This article first appeared in The Edge Malaysia Weekly on July 31, 2023 - August 6, 2023

WHEN construction giant IJM Corp Bhd announced last week that it was looking to take up a 44.83% stake in troubled engineering outfit Pestech International Bhd — via a restricted offer of 800 million new shares by the latter at 15.5 sen apiece, or RM124 million in total — there was some apprehension among the investment community.

The proposed share issuance to IJM at a 47.46% discount to the trading price of 29.5 sen on July 24 — the day the deal was announced — triggered a run on Pestech’s stock the following day. The counter shed 20% of its opening price of 29.5 sen to an intraday low of 23.5 sen, before recovering to close at 26 sen.

IJM, meanwhile, is also seeking a waiver from making a general offer for the rest of Pestech.

The steep discount for the share issuance came on the back of Pestech having a number of issues, among others with the Malaysian Anti-Corruption Commission (MACC). In January this year, Pestech’s top executives, including executive chairman Lim Ah Hock and his nephew, managing director and group CEO Paul Lim Pay Chuan, were charged with allegedly abetting the misappropriation of RM10.6 million.

On July 17, Pestech said that Ah Hock, Pay Chuan and Paismanathan Govindasamy were discharged and acquitted of all charges against them with immediate effect. Paismanathan is the CEO of Pestech Technology Sdn Bhd, and had also been charged with bribery and money laundering.

Apart from trouble with the MACC, in May, Syarikat Pembenaan Yeoh Tiong Lay Sdn Bhd, which is wholly owned by YTL Corp Bhd, terminated Pestech from its role of designing, constructing, supplying, installing, testing, commissioning and maintaining an electrified double track from Gemas to Johor Baru, stating breaches of representations, warranties and undertakings. Pestech, according to its FY2022 annual report also had legal issues with other rail players such as Lion Pacific Sdn Bhd and Dhaya Maju Infrastructure (Asia) Sdn Bhd.

Prior to the MACC issue, Pestech’s controlling shareholders — Ah Hock who has 32.9% equity interest and Pay Chuan who has a 19.45% stake — were looking at a share issuance at about 40 sen apiece. After the restricted share issue of 800 million shares to IJM, Ah Hock and Pay Chuan will own a collective 28.9% of Pestech.

