KUALA LUMPUR (Feb 3): In the peak of the Covid-19 pandemic, Penang-based UWC Bhd stood as one of Bursa Malaysia’s most valuable technology firms, with an impressive market capitalisation of nearly RM8 billion.

In 2020 and 2021, the global chip shortage had pushed share prices of semiconductor and semiconductor-related stocks up, including that of UWC’s — an integrated engineering solutions provider — to historic highs.

However, these counters experienced a sharp correction in 2022, as the supply from outsized capacity expansion came online amid a tapering of global demand.

In simple terms, the chip crunch eventually transformed into a glut, leading to a significant halving of UWC’s market value to about RM4 billion in 2022.

Simultaneously, the group’s net profit also nearly halved to RM54.3 million in the financial year ending July 31, 2023 (FY2023), from a record high of RM106.8 million in FY2022.

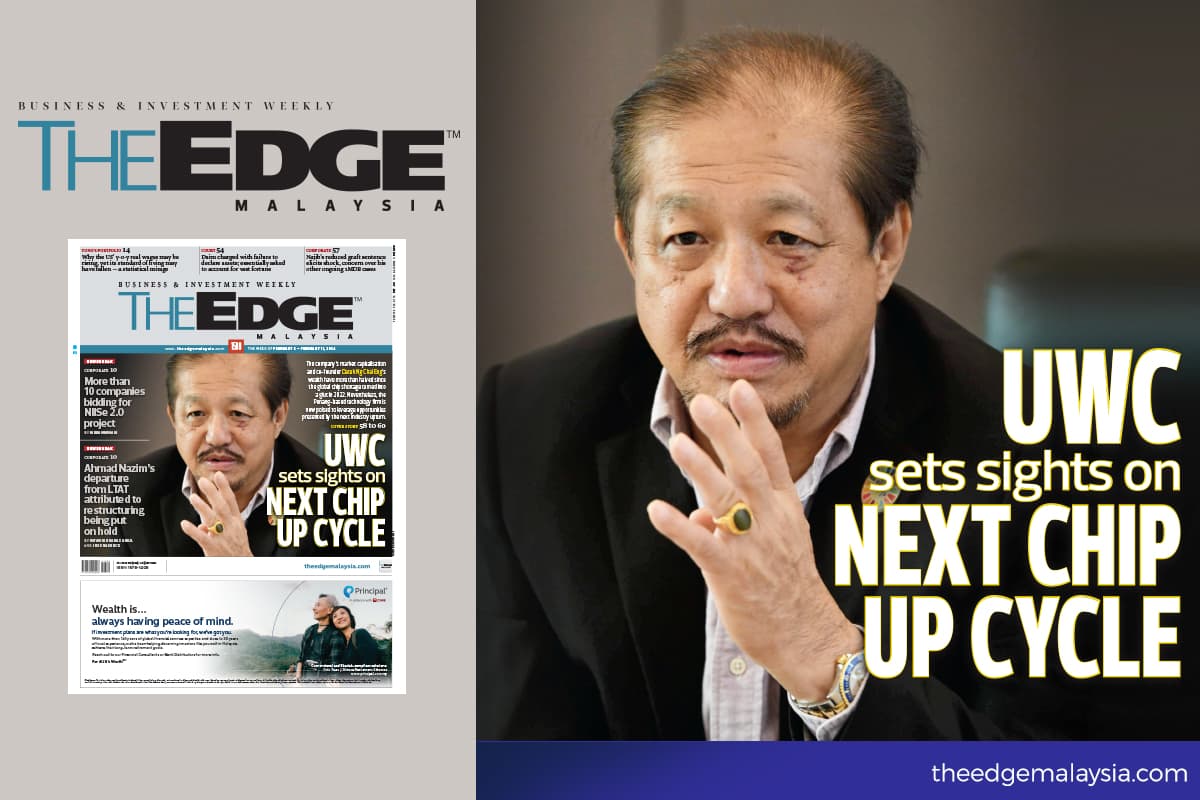

In an exclusive interview with The Edge at UWC’s headquarters in Batu Kawan Industrial Park, executive director and group chief executive officer Datuk Ng Chai Eng emphasised that the worst is over for the global semiconductor industry, which faced oversupply issues over the last two years.

“Many of our customers from the front-end segment have indicated that the global semiconductor industry will be seeing a ‘tsunami of orders’ in 2025. And therefore, we are expanding our capacity to cater to our clients’ growing demand,” remarked the 61-year-old.

Ng, who co-founded UWC with his business partner Datuk Lau Chee Kheong in 1990, was in 2022 one of Forbes 50’s richest men in Malaysia, with a net worth of US$255 million.

Howeever, the self-made tycoon had dropped off the list last year.

Despite the significant shrinkage in UWC’s market value and his net worth, Ng remains unfazed, as he believes the financial performance of the group is more important.

Meanwhile, UMediC Group Bhd, an ACE Market-listed medical devices distributor and manufacturer, is also under the control of Ng and Lau.

Despite being a small-mid cap stock with a market capitalisation of about RM230 million, UMediC has attracted several institutional investors, including Maybank Malaysia Smallcap Fund, Public Mutual funds, Phillip Mutual funds, and the Fortress Global Growth Fund.

While Ng acknowledged that the medical devices business may not experience rapid growth as compared to the semiconductor and technology sectors, he opined that UMediC has the potential to achieve a scale comparable to that of UWC’s in the future.

What are his plans for UWC and UMediC?

Get the full story in this week’s issue of The Edge Malaysia weekly.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.