This article first appeared in Capital, The Edge Malaysia Weekly on December 18, 2023 - December 24, 2023

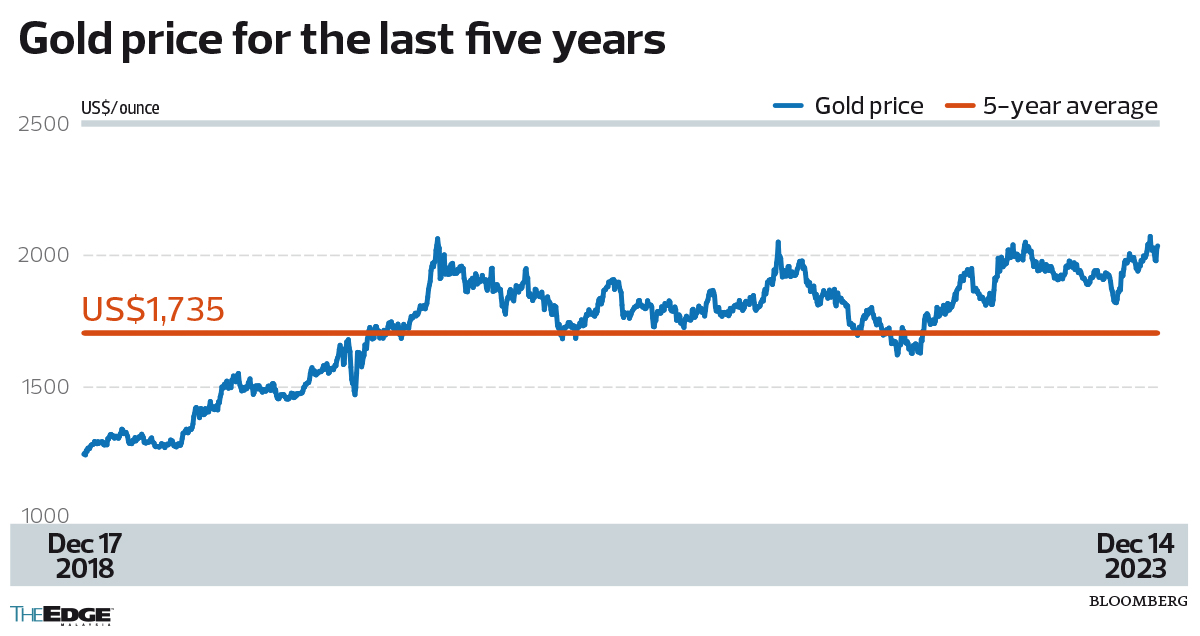

BUOYED by expectations of interest rate cuts, a weakening of the US dollar and a geopolitical premium, experts anticipate a continuing uptrend in the price of gold in 2024, even if inflation eases. On Dec 4, the precious metal hit an all-time high of US$2,135 an ounce, hovering above the previous record of US$2,072 an ounce in August 2020 before falling later that morning to trade at US$2,023 an ounce.

The high came as investors grew increasingly confident in recent weeks that the US Federal Reserve had successfully reined in inflation through an aggressive rate hike cycle, which saw interest rates raised to a 22-year high of 5.25% to 5.5% since July, and may begin cutting rates as early as March next year. Analysts anticipate four cuts to the US federal funds rate in 2024.

Three days later, however, gold reversed its gains following fresh inflation data, slipping 0.1% to US$1,979.99 an ounce amid concerns that inflation has been taking longer to return to the Fed’s 2% target, raising the possibility that the central bank will keep policy rates in restrictive territory longer than anticipated.

Following the US Federal Open Market Committee meeting last Wednesday, the central bank kept the target range for the fed funds rate at 5.25% to 5.5%, confirming broad expectations, but signalled three rate cuts in 2024 instead of four, as anticipated by investors.

Officials see the Fed keeping monetary policy tighter than expected, with the median forecast in FOMC members’ latest Summary of Economic Projections showing that the fed funds rate will end 2024 at 4.6%.

The Fed’s decision affirms OANDA Asia Pacific Pte Ltd senior market analyst Kelvin Wong’s belief that the central bank will adopt a “dovish pause” for now and be ready to cut interest rates only when key economic data such as services activities start to slow down.

“All in all, US weakness is likely to extend into 2024. And if the Israel-Hamas conflict worsens and starts to trigger instability in the Middle East, the geopolitical war premium is likely to increase and may lead to a positive impact on gold prices,” he tells The Edge.

Similarly, BMI Research, a unit of Fitch Solutions, in its Country Risk & Industry Research note on Nov 28, spelt its expectation that in 2024, investor flows into gold will fuel demand amid global growth slowing from 2.6% in 2023 to 2.1% in 2024, a further weakening in the greenback (with a 50% probability of a shallow recession in the US) and as the Fed starts to cut interest rates. The UK-based research firm maintained its 2023 and 2024 gold price forecasts at US$1,950 an ounce, expecting prices to trade within the range of US$1,900 to US$2,000 an ounce in the coming months, with strong upside risks towards the second half of 2024 undergirded by the factors mentioned earlier.