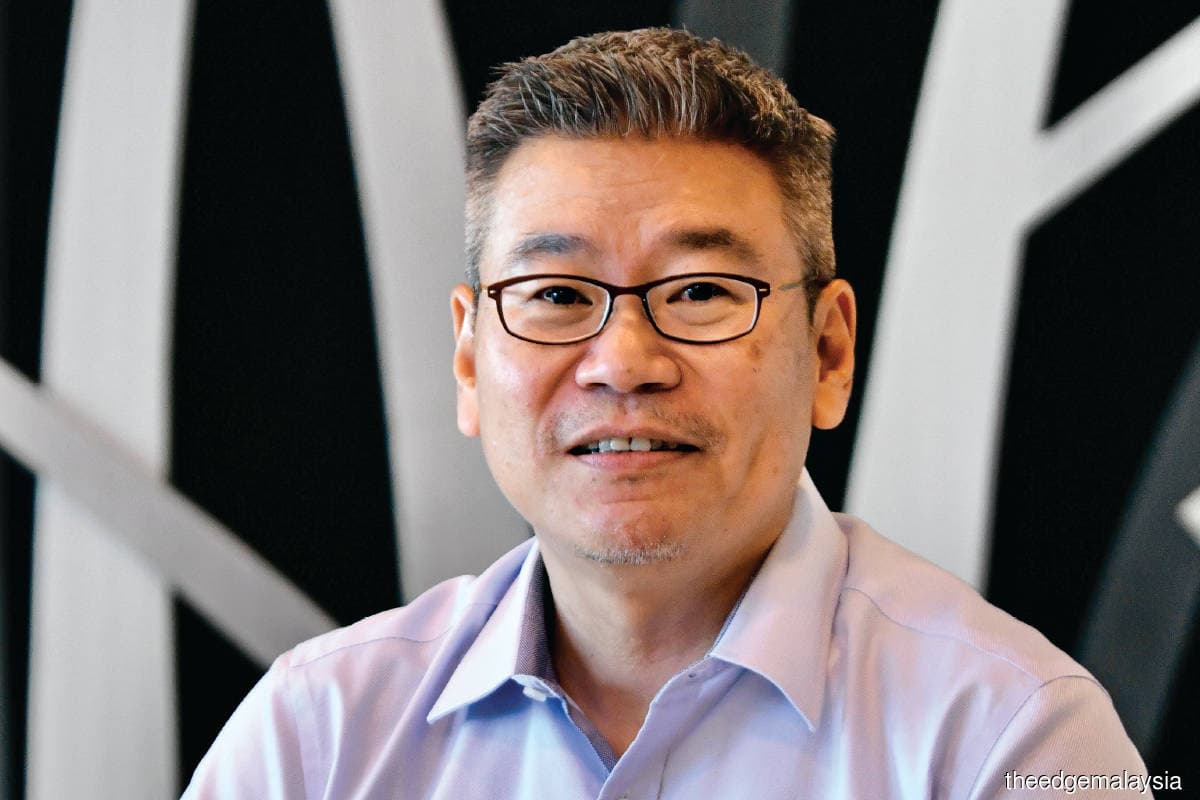

In an exclusive interview with The Edge, IJM managing director and group CEO Lee Chun Fai says, “They (Pestech) had combed the market [looking to raise funds]. Nobody was interested in the placement. And even banks did not want to give them the loans they needed. Therefore, they went looking for a strategic investor. For IJM, we look at long-term investments. At a price of 15.5 sen, we have to balance the risks of the acquisition.”

Lee took over the helm at IJM in April, and was deputy managing director and deputy CEO from April 2015 to end-March 2023.

The merits of buying into Pestech

“Yes, Pestech was asking for 40 sen earlier before these cases [with MACC] came about. I think Pestech’s choices are limited,” says Lee.

However, with the Lims holding less than 30% of Pestech, will they run the company as efficiently as they do now when they control 52.4% of the company?

Truth be told, Pestech has built a niche for itself as the largest pure system service provider in rail electrification and signalling, and has a 20MW large-scale photovoltaic solar plant in Bavet City, Cambodia, which has a 21-year concession and levelised tariff of 7.6 US cents (34 sen) per kWh — higher than Malaysian rates of less than 20 sen per kWh for the latest large-scale solar (LSS) projects, according to IJM.

IJM is also looking at penetrating new markets and Pestech’s presence in some 20 countries, including Myanmar, Vietnam, Cambodia, Australia, the Philippines and China is compelling. IJM, meanwhile, has a presence in seven countries, including Argentina, China, India and the UK.

For its nine months ended March this year, Pestech suffered a net loss of RM132.01 million on the back of RM329.33 million in revenue. The company had suffered four straight quarters of losses.

As at end-March this year, Pestech had cash and bank balances of RM147.13 million as well as RM41.35 million in fixed deposits with licensed institutions. On the other side of the balance sheet, the company had long-term debt commitments of RM761.13 million and short-term debt commitments of RM494.68 million.

However, Pestech’s contract assets amounted to RM1.12 billion, with trade receivables as at end-March of RM200.82 million and other receivables, deposits and prepayments amounting to RM71.76 million.

Lee says, “Pestech expects deferred payments from its Cambodian project, with RM1.6 billion to RM1.8 billion in receivables that trickles in over the long term from the state-controlled energy company in Cambodia.

“This [acquisition in Pestech] is unlike taking on a company with a loan where we need to look for jobs to repay the loan. The money has gone to its capex (capital expenditure) for this project,” he explains.

IJM, in contrast, is a company with a market capitalisation in excess of RM5 billion and is known for its steady earnings. For its financial year ended March 2023, the company chalked up a net profit of RM158.27 million from RM4.57 billion in revenue.

Lee adds, “Pestech is very big in energy transmission. Everyone is going into electric vehicles (EVs). Southeast Asia is a developing region with ongoing industrialisation needs for power. There’s also the big data requirements by data centres, where the buildings are not measured by square footage but by megawattage because the basis of a data centre is the power. If you agree that EV and big data will pick up in a big way, the need for electricity will definitely increase [bearing in mind that] energy transmission is a specialisation with margins that are [better] than [IJM’s] small construction margins.”

While the Pestech narrative should be a good one for IJM, many are still spooked by its venture more than a decade ago involving Scomi Group Bhd, which was delisted from Bursa Malaysia at end-March this year after years of grappling with creditors and failing to come up with a viable rationalisation plan.

The IJM-Scomi Group saga

To recap, in mid-2012, IJM subscribed for 119.11 million new shares, or a 10% stake, in Scomi for RM39.3 million, or 33 sen a share. IJM also subscribed for RM110 million in redeemable convertible secured bonds, which were converted into new shares at 36.5 sen apiece in January 2017 when Scomi shares were trading at about 15 sen. This increased IJM’s shareholding to 24.4% from 7.66%.

