This article first appeared in The Edge Malaysia Weekly on April 17, 2023 - April 23, 2023

IT is hard for investors not to notice Datuk Seri Chiau Beng Teik, founder of home-grown building materials specialist Chin Hin Group Bhd. The spotlight on him isn’t so much about the group’s financial performance, but the slew of mergers and acquisitions (M&A) he has undertaken in recent years.

The low-profile, media-shy 62-year-old businessman and savvy investor has been on a buying spree since Chin Hin was listed on Bursa Malaysia in 2016.

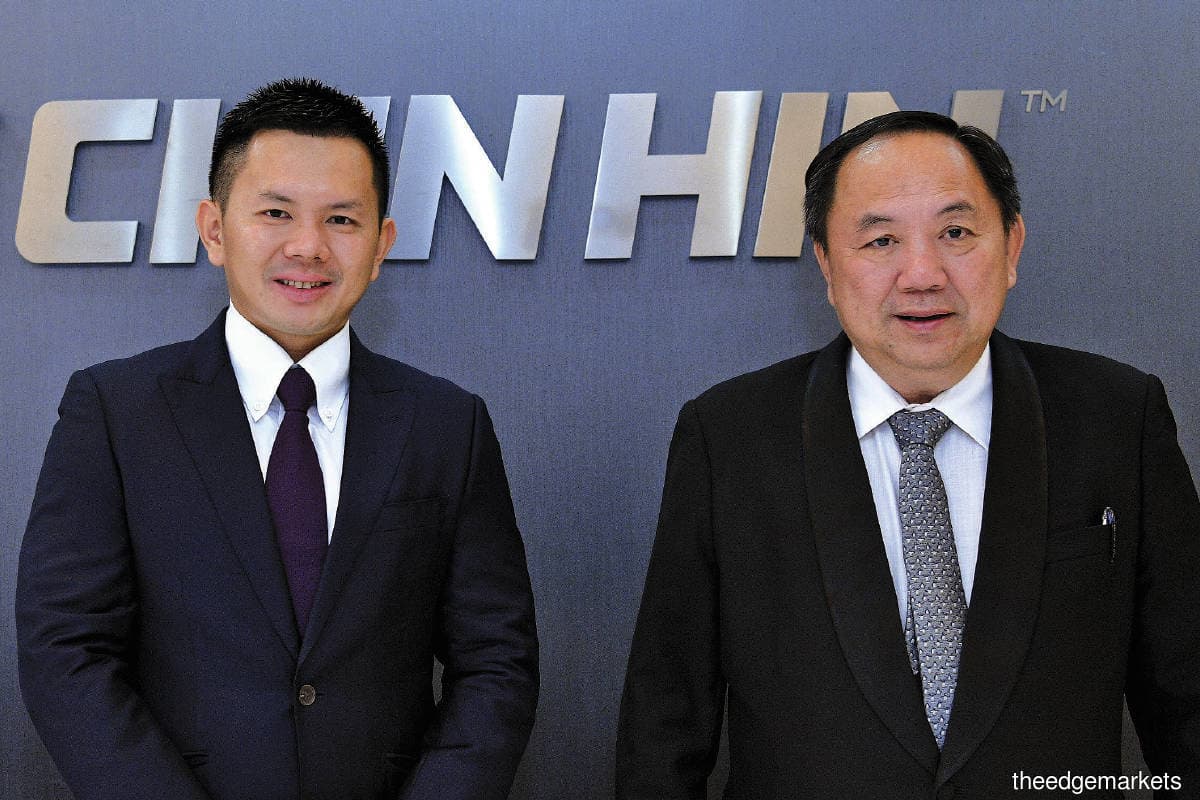

Today, Beng Teik, together with his 39-year-old eldest son Chiau Haw Choon, have under their belt at least six public-listed companies (see shareholding chart). Through their flagship vehicle Chin Hin, the father and son have significant equity interest in property developer Chin Hin Group Property Bhd (CHGP), kitchen cabinet maker Signature International Bhd, safety glass maker Ajiya Bhd and electrical home appliance distributor Fiamma Holdings Bhd.

Meanwhile, the family’s vehicle is also the second largest shareholder of renewable energy player Solarvest Holdings Bhd, with a 19.3% stake. The block of shares was acquired from Chin Hin for RM103.28 million cash in a related-party transaction last year.

Notably, Chin Hin saw its share price hit an all-time high of RM4.79 last Thursday, giving the group a market capitalisation of RM8.48 billion. When the company was listed in March 2016, it was valued only at slightly more than RM400 million.

Compared with its peers in the construction industry, Chin Hin’s current market capitalisation is smaller than that of Gamuda Bhd (RM11.22 billion), but is already bigger than those of Sunway Bhd (RM7.75 billion) and IJM Corp Bhd (RM6.02 billion).