“In the longer term, we expect gold prices to remain elevated in the coming years compared to pre-Covid levels,” says BMI. It also foresees that spot gold (XAU/USD), which is spot gold traded on the foreign exchange market, is likely to evolve in a “bullish environment” in 2024.

To this end, BMI projects that global gold mine production will grow strongly in 2023 and 2024, owing to the higher prices. “Over the medium term from 2023 to 2027, global mine production growth will remain strong, as the high prices by historical standards [will] encourage investment and output.

“[Thus,] we expect global gold production to increase from 107 million ounces in 2023 to 134 million ounces by 2032. This would be an acceleration from the average growth of just 0.8% over the 2016-2020 period.”

Meanwhile, local jeweller Habib Jewels Sdn Bhd managing director Datuk Seri Meer Habib observes that high inflation since the pandemic started in 2020 has fuelled consumers’ demand for gold in Malaysia. He recalls that there was a surge in the company’s gold sales following the government’s approval for Employees Provident Fund contributors to withdraw up to RM10,000 from their accounts in March 2022.

“Many people bought gold, as it is the best hedge against inflation. The demand for gold has had a significant impact on us industry players [indicating the profit-taking reflected in the trajectory of gold prices this year] — although this year, EPF contributors who drew down the RM10,000 had exhausted their cash, resulting in lower sales at the start of 2023 compared with the same period last year. Nevertheless, our year-end gold sales are picking up, as the prospects of investing in gold are increasing,” says Meer, who believes gold could hit US$2,200 to US$2,400 an ounce by end-2024.

Spot gold could hit US$2,330 in 2024

As for how much upside gold prices will have next year, OANDA’s Wong forecasts that the second major resistance for spot gold stands at US$2,330, after US$2,250, which offers an upside potential of 17% from the current price of US$1,985 (as at last Tuesday, Dec 12).

The projections of further upside will depend on two primary factors, beginning with the lower 10-year US Treasury real yield heading into 2024, he explains. “This will be the case for at least the first half of 2024, owing to the current easing trajectory of global inflationary pressures that increase the odds of a first Fed rate cut at the March 2024 FOMC meeting which, in turn, will reduce the ‘opportunity cost’ of holding gold,” he predicts.

“Second, a rising gold/copper ratio, which has been in play since June 2022, suggests an increasing likelihood of a global recession in 2024. That also advocates for a potential bullish outlook for gold prices.”

As investors will want to know whether the current medium-term uptrend will be sustainable after a rally that saw spot gold rising 18% from a low of US$1,833.01 on Oct 6 this year, OANDA sees an increasing risk of a global recession, which in turn may allow the current medium-term uptrend phase of spot gold to remain intact via its portfolio hedging role.

“Using an intermarket analysis approach, the medium-term uptrend phase low of Oct 6, 2023, seen in spot gold has coincided closely with the recent softness of the 10-year US Treasury real yield, as it has declined by 47 basis points from 2.47% printed on Oct 6, 2023.

“Furthermore, the 10-year US breakeven rate (market-based implied US inflation rate 10 years from today) is looking vulnerable for a bearish breakdown below 2.10%, suggesting that the 10-year US Treasury real yield still has room for further downside potential that, in turn, lowers the opportunity cost of holding gold,” says Wong, adding that the technical reading of the Standard & Poor’s 500 against spot gold shows that a US recession is imminent.

Having said that, he cautions that expectations of cuts to the fed funds rate in 2024 risk being dialled back.“The monthly growth of the number of jobs added in the US labour market has continued to tread lower for the second consecutive month and below the 12-month average monthly gain of 240,000. But the slowdown was not as severe as expected in November as the unemployment rate also dipped to 3.7% from 3.9% in October,” he says.

“Overall, the US labour market is still indicating a soft-landing scenario for the [nation’s] economy, which in turn may force market participants to reduce their high expectations of four fed funds rate cuts totalling 100 basis points. Those are based on the current fed funds rate futures data as calculated by the CME FedWatch Tool. Also, it is twice the amount of rate cuts projected in 2024 as indicated by the last Fed officials’ dot plot forecasts released in September’s FOMC meeting.”

Meanwhile, other commodities expected to drive the commodity market next year could include industrial metals such as copper, as its price movement has a strong direct correlation with the growth prospects in China, says Wong.

“The heightened risk of a deflationary spiral remains sticky in China, owing to the chronic weakness seen in the property market, which may put pressure on China’s top policymakers to make a shift away from the current targeted approach by adopting more broad-based stimulus measures, coupled with structural moves to remove bad assets from property developers’ balances to negate the deflationary risk. Such moves in turn may trigger a positive feedback loop into copper prices after trading almost flat in 2023,” he surmises.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.