This article first appeared in The Edge Malaysia Weekly on January 29, 2024 - February 4, 2024

THE technology sector could be in for an upcycle after languishing in the past 18 to 20 months on tepid demand, and analysts believe that selected electronic manufacturing services (EMS) firms are set to ride the tech wave, a projected global slowdown notwithstanding .

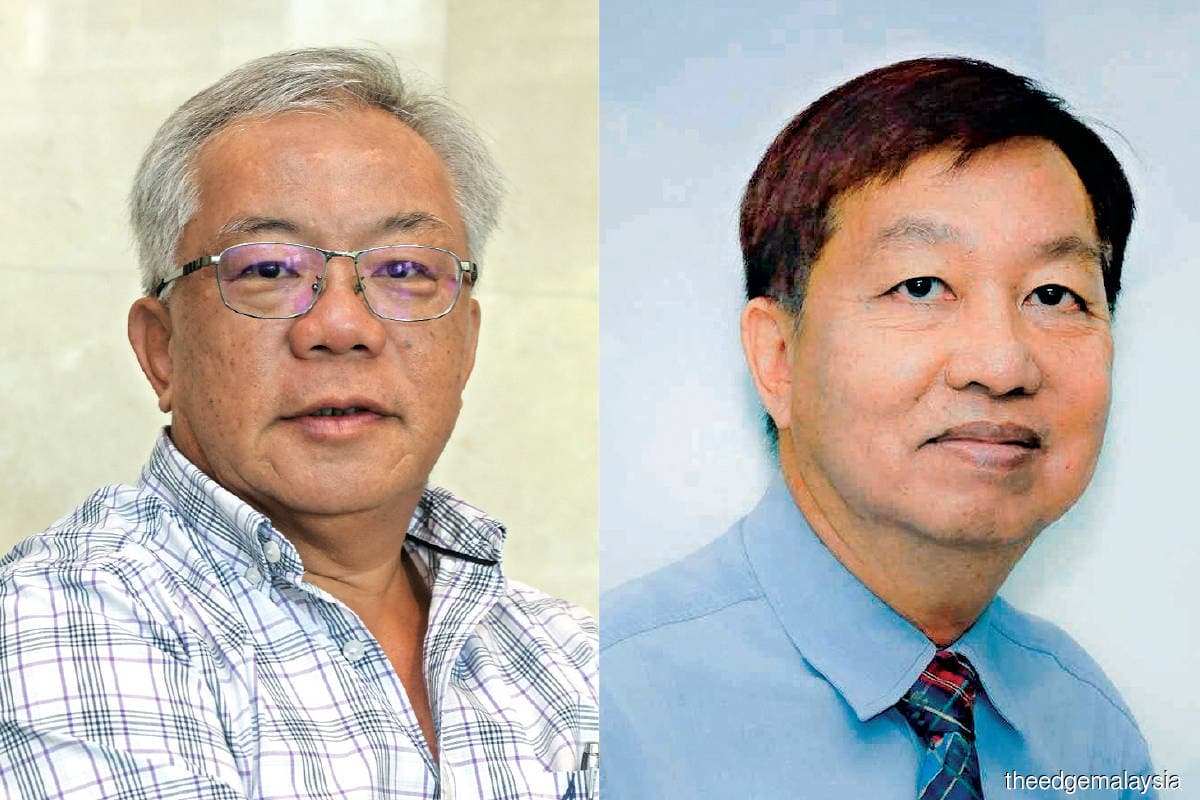

Kenanga Research analyst Samuel Tan believes any weakness in EMS counters in the first half of the year may offer investors buying opportunities. Moreover, he says the share price of EMS counters has yet to fully reflect the potential of a semiconductor rebound.

“We are looking for a more meaningful rebound in the second half of the year. So, at this juncture, we recommend that clients start to build positions. As you know, the tech sector’s comeback is usually quite fast, so it’s very hard to time it. We believe any weakness in the first half of this year is the opportunity to build some positions,” he tells The Edge.

“It should be quite muted for EMS companies that focus on consumer products. But those that have more exposure to more diverse clients such as NationGate Holdings Bhd and PIE Industrial Bhd should do better.”

Phillip Capital analyst Tan Jian Yuan concurs, saying that consumer-centric EMS companies will be more susceptible to a potential global economic slowdown on the back of weaker consumer sentiment.

Industrial-centric EMS companies are in a better position, however, as they are exposed to structural growth themes such as 5G, electric vehicle (EV), artificial intelligence and data centres.

“We do expect some industrial EMS companies to see strong EV contribution growth in 2024. For example, we estimate that Cape EMS Bhd’s EV segment will make up a third of its revenue, based on our 2024 forecasts,” says Jian Yuan.

Red Sea crisis could support demand order

Industry players believe the picking-up in the semiconductor cycle as well as the Red Sea crisis could help sustain order demand.

Aurelius Technologies Bhd (ATech) executive director and CEO Loh Hock Chiang tells The Edge: “Customers’ destocking initiatives seem to be subsiding as the order book starts to rebuild at a healthy rate. Despite sluggish global demand, thematic drivers such as electrification for automation and industrial products, the heightening of energy demand, the China+1 policy and various other geopolitical escalations are likely to support production growth over the foreseeable future.”