However, in terms of its stock valuation, Chin Hin is currently trading at a high price-earnings ratio (PER) of 87 times, against a net profit of RM97.76 million in the financial year ended Dec 31, 2022 (FY2022), of which RM76.32 million was actually a “gain on disposal of investment in an associate company”, believed to be the sale of Solarvest shares. For comparison, Gamuda’s shares are trading at a historical PER of six times, Sunway at 11 times and IJM at 42 times.

The impressive share price performance and high market capitalisation of Chin Hin may have earned Beng Teik and Haw Choon some bragging rights, but the group’s swelling debts and rising gearing level as a result of their acquisition spree remain a pebble in their shoes. Moreover, unlike Solarvest, some of Chin Hin’s investments have yet to make a meaningful profit contribution or realise gains for the group.

In an exclusive interview with The Edge, Haw Choon reveals that in a move to address its high gearing level, Chin Hin will undertake several corporate exercises, including a private placement, two initial public offerings (see story on Page 19) and a divestment of non-core assets. More importantly, the group is likely to refrain from any major M&A activities.

“Yes, we are aware of the situation with Chin Hin’s balance sheet. That’s why, for now, we are not making any further acquisitions under Chin Hin. But for other public-listed companies where we are still at a comfortable level, we might make further acquisitions,” he says.

“We also intend to undertake a private placement exercise to improve our balance sheet. We will do it whenever we think it is necessary. In fact, we also plan to divest some of our non-core assets.

“We have financial governance to meet. That’s why we cannot allow our gearing to be too high.”

Chin Hin has undertaken two private placement exercises since it listed, in 2017 and 2021. Likewise, its property arm CHGP — which undertook a back-door listing via Penang-based Boon Koon Group Bhd — undertook private placements in 2021 and 2022.

Portfolio management

With at least six public-listed companies under its umbrella, not to mention other investments in public-listed companies, Haw Choon describes the game as portfolio management.

Nonetheless, his definition of portfolio management appears to be rather different. The Chiau family could be an aggressive major shareholder once it emerges in a public-listed company. Signature is a good example of this.

In a span of 13 months, the kitchen cabinet maker has spent RM185 million to acquire four companies, including two in Singapore. The company has also invested RM30 million for the automation of carpentry works (see accompanying story on Page 19).

“Chin Hin’s gearing is 1.3 times now. Our immediate goal is to bring it down to 1.1 to 1.2 times. That’s our first priority. We are like a portfolio manager. When Chin Hin is overgeared and is stretching its balance sheet, we apply controls,” says Haw Choon.

“That’s why it is like portfolio management. We really need to fix certain businesses. For instance, we now intend to divest Chin Hin’s small and irrelevant businesses, as well as its non-profitable and non-core assets to reduce our gearing.”

Chin Hin’s gearing had increased from 0.93 times in 2020 to 1.27 times in 2021 and 1.3 times in 2022. The group’s short-term borrowings jumped from RM347 million in 2020 to RM518 million in 2022, while its long-term borrowings ballooned from RM67 million in 2020 to RM351 million in 2022. Its inventory level tripled from RM95 million in 2020 to RM320 million in 2022.

Haw Choon admits that Chin Hin is growing “too wide”. Therefore, the group now needs to consolidate and focus on a few key growth areas, such as Fiamma and Signature, as well as its construction and property businesses under CHGP.

“Give us another one to two years. I think when the numbers come in, and with our listing plans, I believe our balance sheet will improve,” he says.

Haw Choon explains that Chin Hin will focus on growing its existing businesses as the group strives to be one of the few companies in the industry to have a unique business model of providing end-to-end solutions, from upstream activities (building materials manufacturing, construction and engineering) to downstream (property development and home and living solutions).

“We will be very satisfied with our existing businesses. We still intend to grow. But any M&A will not likely happen in our companies that have a high gearing, where our balance sheets are stretched. For example, you probably won’t see much action in CHGP and we will control the gearing of Chin Hin,” he says.

“We are going to have two IPOs by the second half of 2024 or first quarter of 2025. We may undertake some corporate exercises in the next 24 months to reduce our gearing.”

Haw Choon points out that the high gearing of CHGP is mainly due to the nature of its business. “We are in property development, so we need to buy land. But the profit will only come in the third and fourth year, so we can’t do away with high gearing. It’s beyond my control.

“Likewise, the higher inventory level is because of our land. When we get the development order, the land that we buy will be moved into inventory, that is a normal process because we have not launched the property,” he explains.

High risk taker

Interestingly, Haw Choon acknowledges that Chin Hin and the Chiau family are high risk takers and they like to use leverage. However, he stresses that it is not fair to suggest the group builds its businesses only by raising debt and using leverage.

“About 15 years ago, we had only 70 employees. Our turnover was only RM200 million. How could we have leveraged to where we are today if we didn’t have competency? It would be unfair of you to make such a statement, for all the efforts that we have put in to grow our businesses,” he says.

“Sometimes, we are upset about some media reports. They only see we are buying companies, but they don’t see the efforts we are putting in to build our businesses. Of course, leveraging is one of our ways to build our businesses. Without leveraging, how can we undertake so many M&A?”

