This article first appeared in The Edge Malaysia Weekly on March 18, 2024 - March 24, 2024

FUND managers and analysts are hopeful that the lack of interest in retail counters will not continue past the middle of the year and that the influx of tourist arrivals, as well as the US Federal Reserve’s initiation of interest rate cuts in June as projected, will spark a revival of investor interest in the second half of the year.

Much like that of consumer food and beverage (F&B) stocks, the performance of most retail counters on Bursa Malaysia has been lacklustre in recent weeks, unlike the usual upbeat trend normally observed from the December holidays to after the Chinese New Year (CNY) and Hari Raya festivities.

The Bursa Malaysia Consumer Products and Services Index, which peaked at 581.2 points on Feb 27 after the Chinese New Year festive season, slipped 1.4% to the 572.65 level last Thursday.

Retail Group Malaysia (RGM), in its Malaysia Retail Industry Report March 2024 released last Monday, observed that the nation’s retail industry fell short of market expectations as it recorded a disappointing growth rate of -0.2% in retail sales compared with +13.7% in the previous corresponding quarter. It said the retail sector took a beating in the last quarter because consumers lost spending power as retail prices, mainly food prices, continued to rise.

“The shopping traffic for the last three months of the year was similar to the 2022 level. Malaysian consumers were still spending. However, the holiday sales were not the same as pre-Covid-19 levels due to the shortened school holiday. For 2023, the year-end school holiday was only two weeks,” RGM added.

RGM is projecting an average growth rate of 7.1% for the Malaysian retail industry in the first quarter of 2024, owing to the CNY festival as well as the month-long school holiday from February to March.

The retail group said the distribution of Sumbangan Tunai Rahmah (STR) Phase 1 to 8.2 million Malaysians in January also led to higher consumption. The government had raised the maximum payment for Phase 1 of STR to RM500 for households from RM300 the year before.

“[In addition,] the attractive Malaysian currency as well as the visa-free entry for visitors from China brought large numbers of foreign tourists to the country during CNY,” said RGM, which revised its annual growth rate for retail sales in 2024 to 4%, an upward adjustment of 0.5 percentage point from a projection made in November last year.

For the record, the Malaysian government expects economic growth of 4% to 5% in 2024, with inflation anticipated to average between 2.1% and 3.6% this year.

However, the analysts and fund managers whom The Edge spoke to last week do not see the positive sentiments translating into a better performance for retail counters in the near term. Most of them have a neutral stance on the consumer and retail sector in the absence of “near-term catalysts”.

“Rising costs, inflation and the weakening ringgit are challenging issues affecting consumer demand. Looking at the situation in Malaysia currently, we are not surprised that consumer and retail companies are seeing a slowdown in demand. The companies’ share prices are also affected, as rising costs may shrink their profit margins, hence leading to lower profits,” TA Investment Management Bhd chief investment officer Choo Swee Kee tells The Edge.

“It is true that strong economic growth will increase the general income of people and hence may lead to stronger retail growth. However, higher retail sales may not lead to higher profits as profit margins are affected by the much higher cost [of doing business],” he stresses.

Most retail counters have performed sluggishly since November 2023, possibly reflecting the poorer year-end sales as noted in RGM’s report.