When IJM converted Scomi’s debt paper, sceptics felt that the construction company would have been better off cutting its losses and moving on. Scomi fell into the cash-strapped Practice Note 17 (PN17) category in December 2019.

Scomi, which once boasted former prime minister Tun Abdullah Ahmad Badawi’s son, Tan Sri Kamaluddin Abdullah, as a substantial shareholder, was a darling of the stock market in its early years.

In July 2003 — two months after its flotation exercise — Scomi’s stock hit a record high of RM16 per share and it was trading at price-earnings multiples of almost 70 times. Its main business was in the supply of drilling fluids, a substance used to reduce friction when exploring for oil.

While Pestech had issues with MACC, Scomi’s problems had thrust it into the international spotlight. In February 2004, Scomi Precision Engineering Sdn Bhd (known as SCOPE), a 100% unit of Scomi, was alleged to have supplied nuclear components to Libya, in a deal involving Pakistani atomic weapons expert AQ Khan, and sanctions were imposed by the US on some of the top brass at Scomi.

Scomi denied any wrongdoing and the sanctions were lifted after a couple of years.

IJM, however, sold a 21.39% stake in Scomi at end-June 2020 at three sen a share, or a total of RM7.02 million.

In response to The Edge comparing IJM’s foray into Pestech with that of the Scomi misadventure, Lee says: “The big difference is that the synergy is much clearer this time. Last time with oil and gas drilling fluids, everyone said IJM knew nuts about that [business]. At least now with electrification, IJM can understand the business. So, this complements better and is a better fit.”

Other than Scomi, IJM also had a 20.6% stake in Metech Group Bhd, which was delisted from Bursa Malaysia in November 2011 after falling into the PN17 category. How this 20.6% came about is not clear as IJM had the same 20.6% stake in the 1990s when Metech was known as Sin Kean Boon Group Bhd. Metech manufactured roller shutters, storage racking systems, steel doors and other similar products.

Some of IJM’s other corporate deals

Other than Scomi Group, IJM’s other corporate exercises, such as the acquisition and takeover of fellow construction giant Road Builder (M) Holdings Bhd in 2008 for RM1.56 billion, have turned out well.

Road Builder had a 70% stake in RB Land Holdings Bhd (formerly known as Econstates Bhd), which eventually morphed into IJM Land Bhd and was privatised for RM2 billion in mid-2014 by IJM.

Another significant acquisition was undertaken in 2005 when IJM proposed to acquire 25% of Kumpulan Europlus Bhd, a property developer, for RM33 million cash with a call option for a further 5% stake from the company’s controlling shareholder Tan Sri Chan Ah Chye. Chan, who controlled both Kumpulan Europlus and Talam Corp Bhd (now known as Talam Transform Bhd), was facing financial difficulties.

While the deal took some time to materialise, Kumpulan Europlus is today WCE Holdings Bhd, which has an 80% stake in West Coast Expressway Sdn Bhd, the concession holder of the 233km West Coast Expressway. IJM has 26.65% in WCE Holdings and controls the remainder 20% in West Coast Expressway.

In June 2021, IJM hived off its 56.2% in IJM Plantations Bhd to Kuala Lumpur Kepong Bhd for RM1.53 billion, booking a gain of RM700 million. IJM had in 2003 listed its plantation assets by injecting IJM Plantations Sdn Bhd into Rahman Hydraulic Tin Bhd.

IJM also acquired a 32% stake in Industrial Concrete Products Bhd (ICP) from Hume Industries (now known as Hume Cement Industries Bhd) for RM95 million in 2004, and took control of ICP by injecting Malaysia Rock Products Sdn Bhd into ICP for RM110 million worth of shares, to control 71% of ICP. In September 2008, IJM privatised ICP by acquiring the 36.56% it did not already own for a mix of cash and new IJM shares.

While most of IJM’s corporate forays are well thought out and well executed, only time will tell if its entry into Pestech will bear fruit.

IJM’s stock, nevertheless, hit a 52-week low of RM1.43 on July 11. It ended trading last Friday at RM1.50, translating into a market capitalisation of RM5.26 billion.

The Employees Provident Fund, which is IJM’s largest shareholder, has been paring down its stake. As at July 27, EPF had a 17.36% stake, or 608.62 million shares, in IJM — in contrast to end-May, when the provident fund had 17.62% equity interest, or 618.94 million shares.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.