Haw Choon goes on to say that when Chin Hin is undertaking M&A activities, the group makes sure only the good ones are acquired.

“You can’t just say we are using only borrowings to grow our businesses. If we are using only borrowings, none of the companies that we acquire will be successful,” he says.

“Some 15 years ago, we had to borrow to start our cement manufacturing business. If this business venture wasn’t successful, then how did we get listed in 2016? If we are not listed, how can we grow further by buying companies? It is all one package, and leveraging is one of the tools.”

Haw Choon says running the companies well and appointing the right people are important too.

“It took us so much effort to bring the right guy in. If we only think about leveraging, we could have just bought Fiamma, let the company run by itself and then exit our investment. But this is not what we want,” he points out.

“You look at Signature, we are Malaysia’s largest home and living downstream player. We also have a subsidiary going for listing. And you think all these are done just by leveraging?

“No, it’s all about dedication and hard work. Are we making money from the stock market by investing in Signature? No. Signature’s share price has gone up but we have never sold [any shares].”

Haw Choon acknowledges that Chin Hin has been “a little bit aggressive” over the last two to three years. According to him, the group hires good and experienced people to manage its various businesses.

“For example, Fiamma’s founder wanted to retire and sold the business to us. We then appointed Tan Chee Wee, who had worked at Samsung Malaysia Electronics (SME) Sdn Bhd for more than 16 years, as executive director and CEO of Fiamma,” says Haw Choon.

“Likewise for Signature, after co-founder Tan Kee Choong retired, we appointed Lau Kock Sang, who had been director of retail sales since 2012, as the new CEO.”

As for Chin Hin’s construction business, the senior management is mostly from Gamuda, says Haw Choon. Meanwhile, ex-Sunway veteran Ngian Siew Siong was hired as CEO of CHGP’s property development division.

“We need to have higher expenses for salaries to reduce our costs. There are a lot of hidden costs if we hire inexperienced people. We don’t mind paying a high salary to get good and experienced people, rather than see wastage and leakages. We want to hire people who are overqualified. If I want to do a RM300 million business, I will hire someone who has done a RM500 million business before,” he says.

Friends of Eddie Ong

It has not gone unnoticed that the Chiau family and Hextar Group’s Datuk Eddie Ong Choo Meng, another entrepreneur who has been on the M&A trail, have invested in a number of similar companies.

Haw Choon acknowledges that the Chiau family are friends with the Hextar boss, noting that Ong is also a high risk taker doing many M&A. “We are friends, but just friends. Our styles are similar,” he says.

“I met Datuk Eddie first [before his dad]. I know he is an active corporate player. We both speak Hokkien and we became friends. If you look at Chin Hin and our related companies, our share prices don’t just go up and then suddenly come down. We do not use the stock market to make money. We don’t make retail investors lose money.

“All the businesses are under our names. If you look at a certain group of people, they use their proxies to play up the shares. We don’t do that here.”

Beng Teik, who has been relatively quiet during the interview, says he prefers to get to know the owners before undertaking any M&A exercise.

“Yes, we know the owners. If we don’t know them, we won’t buy [into the company]. We take up a placement to get a discount, so we have to go through the owners as well,” he says.

“Most of the time, we look at the longer term; we are not trading shares. We are not buying today and selling tomorrow. When we make a profit, only then will we sell.”

From hardware shop to cement business

After completing his primary education at SJK (C) Pei Min in Padang Setar in Alor Setar, Kedah, in 1974, Beng Teik started working at his father’s hardware shop at the tender age of 13 the following year.

About 20 years down the road, Beng Teik started a cement distribution and trading company before expanding Chin Hin’s business from a single office in Alor Setar to a group of companies with an extensive network of branch offices and factories across Peninsular Malaysia.

Beng Teik, who is executive chairman of Chin Hin, tells The Edge that he likes to buy shares that are trading below the net tangible assets (NTA) or are deemed cheap. “We invest for the long term. We bought NCT Alliance Bhd at 32 sen. Now, it is 40 sen already. But we think it still has good prospects,” he says.

On March 23, CHGP emerged as a substantial shareholder of NCT — an abandoned property projects revival specialist — after subscribing for 75.41 million shares, or a 5.61% stake, for RM24.13 million.

Haw Choon says CHGP is not buying a majority stake in NCT, although it plans to raise its equity interest in the latter.

“We are just passive investors in NCT. The largest shareholder will still be Datuk Seri Yap Ngan Choy and his family. We don’t intend to control the company, but we expect some good investment returns,” he adds.

“In the meantime, if some of their building materials can be sourced from us, why not? On one hand, we can make money from our investment. On the other, we can make money from supplying building materials and construction services.”

The low interest rate environment has ended and this may not augur well for companies with high borrowings. While the Chiau family have demonstrated their skills at corporate M&A over the past few years, it is now time for them to exhibit their strategies and tactics in improving the balance sheet of Chin Hin.

Save by subscribing to us for your print and/or digital copy.

P/S: The Edge is also available on Apple's App Store and Android's Google Play.