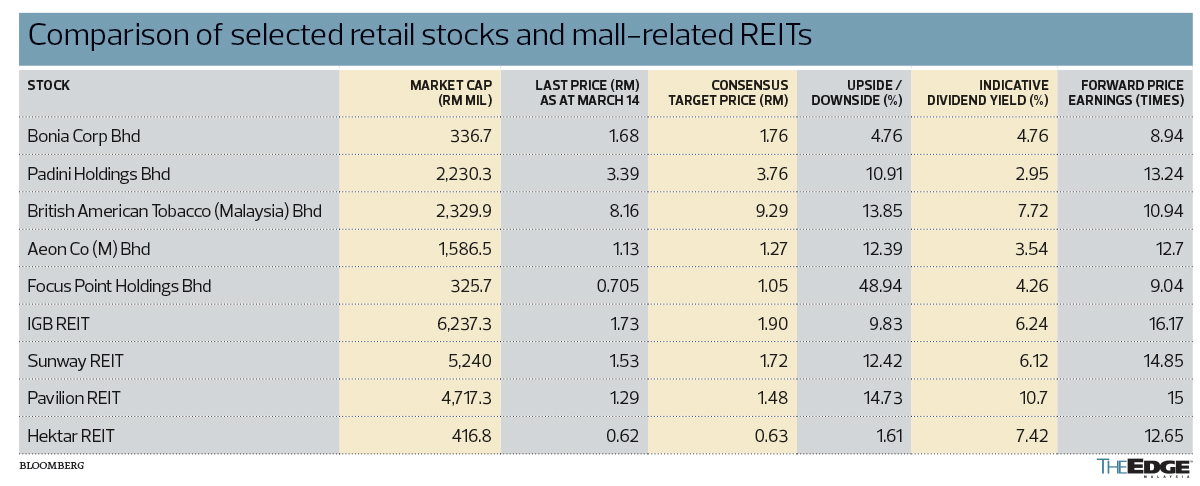

Bursa-listed mass prestige fashion player Bonia Corp Bhd has not displayed the usual vibrancy at this time of year, as was the case in the preceding two years. In fact, its share price slipped 7.7% from RM1.81 on Dec 18, 2023, to RM1.67 on Jan 22 this year. Without much movement since, the counter closed at RM1.68 last Thursday.

Similarly, the share price of department store chain Aeon Co (M) Bhd has hovered at the RM1.10 mark since November while that of Parkson Holdings Bhd rose from 25 sen to 31 sen going into the new year but slipped to 24 sen last Thursday.

Even with better sales traction in January and February due to the CNY season, the analysts agree that any catalysts that may lift retail stocks will only take effect in the second half of the year as the economy recovers.

Discretionary buys expected to fall back

Adding to the woes from heightened retail prices is the increase in the sales and service tax to 8% from 6% previously, as implemented on March 1.

“We expect this to bring about some inflationary pressures while other measures slated to be introduced later will add to these. This is poised to influence consumer sentiment, as we foresee cautious and selective discretionary spending in the light of the heightened cost of living,” MIDF Research tells The Edge.

“We also anticipate inflationary pressures on operations, fuelled by the expectation of cost pass-through from service providers to retail counters, which is likely to elevate operational costs. Investors have to be selective in terms of retail counters and look more towards consumer staples rather than consumer discretionary,” the research house cautions.

To this end, Rakuten Trade head of equity sales Vincent Lau points out that the more affordable offerings in the retail sector such as that of Padini Holdings Bhd and Aeon Co will still carry long-term value as users switch to affordable products in adjusting to the new norm.

“Aeon Co offers staples which many people buy and Padini is affordable. Demand won’t just fall off the cliff,” Lau remarks.

MIDF Research concurs, and adds that it has observed that consumers are now looking for cheaper alternatives like private label brand products and, to a certain extent, are deferring purchases or even prefer purchases with instalment options rather than cash or credit.

“Hence, we expect a spillover impact on retailers like Aeon Co,” says MIDF Research, which is “neutral” on the stock and has a target price of RM1.14.

Lau believes that other retail players such as Focus Point Holdings Bhd will be resilient given that the company has “established its position in its various target markets”. The counter, which stood at 77 sen at the start of December 2023, now hovers at 70 sen.

“Hopefully, with Hari Raya coming and the usual spending spree, and the fact that OPR (overnight policy rate) has not increased, things won’t be that bad,” he quips.

TA’s Choo, who does not provide stock recommendations, believes that some retailers will benefit from tourist arrivals. “As Malaysia ramps up its tourism promotions, retailers catering to tourists should see better sales. Tourists tend to be less sensitive to domestic inflation.”

Similarly, Areca Capital Sdn Bhd CEO Danny Wong, who is neutral on retail counters, foresees a positive trend in tourism-related stocks such as Genting Bhd, its subsidiary Genting Malaysia Bhd as well as retail mall REITs. “Interest rate cuts [later] may result in lower [bank] deposits, which would then encourage spending,” he surmises.

‘Performance of retail REITs resilient’

Wong points out that mall REITs such as KLCC REIT, IGB REIT and Pavilion REIT saw their share prices rise in the fourth quarter of last year from 3Q2023.

