KUALA LUMPUR (Feb 26): Fuel retailer Petronas Dagangan Bhd (PetDag) said its net profit rose by 25% in the fourth quarter from a year earlier thanks to high volume growth on the back of higher demand.

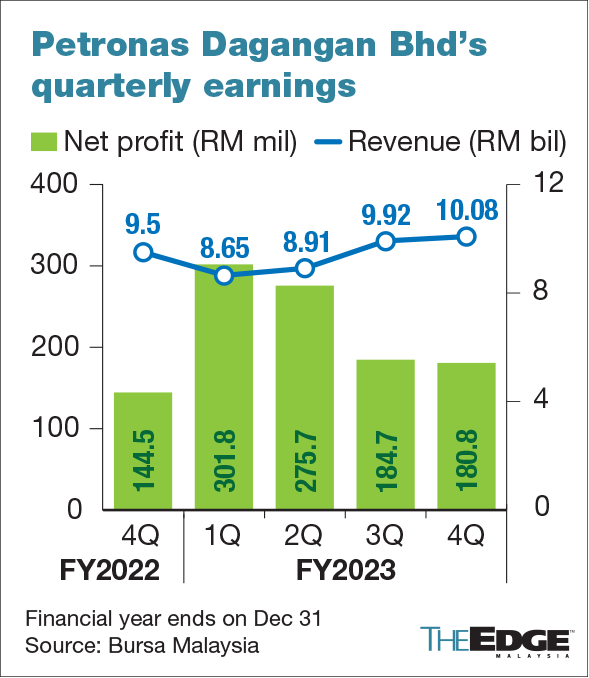

Net profit for the three months ended Dec 31, 2023 stood at RM180.81 million compared to RM144.46 million over the same period the prior year, PetDag said in a bourse filing. Revenue increased by 6% year-on-year to RM10.08 billion from RM9.5 billion.

“On our fuel business, we view the impending regulatory changes in 2024 primarily on targeted subsidy programme present both challenges and opportunities,” PetDag said. “The group will continue to focus on new avenues for growth of our non-fuel business.”

In terms of segments, quarterly revenue rose by 12% to RM5.09 billion for retail while that for the commercial segment edged up 1% to RM4.92 billion. The convenience segment’s revenue climbed 17% to RM63.9 million.

The company also noted that its mobile application Setel had sustained its double-digit growth in gross merchandise value, partly thanks to its participation in the e-Madani programme last year, thus increasing its customer reach in both fuel and non-fuel segments.

PetDag declared a dividend of 27 sen per share for the quarter under review, bringing total dividend for the year to 80 sen per share, a slight increase from total dividend of 76 sen per share declared in FY2022.

For the full year, PetDag registered a net profit of RM943.08 million, up 21.4% from the prior year’s RM776.60 million. Its revenue increased 2.2% to RM37.55 billion from RM36.75 billion.

The company also aimed to seize opportunities in the cleaner energy space through initiatives such as the solarisation of Petronas stations and collaborations with industry players to equip Petronas stations with electric vehicle charging points.

At Monday’s market close, PetDag's share price was unchanged at RM22.72, giving the group a market capitalisation of RM22.57 billion ahead of the results announcement.