen name Cold Eye — owns a 0.975% stake in Able Global. Other notable shareholders include Dana Makmur Pheim (helmed by veteran fund manager Dr Tan Chong Koay), with 0.652% and Neoh Choo Ee & Co Sdn Bhd (spearheaded by seasoned investor Dr Neoh Soon Kean), with 0.65%.

Able Global’s top 30 largest shareholders include Fortress Capital Asset Management (M) Sdn Bhd (0.584%) and Hong Leong Consumer Products Sector Fund (0.488%).

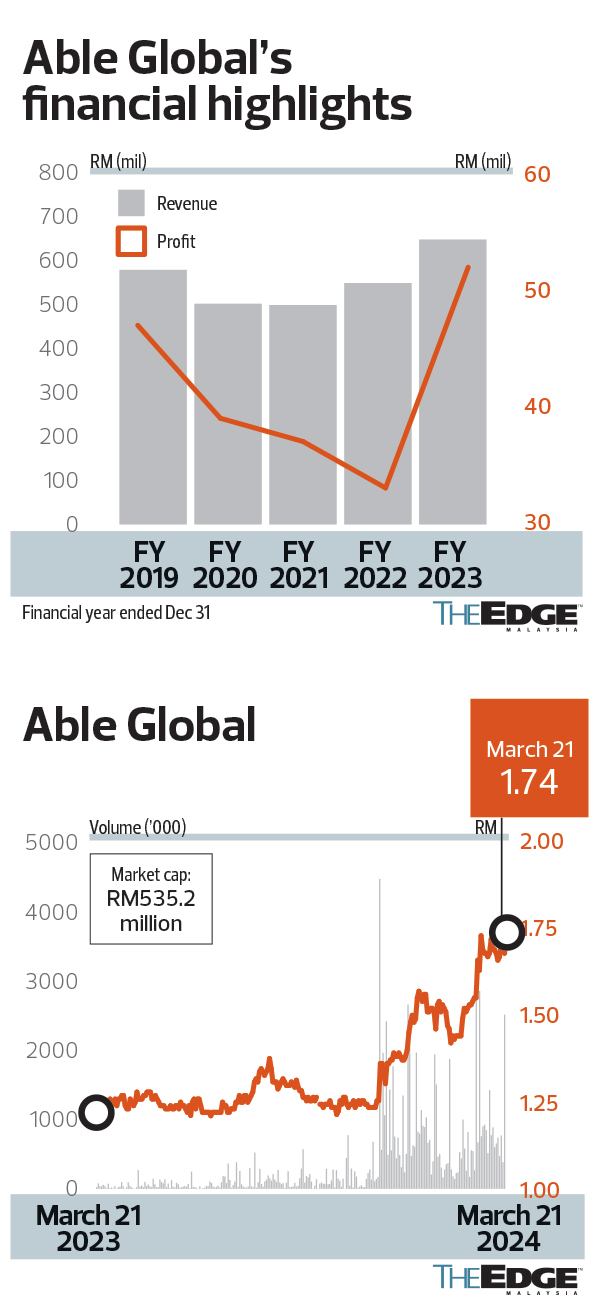

The company’s share price had risen 34% over the past six months to close at RM1.74 last Thursday, for a market capitalisation of RM535.2 million. The counter is currently trading at a historical price-earnings ratio (PER) of 10 times, making it probably the cheapest dairy company on Bursa Malaysia in terms of stock valuation.

For comparison, pure-play dairy companies Dutch Lady Milk Industries Bhd and Farm Fresh Bhd are trading at PERs of 24 times and 60 times respectively, whereas F&B conglomerates Nestlé (M) Bhd and Fraser & Neave Holdings Bhd (F&N) are trading at PERs of 42 times and 21 times respectively.

Able Global’s net profit for the financial year ended Dec 31, 2023 (FY2023) rose 56% to an all-time high of RM51.99 million, from RM33.38 million in FY2022. It declared a dividend per share (DPS) of 6.5 sen for FY2023, a yield of 3.73% based on last Thursday’s closing price of RM1.74. From FY2018 to FY2022, its DPS ranged from 4.0 sen to 6.4 sen.

“We achieved a record profit of RM52 million in FY2023. The demand for dairy products was very good last year. Another important reason is that the prices of raw materials were quite stable across the year,” says Goh.

“We were just selling and selling, while our buyers were just buying and buying. None of us had to worry about the volatility of raw material prices and price hikes.”

Not neglecting the Malaysian market

As part of Able Global’s initiative to solidify its position in Malaysia, the group has secured a contract from the government to provide UHT milk to schoolchildren in 2023 and 2024.

As 80% of Able Global’s dairy products are exported and the Americas account for 20% of its exports, Goh says, the commencement of operations at its Mexico plant since mid-2022 freed up the Malaysian production capacity, allowing the group to better serve the Southeast Asian market.

“Our idea is to reduce our exports to Mexico so that we can sell the balance of our Malaysian capacity to Africa and Southeast Asia. Serving the Malaysian market has been a continuous effort, along with the extension of our product offerings across all distribution channels,” he stresses.

“In the longer term, we hope to build a strong brand image in Malaysia. We want people to at least recognise our brand. For our Malaysian operations, we are running out of capacity. We are just maintaining our output for now until our new factory is up with new capacity. Then, we will start pushing again.”

Currently, you will not see Able Global’s dairy products on the shelves of supermarkets or hypermarkets in Malaysia. This is because the biggest users of its products are sundry and coffee shops, mamak restaurants and warungs.

“There are so many brands in supermarkets, so we have been selling our products directly to the smaller shops via our own sales channel since last year,” says Goh.

Able Global has a fleet of 12 vans that sell directly to the coffee shops. So far, the response has been quite good in the Klang Valley, as the fleet replenishes stock every three to four days on average, he adds.

“Basically, our van drivers will go to the villages and places that our marketing team cannot reach. We have implemented two schemes. First, you can be your own boss. Second, you take a commission. The van belongs to us. We give you a van full of various products. You sell, you take the money, we give you another van full [of goods],” says Goh.

An ‘accidental’ property developer

In 2021, Able Global bought a piece of freehold land in Carey Island, Kuala Langat, Selangor, measuring 297.51 acres for RM169.8 million cash from PNB Development Sdn Bhd. The acquisition was partly to expand and consolidate the group’s dairy production.

“We are in the midst of getting approval from local authorities to develop the parcel of land for commercial and industrial usage. We initially wanted to buy only 100 acres, but the seller insisted that we take the whole tract, which we eventually agreed to,” says Goh.

“We have earmarked 90 acres for our own use [proposed consolidated manufacturing facility]. And for the remaining 207 acres, we will build industrial and commercial properties for sale. Frankly, we did not set out to be a developer but, to acquire the land, we made the bold move of taking up the challenge.”

Dubbed Able Business Park, the development will comprise an industrial park with commercial and residential elements.

“We hope to construct our new factory there and get it running within two years. Altogether, we are looking at a capital expenditure (capex) of RM80 million to RM100 million. The rest of the development [comprising factories to be sold] may be completed in three to four years,” he says.

The capex will be funded via borrowings. At end-FY2023, the company’s net gearing stood at 0.3 times.

Able Global will work with Invest Selangor to fast-track certain processes and bring in quality investments. “So far, we have heard that some manufacturers, warehouses and storage facilities are keen,” Goh says.

If everything goes according to plan, Able Global will fully relocate its dairy operations to Carey Island from Klang.

“The new plant is expected to double our capacity. We will then sell our factories in Klang. We want everything to be together. We want to consolidate our operations in Klang,” he says.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.