It is noteworthy that although RGM acknowledges that the biggest challenge for the Malaysian retail industry remains the rising cost of living — many are already struggling to cope — it anticipates the retail industry to grow by 3.5% during the second quarter of the year with contribution mainly from Hari Raya, the celebrations of which will begin in the second week of April. It projects the industry to grow 2.5% in 3Q2024 and 3.2% in 4Q2024 after a “weak performance in 4Q2023”.

Members of the Malaysia Retailers Association (MRA) and Malaysia Retail Chain Association (MRCA), who were interviewed on their retail sales performances for the entire year of 2023 and the first quarter of 2024 for the RGM report, said that all retail subsectors had expected positive results for the first quarter. This includes the department store-cum-supermarket operators (who are hopeful of a turnaround at a growth rate of 2.7%), fashion and fashion accessories (8.8%), pharmacy (9.4%), personal care (15.5%), furniture and furnishing, home improvement and electrical and electronics (2.2%) as well as department stores (21.5%, which is the most optimistic projection among the retail subsectors).

Should the implementation of the fuel subsidy rationalisation be a cause for concern? RHB Research analyst Loong Kok Wen reasons that since details have yet to be announced, there is no reason for consumers to hold back on spending.

“As for the higher electricity tariff, I do expect some impact on consumer spending. But if we were to compare today’s economic environment with that two years ago when inflationary pressures were even greater right after the Covid-19 pandemic, I’d say that people have adapted to the new norm by now. Coming off a high base, the inflationary pressures should stabilise this year,” says Loong.

MIDF Research tells The Edge that retail REITs may have the advantage of being diverse in terms of their malls. “Which means the availability of variety being F&B outlets, consumer staples, consumer discretionary and entertainment means that footfall will likely be stable. However, it is possible that REITs will be slightly under pressure this year,” cautions the research house, which has “buy” calls on Sunway REIT, Pavilion REIT and IGB REIT with target prices of RM1.70, RM1.48 and RM1.86 respectively.

AmInvestment Research points out that in line with the improved rental reversion and occupancy rates for prime malls, IGB REIT and Pavilion REIT registered stronger earnings in CY2023.

“Notably, the stronger distributable income growth of 20% year on year (y-o-y) of Pavilion REIT was primarily attributed to recognition of a seven-month contribution from the newly acquired Pavilion Bukit Jalil, after its injection on June 1, 2023,” AmInvestment Research said in a March 12 sectoral note.

It pointed out that despite Sunway REIT experiencing improved revenue from its retail and hotel segments, its FY2023 earnings declined 3% y-o-y. “This decrease can be attributed to increased utility and finance costs, as well as the discontinuation of lease income from Sunway Medical Centre (Towers A and B) after its disposal was finalised on Aug 30, 2023. In addition, less established and suburban malls did not fare as well compared to their prime counterparts,” it added.

“Year on year, the 21% drop in Hektar REIT’s distributable income was mainly attributed to the increase in finance cost and negative rental reversion in FY2023,” said AmInvestment Research, noting that despite stronger rental revenue for retail malls in prime locations, the positive performance was partially offset by higher electricity tariff and increased finance cost.

The research house has “buy” calls on Pavilion REIT and IGB REIT, with a “fair value” of RM1.64 and RM1.95 per unit respectively.

Even so, some fund managers are noticeably unexcited about the retail sector for now. Looking at the negative views on retail counters, TA’s Choo opines that investors may channel their funds elsewhere.

“It could be towards tech companies and specific theme plays such as the Johor economic zone, Sarawak growth story and the modernisation of the water industry,” he says.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.

- Subang’s turbulence: Malaysia’s airport expansion faces market realities

- Intel jumps 10%, as investors cheer appointment of new Malaysian-born CEO Tan

- UWC's 2Q net profit more than doubles on semiconductor industry's strong recovery

- Apollo Food 3Q net profit drops 66% on lower margin, absence of one-off gains

- Trump threatens 200% wine tariff if EU does not relent on whiskey

- Stock turmoil spreads as fear hits the world of corporate bonds

- Putin backs US ceasefire idea for Ukraine, but says many details need to be sorted out

- Democrats in standoff with GOP as US shutdown deadline nears

- Vocational college murder case: Third accused says did not see victim steal money

- Anglo American plans fresh job cuts at corporate office under restructuring