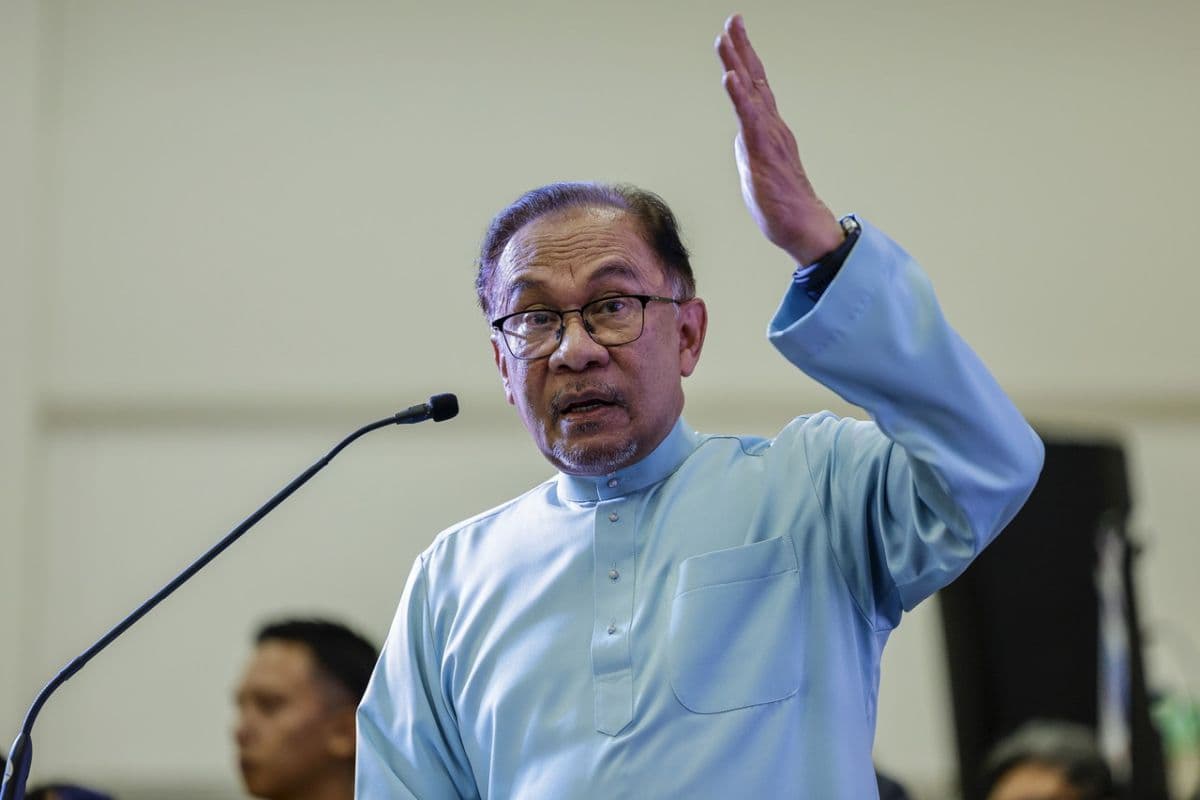

KUALA LUMPUR (Nov 2): The government will refine the inclusion of the logistics sector in the Sales and Service Tax (SST) and has not ruled out the possibility of granting exemptions to certain sub-sectors if it is found to directly affect the public's interests, said Prime Minister Datuk Seri Anwar Ibrahim.

Speaking in the Dewan Rakyat on Thursday, Anwar also clarified that the SST rate for the logistics services will be 6%, and not 8% as proposed for most other sectors.

"However, the government understands that there are many concerns regarding logistics services being subject to SST. The Ministry of Finance (MOF) is currently in the process of refining the details. If it is found to directly affect the interests of the public, exemptions will be considered," he said during his Budget 2024 winding-up speech.

Anwar, who is slso the finance minister, also instructed the MOF to conduct engagement sessions with stakeholders, particularly in the logistics sector, to gather input and opinions before implementing the tax. This process will include identifying a detailed list of logistics sub-sectors that will be subject to the SST.

He also reiterated that the SST rate increase does not affect services widely used by the majority of the people, such as food and beverages, telecommunications and vehicle parking, which will remain at the 6% rate.

During the debate session, lawmakers from both sides of the aisle raised concerns about the government's proposal to increase the SST to 8% from the current 6%, and its expanded scope to include logistics services, potentially burdening consumers with increased costs of goods.

Lim Guan Eng (PH-Bagan) pointed out that the inclusion of logistics services would result in increased costs for goods and would ultimately raise the cost of living for the public. This sentiment was echoed on the opposition side by Tan Sri Muhyiddin Yassin (PN-Pagoh).

Meanwhile, Anwar defended the government's proposal to implement a capital gains tax (CGT), stressing that it would only affect the "mahakaya" (ultra-rich) group.

He pointed out that the 10% CGT rate is lower compared with neighbouring countries such as Thailand and Indonesia, where both CGT and corporate tax are imposed at the same rate.

Anwar denied that the CGT would suppress small and medium enterprises, as it does not apply to individuals disposing of unlisted shares.

"The government also wants to emphasize that the CGT is not imposed on listed shares to ensure that Bursa Malaysia remains competitive with regional countries while maintaining the confidence of foreign investors.

"CGT will also be exempt for the disposal of shares related to approved initial public offering activities, internal restructuring, and venture capital companies," he said.

For more Parliament stories, click here.