ATech’s net profit rose 16.17% y-o-y to RM28.31 million for the nine-month period ended Oct 31, 2023, from RM24.37 million. Communication and Internet of Things products contributed 80.4% to its top line, followed by electronics devices at 14% and semiconductor components at 5.6%.

Maybank Research is positive on ATech’s long-term prospects, considering it as a proxy beneficiary of supply chain diversification and local electrical and electronics foreign direct investments.

“Growth is underpinned by its expansion initiatives and acquiring new customers and products. Nonetheless, we acknowledge potential short-term challenges due to persistent soft end-consumer demand in specific sectors. Significant contributions from key growth catalysts are anticipated only when mass production intensifies in 2H2024,” the research house says in a Jan 4 note.

For PIE managing director Alvin Mui Chung Meng, Malaysia’s EMS industry continues to be the beneficiary of trade diversion from China, so much so that since last year, it has been receiving a flood of customer enquiries.

“For PIE, we are quite selective because we want to make sure that the new business or the new customer can satisfy our criteria in terms of volume, stability, sustainability and margin. We’re lucky in that we have good customer support and there will be some big expansion. We are preparing for new incoming orders,” he says.

Operating five factories in Penang and Thailand, PIE has two additional factories coming onstream. Mui says: “One of the factories is ready [to commence operation], which is for our new business. It is waiting for new equipment and machinery to come in.”

PIE is targeting double-digit growth in earnings and revenue for the financial year ending Dec 31, 2024 (FY2024). “We believe it will be another record year for the company,” Mui says.

In 9MFY2023, the company posted a net profit of RM45.72 million, up 6.8% y-o-y from RM42.8 million, driven by increased orders from new and existing customers. Revenue in the period under review came in higher at RM919.76 million against RM823.86 million previously. It raked in an annual revenue of more than RM1 billion in both FY2021 and FY2022.

“After we achieved the first billion [ringgit in revenue], I think there will be less resistance to achieving the second billion. When your volume grows bigger, the customers will be more impressed and have more confidence in your capability [in delivering orders]. When the volume increases, it will also improve the efficiency and the productivity level, as well as the margins,” Mui says.

PIE is 51.42%-owned by Taiwan’s Pan-International Industrial Corp, which in turn is 27.33%-held by iPhone maker Foxconn, more formally known as Hon Hai Precision Industry Co Ltd. One of PIE’s strengths is its vertical integration capabilities in a wide range of components including printed circuit board assembly, injection moulding, lens, cable and wire, metal stamping and box assembly.

Cape EMS projected to have highest upside

Bloomberg data shows the upside potential of EMS counters, with Cape EMS the highest at 58.3%, based on the consensus target price and last Wednesday’s closing price of RM1.63 and RM1.03 respectively. The company made its debut on the Main Market of Bursa Malaysia in March 2023, offering its shares at 90 sen apiece.

Phillip Capital says the recent dip in Cape EMS’ share price presents a good entry point for investors to accumulate the multi-year growth story at an attractive valuation.

“Cape EMS is reaping rewards from the strong global secular trends, including rising 5G adoption, rapid global EV penetration and being a prime beneficiary of the ongoing US-China trade tensions. We gather that prospects for new customers remain promising as inquiries continue to increase. We reiterate our ‘buy’ rating with a RM1.90 target price, based on 22 times target PE [price-earnings] multiple on 2024 [earnings per share],” it says in a Jan 18 note.

Other EMS stocks in focus include NationGate and PIE, whose shares are expected to register upside potential of 29.9% and 21.1% respectively.

Kenanga’s Samuel prefers both NationGate and PIE. “From the valuation standpoint, PIE is still cheaper. But if you want exposure to data centres, NationGate will be able to offer that kind of exposure. Looking at the immediate developments and order in hand, PIE is likely to deliver better numbers.”

PIE is trading at a forward 12-month PE ratio of 18.7 times, lower than NationGate’s 42.8 times and ATech’s 21.1 times.

In the first nine months of 2023, Nationgate’s net earnings dropped 28.85% y-o-y to RM44.89 million from RM63.09 million, owing to slower demand, especially from networking and telecommunications customers.

Phillip Capital’s Jian Yuan also has Cape EMS and NationGate as his top picks for the EMS sector, with target prices of RM1.90 and RM1.80 respectively.

As for SKP Resources Bhd, having slipped 55.5% in the past one year, its share price is forecast to post an upside potential of 25.9%, based on the target price of analysts tracked by Bloomberg.

For the six-month period ended Sept 30, 2023, SKP Resources’ net profit was down 41.8% y-o-y to RM48.66 million, from RM83.66 million, owing to sagging market demand, coupled with the increase in production costs.

In the past one year, EG Industries Bhd’s share price has gained the most — nearly 300% — as it posted a record-high net profit of RM38.44 million for FY2023 ended June 30, 2023, from RM10.82 million, on the back of a favourable product mix of consumer electronics, 5G wireless access and photonic-modular-related products.

Its FY2023 revenue was also the highest ever at RM1.35 billion, versus RM1.11 billion in FY2022.

The company provides services in original equipment manufacturing and original design manufacturing, with full turnkey solutions for completed final product assembly (box-build), printed circuit board assembly and modular components assembly.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.