This article first appeared in The Edge Financial Daily, on January 6, 2016.

WTK Holdings Bhd (-ve)

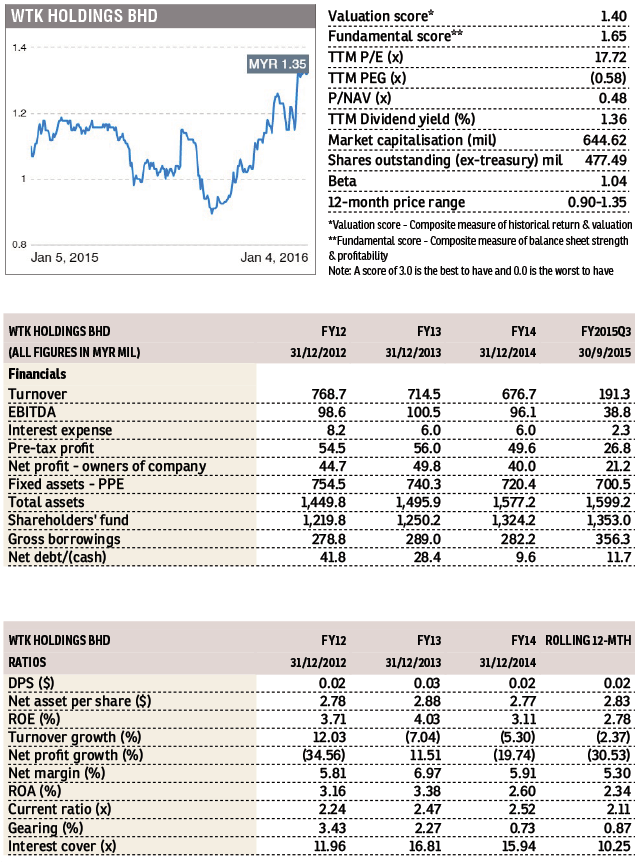

SHARES of WTK (Fundamental: 1.65/3, Valuation: 1.4/3) saw active trading yesterday, closing 8.2% higher at RM1.46.

WTK is primarily involved in the extraction and sale of timber, plywood, veneer and sawn timber, which accounted for about 81% of its revenue in 2014. The company also trades and manufactures various foil and tapes products, cultivates oil palms, and provides offshore service vessels to oil majors.

In 2014, WTK derived 87.0% of its revenue from export, with key markets being Japan, India and Taiwan.

For 3Q2015, net profit expanded an outsized 78.1% y-y to RM21.2 million on the back of a 23.0% increase in revenue to RM191.3 million, due to increased sales of plywood products and higher forex gains.

WTK entered into a sale and purchase agreement last October, to dispose of its investment properties at Wisma Central for RM51.0 million. The transaction is expected to give rise to a disposal gain of approximately RM16 million upon completion.